Steady growth in the

LED lighting market supported the capacity expansion efforts of

LED chip and package industries in 2016, says

LEDinside, a division of

TrendForce. Furthermore, the annual revenue of China’s LED package market grew by 6% for 2016 to reach US$8.9 billion, according to LEDinside’s

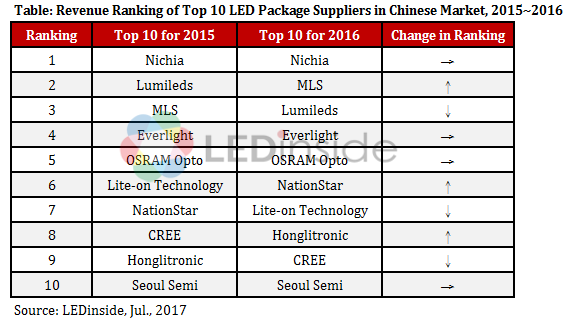

2017 Chinese LED Chip and Package Industry Report. In terms of ranking by revenue market share, Nichia retained its first place position in the Chinese market for 2016, while MLS climbed to second place and Lumileds dropped to third place.

The combined revenue of the top 10 package suppliers in China for 2016 was US$4.1 billion, up by 24% compared with their 2015 figure. By contrast, the average annual growth rate of the global LED package market came to just 6% in 2016. “The ranking indicates an increasing degree of concentration in China’s package industry,” said LEDinside analyst Allen Yu. “Also, domestic suppliers captured more of their home market and thus moved up in the ranking.”

Major domestic suppliers MLS, NationStar and Honglitronic will be raising their production capacity this year. Once the additional capacity from them becomes available, China’s LED package industry will have a more noticeably stronger position in the global market.

Nichia was still the revenue leader in China for 2016 because of its advantages in manufacturing technology, patents and brand name. Besides maintaining a large market share in the backlight market, Nichia has also been very active in the high-class automotive lighting market.

China’s MLS became the second largest package supplier in the domestic market in terms of revenue by extending its market shares for lighting LEDs and display LEDs. MLS also kept raising its production capacity through the entire 2016.

Lumileds slipped down to third spot in the Chinese market ranking for 2016. However, the company maintained annual revenue growth and remained ahead of other suppliers in applications such as high-end commercial lighting, automotive lighting and mobile flash LEDs.

Likewise, Taiwan-based Everlight and Lite-on posted revenue growth in the Chinese market. Everlight saw contributions from a wide range of application demands last year, including TV backlighting, mobile flash LEDs, display LEDs, automotive lighting and infrared (IR) products. Lite-on’s revenue was also driven by mobile flash LEDs, automotive lighting and IR products.

Among the top 10 suppliers in China for 2016, Honglitronic and NationStar were two domestic companies that advanced in the ranking as well. NationStar registered a large annual increase of 36% in its revenue from the domestic market last year. This allowed the company to climb to sixth place in the ranking. NationStar has established itself as the market leader for fine-pitch LED displays and is aggressively expanding into the lighting LED market at the same time.

Honglitronic too is growing its market share for lighting LEDs. Smalite, which is Honglitronic’s subsidiary package maker, saw its revenue shot up by more than 60% annually in 2016. Honglitronic could go up further in the Chinese market ranking for this year as its production site in China’s Jiangxi Province takes on additional production capacity.

LEDinside 2017 Chinese LED Chip and Package Industry Market Report

Release: 30 June 2017

Language: Chinese / English

Format: PDF

Page: 269

Chapter I Chinese LED Package Industry Overview

-

2015-2020 Chinese LED Package Market Size

-

2015-2020 Chinese LED Package Market Size- Market Camps

-

2015-2020 Chinese LED Package Market Size- Power Types

-

Global Top 10 LED Manufacturers Revenue Rankings in China

-

Chinese Top 10 LED Manufacturers Revenue Ranking in China

Chapter II Chinese LED Segment Market Trend

Mobile Backlight LED and Flash LED Market

-

2015-2020 Chinese Package Market Scale

-

2016-2017 Mobile Shipment

-

Backlight LED Specification

-

Flash LED Specification

-

2016-2017 Flash LED Price Trend

-

Backlight LED Supply Chain

-

Flash LED Supply Chain

-

Chinese Small Sized Backlight LED Manufacturer Ranking

Large Sized Backlight LED Market

-

2015-2020 Chinese Package Market Scale

-

2016-2017 TV Shipment

-

Edge-Type TV Backlight LED Specification

-

Direct-Type TV Backlight LED Specification

-

TV Backlight LED Supply Chain

-

Chinese Large Sized Backlight LED Manufacturer Ranking

Lighting LED Market

-

2015-2020 Chinese Package Market Scale

-

Lighting LED Specification

-

Lighting LED Supply Chain

-

Chinese Lighting Manufacturer List

-

Chinese Lighting LED Manufacturer Ranking

-

2016 Chinese Top 10 COB LED Revenue Ranking

Display LED Market

-

2015-2020 Chinese Package Market Scale

-

Display LED Specification

-

2016-2017 LED Manufacturers Display LED Capacity Forecast

-

Fine Pitch Display LED Supply Chain

-

Major LED Display Manufacturers

-

Chinese Display LED Manufacturer Ranking

-

Analysis of Chinese LED Manufacturer R&D Competence

Chapter III 2016-2017 LED Industry Market Focus

Key Trend I- MOCVD Equipment Localization

-

Rising Domestic MOCVD Further Cost Reduction for Chinese Camp

-

New MOCVD Improved Capacity To Phase Out Old Equipment

Key Trend II- Increasing OEM Orders From the World to China

-

LEDinside Perspective- Increasing OEM Orders from the World to China

-

OEM Business Chain in China- LED Package House and Internal Brands

-

International Camp OEM Orders Flew to Chinese Camp

-

International Brands' Outsource Orders Increased

-

Major OEM Revenue Scales Sufficiently Increasing

-

2013- 2016 OEM Capacity Analysis

Key Trend III- AlInGaP LED Production Scale Up

-

AlInGaP LED Chip House in China and Taiwan

-

2017 AlInGaP LED Manufacturers Expansion Plan

Key Trend IV- Blooming LED Filament Market

-

LED Filament Bulb Market Trend- 2016-2018 Global LED Filament Bulb Market Scale & Forecast

-

Chinese LED Filament Lighting Manufacturer Strategy- MLS Bought Super Trend and Ledvance to Grab LED Filament Market

-

Chinese Major Filament LED Players and Capacity

Chapter IV Chinese LED Package Manufacturer Strategy Analysis

-

Major 20 Chinese LED package manufacturers strategy analysis, including revenue and profit, product mix, production capacity expansion plan, business summary for 2016, financial analysis, main customers, and LED perspective.

Chapter V International LED Manufacturers Business Activities in China

-

Nine international enterprises and eight Taiwanese manufacturers business activities are analyzed in the report, including company product and business strategy, revenue and profit, Chinese revenue and share, and main customers in China.

Chapter VI China’s LED Package Manufacturers Competitiveness

Chinese and International Manufacturers Competitiveness

-

Major LED Manufacturers Global Revenue

-

Major LED Manufacturers Revenue from China Market

-

Major Manufacturers Revenue from China

-

Major Package Manufacturers Revenues Growth Rate

-

Top 10 LED Manufacturers Revenue Rankings in China

-

International Manufacturers Activities in China’s LED Industry

Intense Market Competition Between Chinese Manufacturers

-

LED Industry Development Revolution From Mature Stage

-

Industry Concentration By Province

-

Industry Concentration By Region

-

Industry Concentration

-

Industry Integration Trend

Chinese Chip and Package Industry Trend

-

Package Manufacturers to Integrate into Lighting Field

-

Package Manufacturers to Integrate into Supporting Fields

-

Few Chip Manufacturers to Integrate into Packaging Business

Opportunities and Threats in Chinese LED Package Industry

Chapter VII Chinese Chip Market Analysis

-

2010-2016 Chinese LED Chip Industry Subsidies Analysis

-

2015-2016 Chinese LED Chip Market Scale

-

Chip Industry Development- 2015-2020 Chinese LED Chip Market Scale

-

Chip Industry Development- 2015-2017 Chinese LED Chip Production Value

-

2016 Chip Manufacturer Revenue Ranking in China

-

Major 13 Chip Manufacturer in China- Chip Revenue, MOCVD Plan, Product Strategy

Chapter VIII Conclusions and Suggestions

If you would like to know more details, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912