Staying free of patent infringement is the key to component adoption by brand manufacturers

Generally speaking, patents and IPs are important to major brands including Apple, Samsung, and LG, as these companies may be forced to compensate other parties or have their products barred from certain markets if they are accused of patent infringement. In the worst case scenario, their downstream distributors may be forced to remove end-products from retail shelves. Any financial savings these companies may obtain as a result of using components with questionable IP statuses would be far outweighed by the aforementioned negative outcomes in the event that patent infringement is established.

As such, these major brands are, for the most part, conservative in releasing or adopting products if they are unfamiliar with the patent statuses of emerging technologies contained within said products, since the risk of litigation can be high. This behavior also indirectly explains the primary reason for Apple to construct its own production line in Longtan, Taiwan. Of course, within the overall supply chain, component suppliers also need to provide their brand clients with products that are clear of patent infringement and provide the clients with full guarantee of inculpability.

However, history would suggest that the period after a new product has been introduced to market but before it can gain enough steam to generate revenue on a large scale is typically when suppliers engage in a hypercompetitive fight over IPs. Lawsuits, negotiations, and predatory pricing at loss-taking levels between companies are not uncommon during this period.

The Mini LED backlighting market is the perfect illustration of this sort of corporate behavior. As Apple and Samsung are now gearing up to source a substantial number of Mini LED backlights to integrate into their new products, projected to enter mass production in 2021, the various Mini LED suppliers’ patent litigations that are sure to come will be the key to barricading their competitors from the market. Naturally, these suppliers are wary of infringing on hidden patents.

Epistar’s Patent Map

At the time of writing, Epistar has accumulated over 4,400 LED-related patents. In particular, Epistar holds the vast majority of patents and technologies related to flip chip, a crucial aspect of Mini LED chip manufacturing. The company thus has a comprehensive technological and patent strategy for flip chip. Furthermore, LED lighting uniformity and secondary LED optics may drastically increase in importance in the Mini LED era.

It should also be pointed out that certain displays with Mini LED backlights may feature HV Mini LED chips as a power-saving measure. Epistar already thought of power-saving features as one benefit of HV LED chips around 2009, and the company applied for various patents related to the fundamental technologies of HV LED power saving.

Epistar has garnered much industry acclaim with the high performance of its Mini LED chips. That is why Epistar is able to successively become a key part of U.S. and Korean brands’ supply chains. As for how Epistar plans to react against the multitude of Chinese competitors, Epistar president Chin-Yung Fan indicates that the company’s reaction would depend on the needs of the individual clients, since different clients require different product specs. For instance, tablet manufacturers place stringent requirements on LED power consumption and optical distance. In particular, Mini LED chips require shrinking LEDs to miniscule dimensions, ensuring the electrodes’ smoothness and consistent height, in order to maintain a good current distribution, thereby raising the product reliability via a good insulation layer design. Each of the above processes poses considerable technical challenges. Fortunately, Epistar has the perfect solution to address all of these challenges.

Meng-Chun Kuo, director of Epistar’s intellectual property division, formed a backronym with the name “Epistar” using various processes involved in LED epitaxy and chip manufacturing. This backronym is meant to outline the company’s various key patent categories:

E – Epitaxy

P – PSS (pattern sapphire substrate)

I – Insulating structure; the coating process creates a protective insulating layer, thereby solving the problems with defects and electrical characteristics and raising the reliability of the Mini LED

S – Spreading-current structure; also includes electrode design, among other processes

T – Transparent contact layer, a layer of ITO (iridium tin oxide)

A – Angle adjustment; the angle at which light is emitted from the display can be enlarged through chip structural design

R – Reflecting mirror, which increases the light extraction rate

Patents related to key technologies in the Mini LED display industry:

According to AT IP Management, which is well-versed in litigations with Japanese and Korean companies, Mini LED technologies bring with them a large number of possible patents. AT IP Management has provided some insight into each of the Mini LED-related technologies.

The five major LED manufacturers (Nichia, CREE, OSRAM, Philips Lumileds, and Toyoda Gosei) as well as Epistar and Seoul Semiconductor possess comprehensive strategies with regards to LED wafer epitaxy and chip processes. Although the number of patents a company holds directly determines the influence of said company in the fields of wafer epitaxy and chip processes, patent-related litigations are prohibitively expensive. As such, unless a company registered overwhelming revenue in relation to its competitors, defending one’s market share via patent litigations is generally not a viable strategy. Given the enormousness of the Mini LED backlight market, major manufacturers competing in this space will aggressively defend their positions via defending their patents.

In terms of phosphor and packaging, Mini LED is relatively different from some of the more prevalent technologies in the past. Epistar’s COB technology, Korean manufacturers’ quantum dots, GE’s PSF phosphors, and certain Japanese manufacturers’ optical uniformity are all examples of disruptive Mini LED technologies not possessed by the five major LED manufacturers, making these disruptive technologies likely important areas of development in the future.

Drivers and backlights were some of the technologies that were in development in the past but less often used in real-life applications. For instance, local dimming as a concept was mentioned early on (prior to 2009), and its related patents have been applied for since. However, only until the recent couple of years (2019-2020) when Mini LED technology matured did local dimming Mini LED displays see rapid growth in the market, thereby challenging OLED’s superiority in certain display sizes.

At the moment, these emerging technologies and products are still in the integration stage. Companies such as Apple, Samsung, LG, TCL, Asus, Xiaomi, Lenovo, and Huawei are all rushing to release new products, although which design will win out as the market mainstream remains to be seen, with 2021 expected to become the most important year in terms of market observation. At that time, what technologies will become the market mainstream will be revealed.

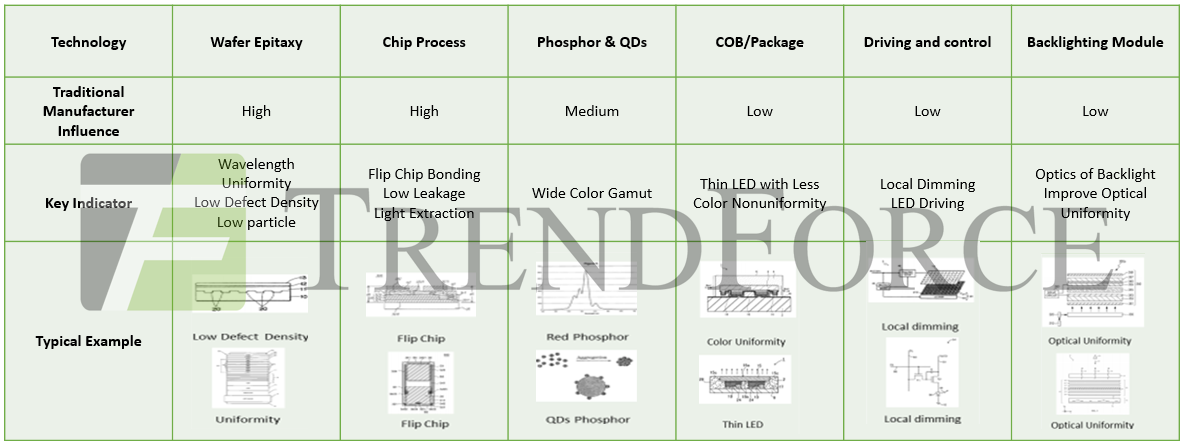

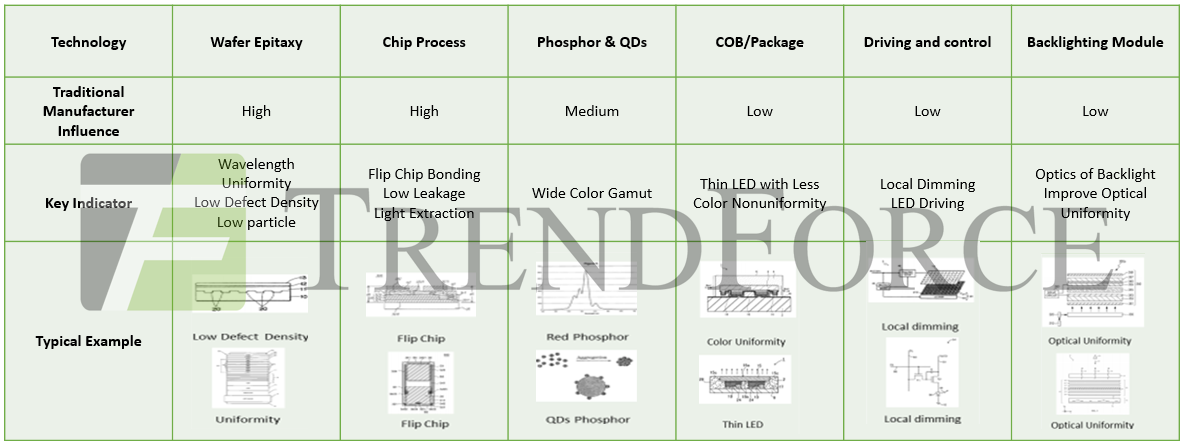

The table below summarizes the key technologies in the Mini LED industry. Major upstream LED manufacturers’ patents remain important; for instance, Epistar and Nichia possess a large number of key patents. On the other hand, midstream and downstream technologies lean more towards color accuracy, optical uniformity, Mini LED backlighting, and local dimming zones. Samsung, Apple, and other companies from Japan, Korea, and Taiwan, have all made their respective large-scale patent strategies.

TrendForce believes that even leading manufacturers need to carefully pick LED component manufacturers with an advantage in patents as they engage in patent transactions and patent licensing, in order to navigate the precarious patent minefields while successfully avoiding missteps of patent infringement. In an increasingly hypercompetitive market, patent wars are expected to become ever more vicious going forward.

Key Technological and Patent Examples in the Mini LED Display Supply Chain

Source: AT IP management