According to the newest 2019 Mini LED and HDR High-End Display Market Report by LEDinside , a division of TrendForce , after 3 years of mini LED backlight technology development, mini LEDs will finally make an official appearance on displays in 2019 and compete directly with OLEDs. Apple, with eyes set on the advantages of mini LED technology for a while, is also eager to strike collaborations with suppliers in Taiwan and Japan to introduce this technology into desktop displays, notebooks and tablets.

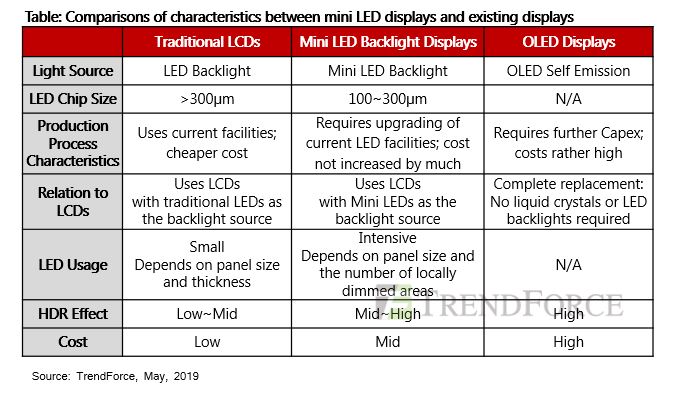

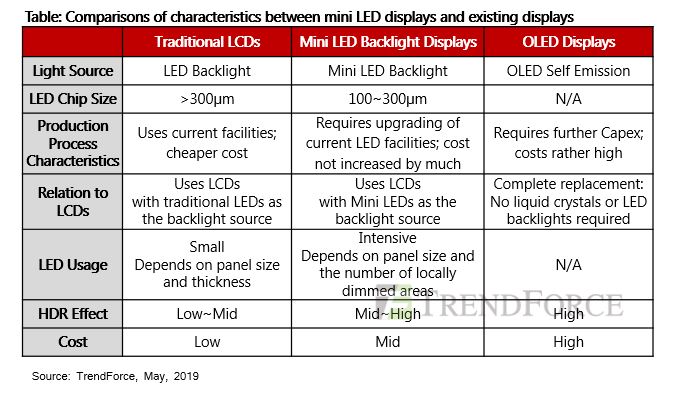

TrendForce explains that, in comparing the two, Mini LEDs possess a local dimming function with a contrast effect similar to that of OLED displays. On some product lines, costs for mini LED backlit displays may even be lower than their OLED counterparts. For traditional LCD panel manufacturers, this translates into an opportunity to re-upgrade product specs and a chance to compete with OLED technology.

“Costs ” to Become the Key to Backlit Mini LED Mass Production Feasibility

Since mini LED backlight technology only differs from traditional ones in its greater usage of mini LED chips, panel manufacturers only have to redesign driver ICs, select substrates and reinvest in a few equipment, such as those used in surface-mounting and equipment inspection. The availability of existing panel production lines for use allow panel manufacturers to undergo a painless, hassle-free upgrade.

In contrast, the increased usage of LEDs will certainly raise costs for traditional LCD panels. Finding a way to lower costs and narrow the gap between mini LED backlit display and traditional LCD costs will be the key to mini LED backlight prevalence.

From a supply chain standpoint, Taiwan panel manufacturers are lagging behind in OLED panel production capacity, and are thus the most motivated to develop mini LED backlight technology solutions. AUO and Innolux joined hands with their respective LED subsidiaries in development: AUO with Lextar, and Innolux with AOT, Epileds and other companies as main collaborators. Through these partnerships, they hope to keep intact the competitive edge their LCD products previously possessed. Furthermore, Taiwanese LED giant Epistar, who focuses on advanced displays and backlight applications, is providing products custom made for customers and also possesses the ability to modify its own facilities.

China's vendors have also been actively developing micro LED and mini LED technologies. Sanan, for example, has established the first epitaxial wafer and chip production lines for micro LEDs in 1Q19, and has already finished developing a micro LED product that uses 20-micrometer chips. Sanan has joined forces with Samsung, becoming Samsung's go-to supplier for mini LEDs. Chinese panel supplier BOE has also declared news of forming a joint venture with American company Rohinni for the purpose of producing micro and mini LEDs solutions for display backlight sources; their main aim is to ramp up transfer speed, precision and yield of LEDs to substrates and create cost-competitive products.

2019 Mini LED and HDR High-End Display Market Report

Release Date: 30 April 2019

Format: PDF

Language: Traditional Chinese / English

Page: 100~112

Quarterly Update: Micro / Mini LED Market Prospective Analysis-Player Movement, New Technology Introduction, and Display Week / Touch Taiwan Exhibit Show Report (April, July, October 2019; 10-15 Pages / Quarterly)

Chapter 1 Mini LED Market Scale Analysis

u 2018-2023 Mini LED Output Value Analysis and Forecast

u 2018-2023 Mini LED Output Analysis and Forecast

u 2018-2023 Mini LED Backlight Display Penetration Rate Forecast

Chapter 2 Mini LED Definition and Application Advantages

u Display Development Trend

u The Origin of Miniaturized LED

u Miniaturized LED Size Definition

u LED Light Source for Display

u Mini LED Backlight Product Highlights

u Mini LED Backlight Product Highlight - Cost

u Mini LED Backlight Product Highlight - Brightness

u Mini LED Backlight Product Highlight - Contrast

u Mini LED Backlight Product Highlight - Reliability

u Mini LED Backlight Product Highlight – Slim

u Comparison on Competitiveness of Various Displays

Chapter 3 Mini LED Backlight Product Application and Trend

u Mini LED Backlight Module Display Processing Cost Structure

u Mini LED - Chip Processing Cost Analysis

u Mini LED – Die Bonding Processing Cost Analysis

u Mini LED - PCB Processing Cost Analysis

u Mini LED - Drive IC Processing Cost Analysis

u Mini LED Backlight Display Application Product Overview

u Mini LED Product Application Specification Overview

u Cellphone Application Market Development Trend

u Cellphone Application Market Cost Trend

u Tablet Application Market Development Trend

u Tablet Application Market Cost Trend

u NB Application Market Development Trend

u NB Application Market Cost Trend

u Automotive Display Application Market Development Trend

u Automotive Display Application Market Cost Trend

u MNT Application Market Development Trend

u MNT Application Market Cost Trend

u TV Application Market Development Trend

u TV Application Market Cost Trend

Chapter 4 Mini LED Technology and Challenge

u Mini LED Technology and Challenge

u Chip-Mini LED Chip Characteristics

u Chip-Mini LED Flip Chip Structure

u Chip-Mini LED Chip Light Shape Characteristics

u Chip-Mini LED Chip Challenge Stepper Image

u Probing and Sorting- Face Challenge Due to the Growth of Usage Volume

u Probing and Sorting- Mini LED Chip Binning Challenge

u Package-LED Package Technology Development Trend

u Package-CSP Classification and Technology Challenge

u Package-Mini LED Classification and Technology Challenge

u Package-Comparison of Difference between Mini LED and CSP

u SMT-Mini LED SMT Overview

u SMT-SMD v.s Mini LED Size Comparison

u SMT-Mini LED SMT Problem Analysis

u SMT-Pick and Place Problem Analysis

u SMT-Mini LED Welding Technology Classification

u SMT-Surface Mount Technology-Solder Paste Process

u SMT-Solder Paste Processing Problem Analysis

u SMT-Surface Mount Technology-Metal Eutectic Process

u Color Conversion-Wide Color Gamut Display Solution Trend

u Color Conversion-Wide Color Gamut Display Solution Specifications

u Color Conversion- QD Backlight Display Technology Structure

u Color Conversion-QD Backlight Technology Development Trend

u Backplane-Display Backplane Structure

u Light Source Backplane- Material and Drive Mode Classification

u Light Source Backplane-Glass Substrate and Switch Component Characteristics

u Light Source Backplane- Comparison of Difference of PCB Substrates

u Light Source Backplane- Comparison of Backplane Technology Differences

u Drive-Mini LED Active and Passive Drive Analysis

u Drive-Mini LED Passive Drive Classification

u Drive-Mini LED Passive Drive Light Source Module-Scan Mode

u Drive-Mini LED Passive Drive Partition Drive IC Volume Evaluation

u Drive-Mini LED Active Drive Light Source Module

u Light Processing- Challenge in Uniformity of Mini LED Backlight

u Light Processing- Calibration of Mini LED Backlight Display Disuniformity

u Light Processing- Differential Analysis in Mini LED Image Splicing

u Thinning- Evolution of Mini LED Backlight Display Light Source

u Thinning- Mini LED Backlight Display Development Trend

u Thinning- Trends in the Thinning of Mini LED Backlight Displays

u Thinning- Challenge of Mini LED Backlight Display Thinning

Chapter 5 Mini LED Key Manufacturer News Analysis

u Mini LED Backlight Supply Chain Analysis

u Mini LED Sorting and Binning Equipment Manufacturer-SAULTECH

u Mini LED Die Bonding Equipment Manufacturer- ASM Equipment and Inspection Solution

u Mini LED Die Bonding Equipment Manufacturer- ASM in Industry 4.0

u Mini LED Die Bonder Equipment Manufacturer-K&S

u Mini LED Die Bonder Equipment Manufacturer-Rohinni

u Mini LED Light Source Backplane Manufacturer-UNIFLEX

u Mini LED Drive IC Manufacturer-Macroblock

Chapter 6 Mini LED Supply Chain and Manufacturer News Analysis

u Mini LED Backlight Application Products Overview

u Global Major Mini LED Backlight Manufacturers’ Supply Chain Analysis

u Regional Manufacturer News Analysis-Taiwan Companies

u Regional Manufacturer News Analysis - Mainland Chinese Companies

Further information, please contact: