According to the latest TrendForce’s report ‘2021 Global LED Lighting Market Outlook: Light LED and LED Lighting Market Trend (1H21)’, the global LED lighting market is more optimistic than previous estimates, it is estimated with an opportunity to grow 5.1% in 2021.

In the short term, due to the rapid spread of COVID-19 around the world, the demand and consumption of LED lighting has been suppressed to some extent. In the medium and long term,there still exist uncertainties to each industry under the impact of pandemic. However, in order to alleviate the negative effects on economic growth, governments around the world take actions to spur economic by fiscal stimulus and monetary easing policies. It is expected to recovery extensively. Thus, the lighting industry will benefit from government policies as downstream LED lighting demand is highly correlated with macroeconomic development.

LED lighting products are the necessities for people's production and living, thus the rigid demand market still exists. During the epidemic, the demand for residential lighting market has not decreased but increased, which demonstrates this of essential characteristic.

In addition, LED lighting products are further developed to digital intelligent dimming and control fixtures. It is believed that lighting industry will also pay more attention to the intelligent systemization of products, human-caused health lighting and market demand for segmented applications in the future. TrendForce estimates that it will reach US$44.3 billion in 2025.

2021 Key Lighting Market Trend Analysis:

Smart Lighting, Human Centric Lighting (HCL), Niche Lighting

1. The government's investment in lighting for smart buildings and the development of smart urbanization drive the increase of market demand for smart lighting

Amid the COVID-19 crisis, smart lighting market development was better than traditional LED lighting market in 2020, thanks to users’ growing demand for smart lighting system boosted connected lighting market.

From the perspective of applications, smart commercial lighting combines human-centric lighting requirements and smart lighting to improve light quality and energy-saving control. Although it is affected by the epidemic in the short term, it will show rapid growth in the long term.

The second biggest lighting market is residential application. Driven by the development of smart home market, especially in high-end residence, smart home lighting enjoyed strong demand. And the epidemic has accelerated the penetration rate of smart lighting products. It is the fastest-growing application category in 2020 with a growth of 27% YoY.

Outdoor smart lighting market sector, despite its relatively small market size, is growing with fast speed attributed to the promotion of energy-saving policies and stimulus packages launched by the governments, including the infrastructure stimulus packages in Europe and Australia as well as FAST Act and Highway Trust Fund in the US. In addition, due to the trend of smart city construction, with IoT and 5G development, the smart street lighting market has reached the high-speed replacement and development phase, TrendForce says.

2. Human-centric lighting is currently mainly reflected in the application of high color rendering lighting and healthy lighting

GE Current has worked with Nichia to apply TriGain in commercial lighting for the achievement of high color saturation and CRI / R9. Besides, luminous efficacy may not be sacrificed. According to TrendForce, the sales performance of track lights with TriGain technology has been brilliant in 2H20.

In order to reduce the harmful effects of blue light, 435nm LED may be introduced in healthy lighting products. In the future, schools will be expanded to.

3. The horticultural lighting LED in the niche lighting market has become one of the fastest-growing lighting sectors

Owing to the accelerated legalization of cannabis cultivation and the pandemic-induced surge of recreational and medical cannabis markets in North America. In addition, the pandemic exerts an increasingly obvious influence on food supply chain, contributing to a new round of development in building indoor vertical farms, which boosts the demand for replacing and purchasing lighting devices. Moreover, the large reduction in the cost of lighting LED products, including the unit price of red LED and medium- and high-power LEDs, brings down the overall fabrication costs of luminaires.

Market demand for horticultural lighting proliferated in 2020, according to TrendForce’s latest investigations. Most manufacturers, such as OSRAM, Samsung, Cree, Lumileds and Seoul Semiconductor, has continued improving product performance, and launching higher specifications of horticultural LED products in response to customer demand. This move will accelerate the replacement of traditional lighting products by LEDs.

2021 Lighting Market’s Development Opportunities and Challenges

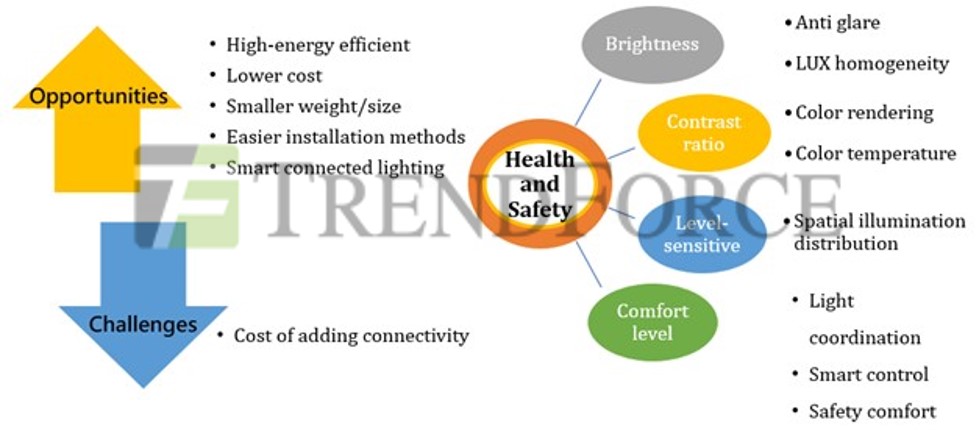

The market drivers of the future lighting industry will mainly come from: higher energy efficiency, lower cost, lighter weight, smaller size, easier-to install lighting devices, and more convenient intelligent control. With the development of IoT technology, intelligent control will be a major driver of the future market.

In terms of health and safety, at the same time, the next generation of lighting products must have higher quality and quality (reflected by contrast and brightness), more comfortable and so on.

In the end, though observing performance of lighting manufacturers, due to the dual impact from the US-China conflicts and the COVID-19 epidemic, they will face more severe market challenges in 2020. By observing their revenue and product performance, TrendForce found that most of them continue to strengthen the development in professional lighting and smart lighting markets. With the demand for smart lighting products increased, the revenue reduction for some players, who have developed this market in an earlier stage, greatly narrowed in 2020.

Analyst: Christine / TrendForce

For more details on the lighting market, please stay tuned for the latest report- 2021 Global LED Lighting Market Outlook!

2021 Global LED Lighting Market Outlook- Light LED and LED Lighting Market Trend

Release Date: 31 January 2021 / 31 July 2021

Language: Traditional Chinese / English

File Format: PDF/Excel

Page: 80-100 / Semi-annual

1. Lighting LED Market

2. Global Lighting Market Trend

3. Regional Lighting Market Trend and Regulation

4. High Growth LED Lighting Market

-

Horticultural Lighting (1H21)

-

Stadium Lighting (2H21)

5. Smart Lighting Market Trend

-

Commercial Lighting (1H21)

-

Street Lighting (2H21)

6. Lighting Product and LED Market Requirements

7. Lighting Manufacturer Revenue Ranking

8. The Impact of US-China Trade Conflict and COVID-19 on the Lighting Industry

1H21 Global LED Lighting Market Outlook- Light LED and LED Lighting Market Trend

Chapter 1 Lighting LED Market

2021-2024 Lighting LED Market Scale- by Package

2019-2021 Lighting LED Market Scale- by Power

Chapter 2 Global Lighting Market Trend

TrendForce LED Lighting Market Scale- Methodology

TrendForce LED Lighting Market- Production Definition

2021-2025 Global LED Lighting Market Scale: by Product

2021-2025 Global LED Lighting Market Scale: by Region

2021-2025 Installed Global LED Lighting Market and Penetration

2019-2021 Global LED Lighting Market Forecast: by Product

2020 Global LED Lighting Market-Value Based: by Region vs. by Product

2020 Global LED Lighting Market-Volume Based: by Region vs. by Product

2021 Global LED Lighting Market-Value Based: by Region vs. by Product

2021 Global LED Lighting Market-Volume Based: by Region vs. by Product

2021-2025 Global LED Lighting Application Market Trend

2021 Lighting Market’s Development Opportunities and Challenges

Chapter 3 Regional Lighting Market Trend and Regulation

Global LED Lighting Market Trend

European Lighting Market Trend

US Lighting Market Trend

Japan Lighting Market Trend

China Lighting Market Trend

Asia Pacific Lighting Market Trend- Southeast Asia, Australia and India

Middle East and Africa Market Trend

Latin America Lighting Market Trend

Chapter 4 High Growth LED Lighting Market

2020-2025 Horticultural Lighting Market Size- LED Package

2020-2025 Horticultural Lighting Market Size- LED Luminaire

2020-2025 Horticultural Lighting Market Size- LED Luminaire- By Region

Main Manufacturers of Horticultural Lighting

Mainstream Horticultural Lighting Brands’ Product Spec. Analysis

Specification Requirements of Horticultural Lighting LEDs from Major Applications

DLC Releases New Technical Standards for Horticultural Lighting Products

Chapter 5 Smart Lighting Market Trend

Development Status of Smart Lighting Market

2021-2024 Global Smart Lighting Market Scale

2021-2024 Smart Lighting Communication Technology Market

Chapter 6 Lighting Product and LED Market Requirements

Filament Light Specification and Price Overview by Regions

Filament Lamp Market- LED Specification Requirements

Street Light Specification and Price Overview by Regions

Panel Light Specification and Price Overview by Regions

Panel Light Market- LED Specification Requirements

Troffer Light Specification and Price Overview by Regions

Troffer Light Market- LED Specification Requirements

High Bay Specification and Price Overview by Regions

High Bay Market- LED Specification Requirements

Explosion-proof Light Specification and Price Overview by Regions

Explosion-proof Light Market- LED Specification Requirements

Chapter 7 Lighting Manufacturer Revenue Ranking

2019-2020 (E) Top 20 LED Lighting Player Revenue Ranking - Lighting and LED Lighting Revenue

Signify

Zumtobel

Fagerhult

Glamox Group

Acuity Brands

Hubbell

GE Lighting

Valmont Industries

Panasonic

Endo Lighting

IWASAKI

Chinese Lighting Manufacturers’ Strategies

Opple Lighting

Yankon Lighting

MLS/LEDVANCE

NVC Lighting

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|