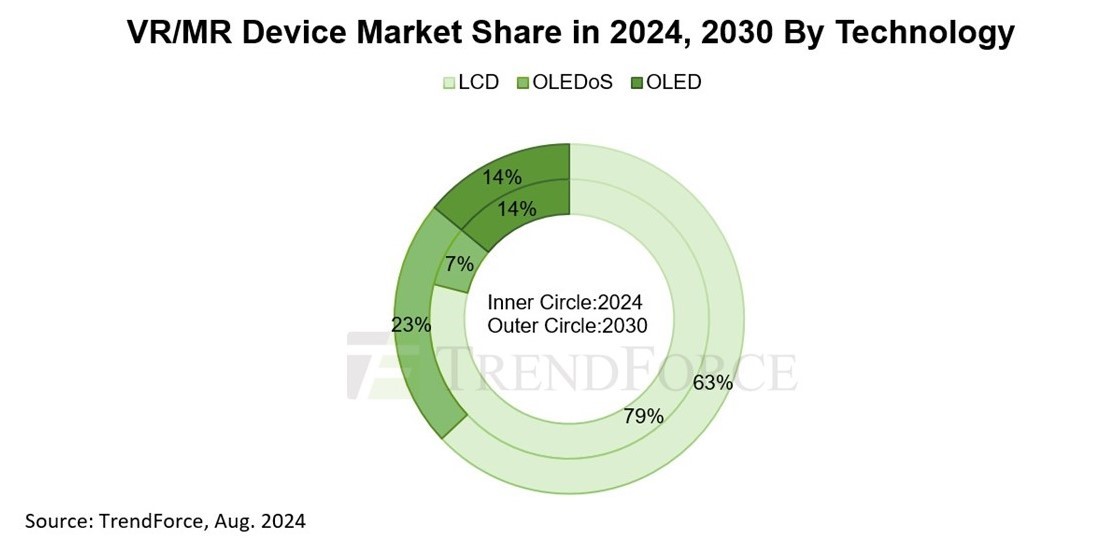

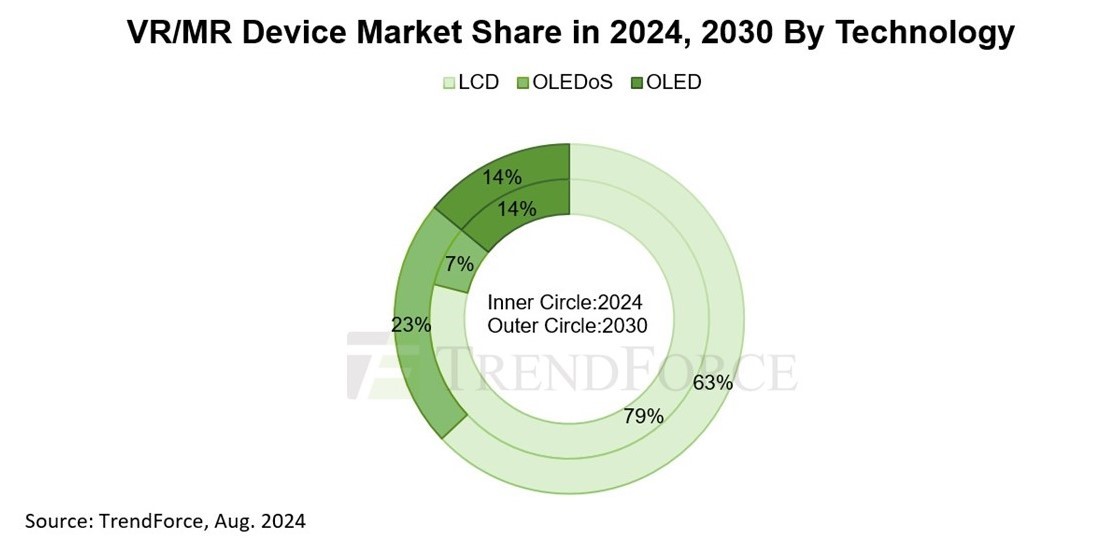

TrendForce’s latest report reveals that shipments of near-eye displays are expected to increase year-by-year over the next few years following inventory clearance. It is anticipated that OLEDoS will dominate the high-end VR/MR market, with its technological share rising to 23% by 2030, while LCD will continue to occupy the mainstream market, holding a 63% share in near-eye displays.

TrendForce defines VR/MR devices as near-eye displays that achieve an immersive experience through a single display. Devices emphasizing transparency and the integration of virtual and real-world applications are classified as AR devices.

TrendForce notes that VR/MR has already established a solid foundation in the entertainment and gaming sectors. Furthermore, the introduction of Apple Vision Pro in 2024 is expected to open new avenues for VR/MR applications. Current issues of high pricing and limited service content are expected to improve over time. Therefore, TrendForce predicts that VR/MR device shipments could reach 37.3 million units by 2030, with a CAGR of 23% from 2023 to 2030.

Manufacturers’ strategies drive OLEDoS penetration in the VR/MR market

The collaboration between Sony and Apple on the Apple Vision Pro has established OLEDoS as dominant in the high-end VR/MR market. This partnership highlights the industry’s pursuit of high-resolution VR/MR devices and has increased attention on OLEDoS.

OLEDoS employs CMOS and top-emitting OLED components to achieve higher luminous efficiency, pushing the basic resolution of OLEDoS products to over 3,000 PPI. TrendForce notes that the complexity of CMOS manufacturing and its lower yield rates result in high production costs for OLEDoS displays, which limit its penetration growth.

TrendForce also indicates that, in addition to international companies actively investing in the OLEDoS field, Chinese manufacturers such as SeeYa and BOE are also following suit. This is expected to drive the future expansion of this technology in the VR/MR device market, helping to reduce costs and improve yield for CMOS technology. OLEDoS still has potential in the high-end market, with TrendForce estimating its market share will increase from 7% in 2024 to 23% in 2030.

Investment in development resources and iteration of display specifications strengthen LCD competitiveness

In the mainstream near-eye display market, LCD technology remains dominant due to Meta’s focus on cost-effectiveness. However, as these devices continue to pursue higher resolution and image quality, LCD products—with their 1,200 PPI—will face competition from other technologies. TrendForce estimates that in 2024, the shipment volume of LCD near-eye display products will be 6.8 million units, a 5.6% decrease compared to 2023.

TrendForce points out that there is still room for optimization in the complex components of LCD. For example, improving liquid crystal materials to reduce dizziness and upgrading backplane technology to boost resolution beyond 1,500 PPI. BOE has invested heavily in the application of LCD in near-eye displays, with continuous updates and iterations of LCD display specifications in VR/MR devices, ensuring this technology maintains strong competitiveness in the mid-to-low-end market. TrendForce forecasts that LCD technology will hold a 63% market share by 2030.

OLED market share to remain between 13% and 15%

Emission material cannot fully cover the screen after deposition, which exacerbates the screen door effect when using VR/MR devices. TrendForce indicates that OLED is less competitive than OLEDoS in the high-end market and cannot match the cost-effectiveness of LCD products. Additionally, the application of OLED in the VR/MR market relies heavily on specific manufacturers, limiting its long-term penetration rate. TrendForce estimates that from 2024 to 2030, the market share of OLED in the VR/MR market will remain between 13% and 15%.

Author: Eric, Thea / TrendForce

TrendForce 2024 Near-Eye Display Market Trend and Technology Analysis

Release Date:2024 / 07 / 31

Languages:Traditional Chinese / English

Format:PDF

Page:164

Chapter I. Near-Eye Display Development Overview

-

The Birth of AR / VR / MR

-

From Reality to Virtuality: The Continuous Spectrum of Virtual and Real Images

-

Two Major Meanings of MR in Marketing

-

Technical Architecture for Creating XR Experiences

-

Holy Grail: “The Whale Moment” of MR

-

AR / VR / MR Specification Analysis

-

AR / VR / MR Display Technology Roadmap

-

AR / VR / MR Market Challenges: High PPI

-

Highest Resolution for Eyes is Limited to the Central Area:From the Retina to Fovea

-

Foveated Display: Efficient Redistribution of Pixels

-

AR / VR / MR Display Challenges: Vergence Accommodation Conflict (VAC)

-

Development of VR / MR Device Display Solutions

-

Key Indicators for VR / MR : The “Out of Control” Requirements of Resolution

-

VR / MR Dilemma: Trade Off between PPD/Thickness and Power Consumption

-

Key Indicators for VR / MR Optical Technology: Thickness

-

Key Indicators for VR / MR Optical Technology: FOV

-

VR / MR Dilemma: Reduced MPRT to Suppress Display Drag

-

Pancake Optics Becomes a Must for VR / MR Technology

-

Pancake 2.0: Highlights of the Optical Technology

-

Pancake 2.0: Thickness Is Further Decreased

-

Pancake 2.0: Efficiency Is Further Increased

-

VR / MR Optic System Landscape

-

VR / MR Displays: LCD vs. OLED

-

PPD Competitions for VR / MR Extend from Displays to Systems

-

Latency Issues of VST Displays

-

Aligning Display Specifications with VR / MR Requirements

-

AR Market Challenges- Never Too Small

-

AR Market Challenges- Never Too Bright

-

Optical System Trend

-

Light Engine vs. Optical System

-

Optical Analysis Landscape

-

Aligning Display Specifications with AR Requirements

-

Augmented Reality Display Technology Matrix

Chapter II. Near-Eye Display Market Trend Analysis

-

2024-2028 NED Market Size Analysis

-

2024-2028 VR / MR Market Size Analysis

-

2024-2028 AR Market Size Analysis

-

2024-2028 VR / MR Market Size Analysis :LCD/OLEDoS

-

2024-2028 AR Market Size Analysis :OLEDoS/LEDoS

Chapter III. Near-Eye Display Technology Overview

3.1 OLEDoS

-

OLEDoS Basic Process

-

OLEDoS Technology Landscape

-

OLEDoS: Further Increases in PPI and Brightness

-

OLEDoS Analysis: Sony / eMagin / Kopin / RAONTECH

-

Al Anode Process as an Alternative to High-Resolution OLEDoS

-

Adopting Al Anode May Change Division of Labor in OLEDoS Industry

-

Transparent OLEDoS: OLED-on-SOI

-

OLEDoS Shifts from AR to VR / MR in 2024

3.2 LEDoS

-

Augmented Reality: LEDoS Manufacturing Process

-

LEDoS Technology Portfolio Roadmap

-

LEDoS Equipment and Manufacturing Process Upgrades

-

Epitaxy: Substrate Materials and Size Options

-

Chip: 2D / 3D Structural Analysis

-

Chipmaking and Back-end Chipmaking Processes

-

ALD Passivation

-

Bonding: Temperature, Stress, and Precision are Key Technical Factors

-

Bonding: CTE Mismatch

-

Bonding: Size Mismatch Problem

-

Non-conventional Bonding: LED + Single-substrate Process

-

Intrinsic Limitations of LED Light Sources: Light Concentration Challenge

-

On-chip Optics: Micro-optics is a New Focus

-

Full Color Microdisplay Technologies

-

InGaN Red Light Technology

-

Red Light Dilemma: InGaN or AlInGaP?ALD Passivation

-

InGaN Red LEDoS Are Still Under Development

-

Full Color Display: QD Color Conversion Pros and Cons Analysis

-

Full-colorization: QDCC To Be Further Advanced by NRET Mechanism

-

QDCC Capable of High Resolution Up to 3,000 PPI

-

Full Color Display: RGB Vertical Stacking

-

Vertical Stacking LEDoS Technology

-

Vertical Stacking LEDoS Technology Challenges

-

Advantages of Vertical-stacking LEDoS Technology

-

Vertically Stacked LED PKG: Commercial Application Aiming at Displays

-

Next “Battlefield” for LEDoS Miniaturization: QDCC vs. Vertical Stacking

-

Full-colorization: Multiple or One Color Tunable LED

-

Wire/Rod LEDoS: An Edge in Efficiency for High PPI Applications

-

LEDoS Technology Evaluation for NED

-

Wire/Rod LEDoS: Pros and Cons

-

LEDoS Microdisplay Key Technology Analysis

3.3 LCD

-

Key LCD Technology: Color Sequential

-

LCD Key Technology: Mini LED Backlight

-

LCD (on Glass) PPI Breakthrough

-

LCD (on Glass) High Frame Rate

-

LCD Backlight Revolution: Laser

-

LCD Backlight Revolution: Laser + HOE

-

LCD Technological Development Summary: LCD Potential Fully Release

-

LCD Maintain Competitiveness in VR / MR: The Abundant “Arsenal”

3.4 LCoS

-

LCOS: Light Engine Miniaturization

-

LCOS: Display Module Size Shrinks to 0.47cc

3.5 DLP

-

DLP Further Advancement: Tilt-and-Roll Pixel (TRP) Technology

3.6 LBS

-

LBS: Ecosystem and Light Engine Miniaturization

-

Laser Beam Scanning: Size / Resolution

3.7 OLED

-

Positive Cycle Between OLED and Other Technologies

-

Vertical Stacking of OLED Driver Circuits: OLED-on-OS-on-Si

Chapter IV. Industry Layout and Player Dynamic Updates

-

XR Companies M&A Strategies Overview for LEDoS

-

Google M&A Strategies (JDC/Raxium)

-

Meta M&A Strategies (InfiniLED/MLED)

-

Apple M&A Strategies (Luxvue/Tesoro)

-

Porotech

-

JBD

-

Sitan

-

Raysolve

-

Saphlux

-

Mojo Vision

-

Ostendo

-

LG OLEDoS Advancement History (2021-2024)

-

Collaborate to Enter the High-end MR Competition in Businesses

-

Apple Vision Pro Display and Optic

-

Apple Vision Pro Spillover Effect

-

Apple Vision Pro as a Productivity Tool for Consumer Market

-

Microdisplay Battle between LCD and OLED: Quest 3 vs. Vision Pro

|

If you would like to know more details , please contact:

|