After several years of price competition and industry integration, LED lighting industry has entered a mature period. The performance-price ratios of products have been greatly improved, the penetration rate of LED products in application market has been increased, and the traditional application market has gradually become saturated. Competitive advantages of enterprises are shifting from the scale of enterprises and product costs to product and technology capabilities; products’ added value will become more prominent.

The rise of the Internet of Things has led LED lighting to networked high-value digital lighting. Smart systems can collect information of users and environment, etc., make data analysis, and then adjust devices. Personalized and human-centric smart lighting has become the focus of future industrial development.

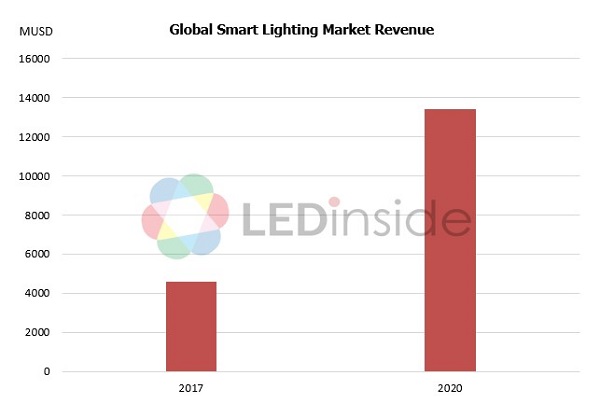

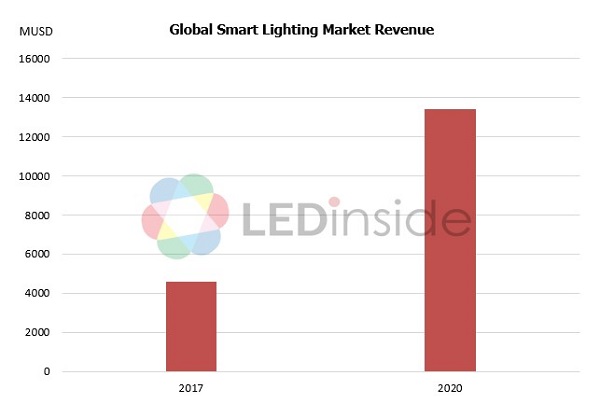

In 2017, the global smart lighting market has entered rapid development driven by the technology development, maturing products, active promotion by manufacturers, and the popularity of smart lighting concepts. The market size has reached close to $US4.6 billion with an annual growth rate of 95%. The market is expected to continue the growth in the next few years, reaching $US13.4 billion by 2020.

|

|

(Source: LEDinside) |

Smart lighting has inherent advantages to be the start point of smart city; major manufacturers actively deploy in the market

Smart lighting not only has higher profit margins, but is also an excellent start point of smart city. With continuous development, cities will face more challenges in terms of energy consumption and infrastructure construction. By 2030, the portion of people living in urban areas is expected to reach 60% of the global population, and the urban energy consumption will account for about 75% of the total energy consumption worldwide. The power consumption of lighting will account for nearly 40% of total energy consumption of cities. As an important part of smart cites, smart lighting has advantages in terms of access point number in the Internet of Things. Governments are also actively advocating the construction and development of smart cities.

Lighting giants such as Philips and Osram have also laid the foundation in smart lighting market. In 2015, Philips Lighting participated in Los Angeles’ pilot project of connected lighting. Philips CityTouch was adopted as a smart connected lighting management platform. In 2017, City Touch flex was introduced to China. This smart connected lighting system was combined with China Telecom's next-generation NB-IoT technology and Tianyi cloud service. It can be used to access various types of smart city applications including urban emergency system, traffic signal management system, security monitoring system, etc., jointly accelerating the construction of smart cities in China.

In January 2018, Osram released SymphoCityTM, an open platform integrating software and hardware used for smart city management. In addition to lighting, it also enables integrated multi-purpose management of urban security, environment, energy and communication, etc. This will assist in better management of cities, improving efficiency, reducing costs and promoting the development of smart cities.

In addition, Chinese manufacturers like Feilo Acoustics and Unilumin Group are also actively promoting smart street lamps. They mainly work on projects initiated by Chinese government. For example, Feilo Acoustics has signed strategic cooperation agreement on smart city with more than 20 Chinese cities, and also works with the government of Cengong, Guizhou in “Smart Cengong” project with an investment of about 4 billion yuan.

Communication technology continues to advance, showing diversified development

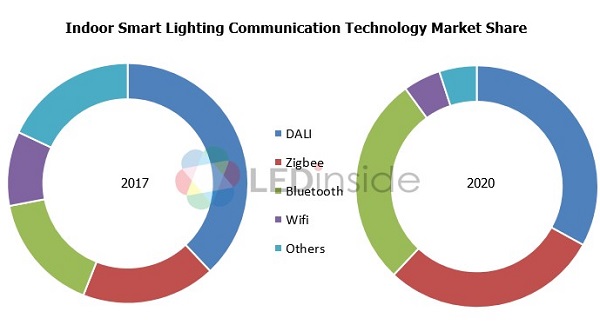

As far as current development of Internet of Things and smart lighting, communications technologies such as DALI, ZigBee, Bluetooth, Wi-Fi, LoRa, NB-IoT, Sigfox, Z-wave, EnOcean, etc. have emerged in the market.

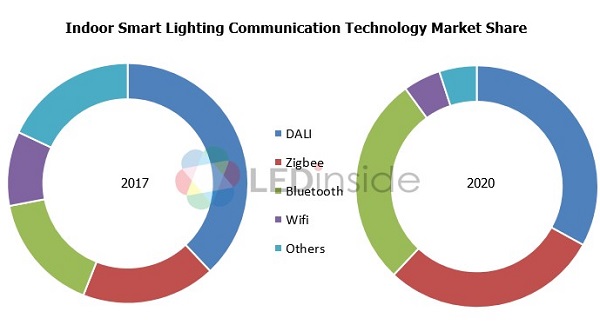

In the field of indoor lighting, there are many wireless communication protocols available, but DALI wired technology, which is specifically designed for lighting, still occupies the highest market share. The systems based on the DALI protocol have distributed smart modules, each of which has capabilities of digital control and digital communication. Information of address and lighting scenes are stored in the memory of each DALI module. Through DALI bus, the modules can make digital communication, give instructions and status information, switch on/off the lights, adjust the brightness, complete system settings and so on.

Currently, prominent advantages of wired control technology are stability and reliability. But wireless technology will become the mainstream control technology in the future as it constantly goes mature. Hence, the market share of DALI is expected to shrink gradually in the future, while ZigBee and Bluetooth will occupy a major share. ZigBee is the most common protocol for wireless communication in networked lighting. This technology is relatively mature after a long time of development. In addition of advantages in network architecture, ZigBee is also more power-saving. In the Chinese market, for example, more and more manufacturers have joined the camp of ZigBee. They have also shifted the focus to developing more products for China’s domestic consumers, instead of targeting most of their products at overseas markets as in the past.

|

|

(Source: LEDinside) |

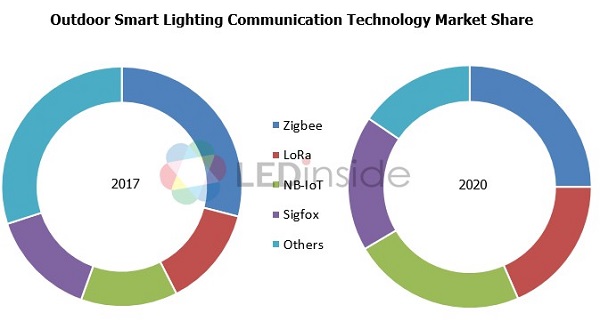

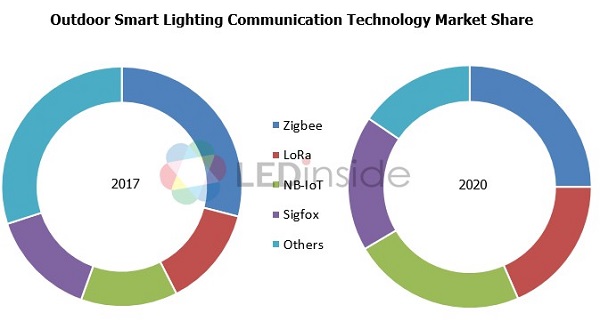

In outdoor lighting, ZigBee is also the most widely used technology at this stage. However, due to its short range, ZigBee still faces many restrictions in outdoor lighting applications. The share of ZigBee in outdoor smart lighting applications is estimated to decline slowly after 2017.In outdoor lighting, ZigBee is also the most widely used technology at this stage. However, due to its short range, ZigBee still faces many restrictions in outdoor lighting applications. The share of ZigBee in outdoor smart lighting applications is estimated to decline slowly after 2017.

With the rise of the Internet of Things, Low-Power Wide Area Network (LPWAN) has appeared for IoT applications with low bandwidth, low power consumption, long distance and large numbers of connections. Mainstream examples include NB-IoT using licensed spectrum, LoRa (Long Range) and Sigfox using unlicensed spectrum, etc. LPWAN's capability of long-range communication enables large-scale IoT deployments and avoids frequent battery replacement, lowering the maintenance costs.

|

|

(Source: LEDinside) |

Among several low-power wide area networks, LoRa was more open and put into commercial uses earlier. With its industry consortium established in 2015, LoRa is currently the most widely used in LPWAN. The NB-IoT, which had its standards freezing in 2016, can avoid wireless interference as it uses licensed spectrum. Furthermore, it has high level of security and quality as service providers do, thus is more competitive in smart lighting scenarios that demand greater reliability. The market share of NB-IoT also grows the fastest.

To sum up, the current markets of various types of low-power wide area networks are relatively fragmented, their market shares are relatively low as well. The market concentration is expected to increase gradually as the technology advances and the functions improve.

Related reading: