In August, tech giants Meta and Apple announced plans for smart glasses, making AI glasses a hot topic in the stock market and causing the prices of related stocks to go up.

The rise of AI glasses is also boosting their future development. However, currently, smart glasses have some big problems to solve. The hardware and software are not advanced enough, making it unclear how they can be used in real life, resulting in slow market growth. AI technology alone may not be sufficient to fix these issues.

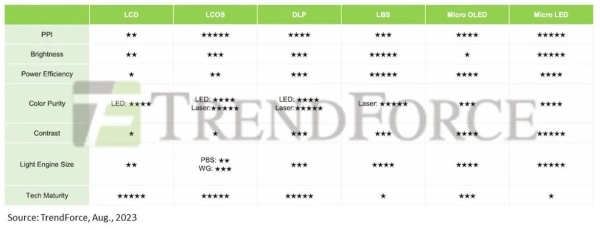

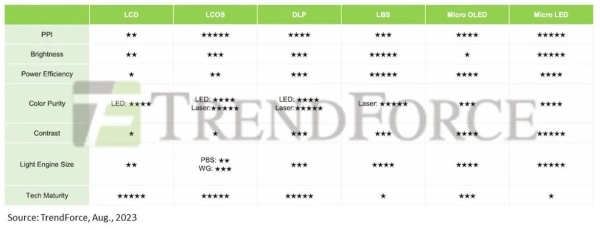

One key part of smart glasses is the near-eye display system, which affects how images look through the glasses. To achieve high definition imaging both indoors and outdoors, companies have proposed different display technologies such as LCD, LCoS, DLP, and LBS. However, each technology has its own problems, such as low brightness, poor resolution, high power consumption, and large size.

Compared to the said technologies, although Micro OLED has low brightness and Micro LED has challenges with full-color display, both are more balanced in terms of resolution, contrast, size, and power consumption. These features make them better suited for smart glasses.

In recent years, with efforts from universities, businesses, and research institutes, both Micro OLED and Micro LED have made significant improvements. Entering 2024, these technologies will continue to advance, and we will see more new AR glasses using them. The display industry is also investing more resources into Micro OLED and Micro LED. In the future, the two technologies might compete to become the best choice for near-eye displays.

Adoption of Micro LED and Micro OLED Near-eye Displays Is on the Rise

According to estimates from TrendForce, in the field of AR glasses, Micro OLED technology will make up 54% of the market in 2024, while Micro LED will account for just 18%. However, by 2030, the situation is expected to turn around, with Micro LED taking up 44% and Micro OLED dropping to 25%.

In the VR/MR (virtual reality/mixed reality) sector, LCD is expected to be the main display technology in 2024, covering 79% of the market, while Micro OLED will only account for 7%. Still, Micro OLED is predicted to dominate the high-end VR/MR market by 2030, with its share going up to 23%.

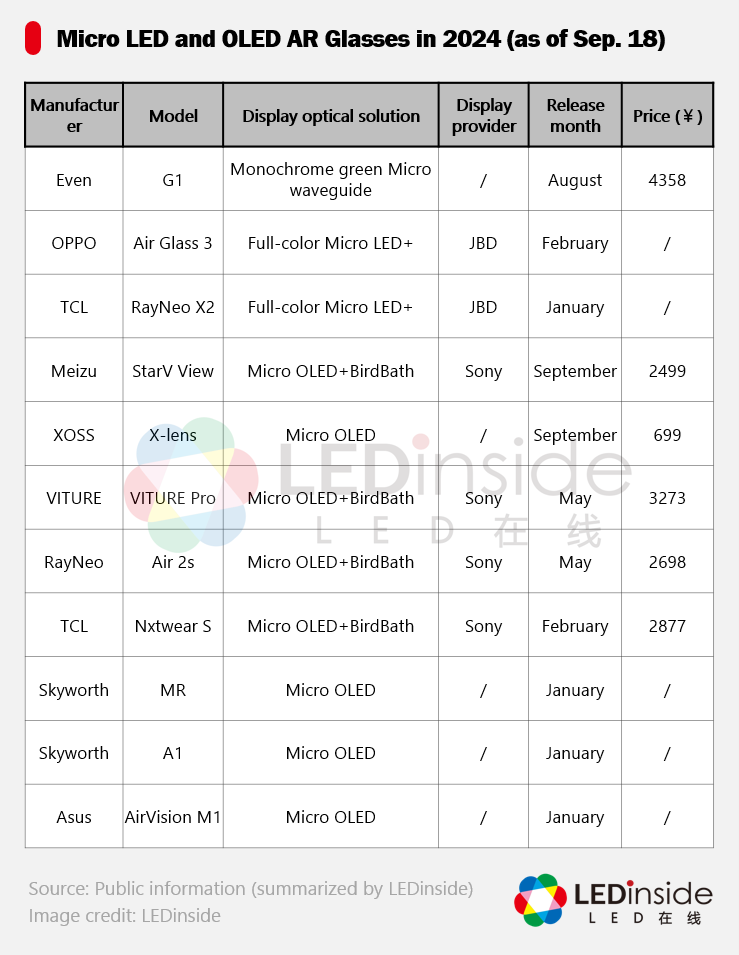

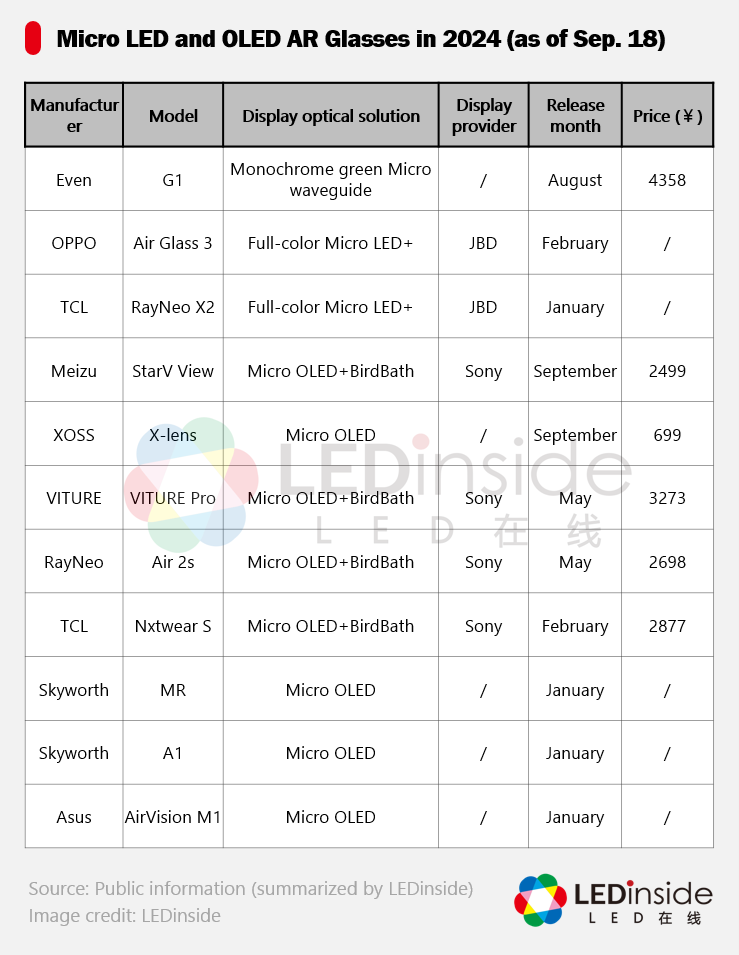

For new products announced this year, if things go as expected, more AR glasses will be engineered with Micro OLED and Micro LED technologies. There are eight new models using Micro OLED and three using Micro LED.

The more advanced Micro OLED remains the popular choice for AR glasses manufacturers, often paired with BirdBath optical solutions. Alternatively, TCL, OPPO, and Even Realities are opting for full-color or monochrome Micro LED combined with optical waveguides.

Development of Micro LED and OLED Microdisplay Industry Is Accelerating

Regarding configurations of AR glasses for 2024, there has not been much change in the use of Micro LED and Micro OLED microdisplay technologies. Micro OLED is still more commonly used. Although Micro LED is not yet widely adopted, its development is speeding up from a supply chain perspective, becoming increasingly competitive. It is expected that in the future, Micro LED could become a strong rival to Micro OLED.

-14 Companies Innovate in Micro LED and OLED Microdisplay Technologies

According to a brief survey done by LEDinside, several manufacturers in China and other countries, including JBD, Innovision, Raontech, Hongshi Intelligence, Vuzix, VueReal, Saphlux, Aledia, Q-Pixel, PlayNitride, Sitan, and Mojo Vision, have been making significant strides in improving Micro LED technology for microdisplays this year. The advancements mainly involve solving issues like full-color display and power consumption, bringing new hope for the commercial use of Micro LED microdisplays.

In September 2024, JBD introduced the “Hummingbird I” polychrome Micro LED optical module, achieving an extremely high brightness of 6000 nits, suitable for various AR glasses applications. The AR eyewear maker also launched the industry’s smallest optical engine, the Hummingbird Mini II, with a volume of only 0.15 cubic centimeters. Additionally, JBD released the ARTCs, an AR waveguide display quality correction device, addressing image quality issues related to diffractive waveguides.

Moreover, several Chinese businesses have also achieved new breakthroughs: Sitan Technology unveiled a 0.13-inch Micro LED microdisplay with a resolution of 11,400 PPI. Hongshi Intelligence managed to mass-produce a self-developed Micro LED chip for microdisplays. Innovision introduced a mass-production-level, monolithic full-color XGA Micro LED chip for microdisplays. Saphlux launched the T2 display series, featuring a 0.39-inch size that boosts color gamut by 70% and brightness by 40%.

-Businesses Intensify Collaboration to Advance Micro LED and OLED Microdisplay Technologies

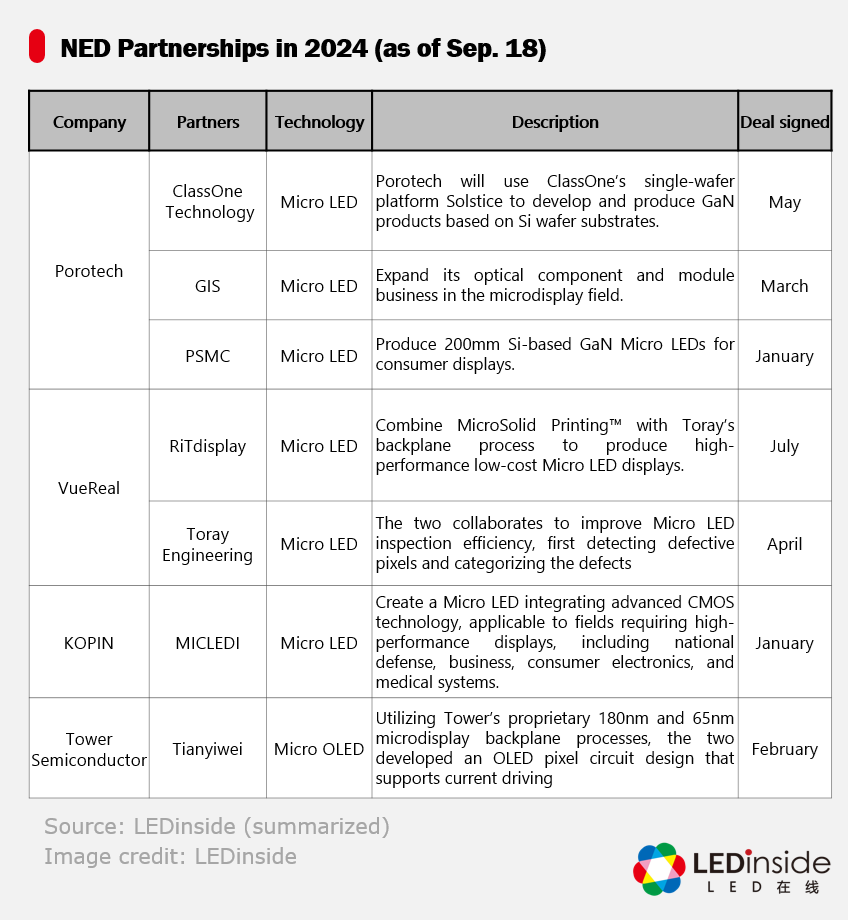

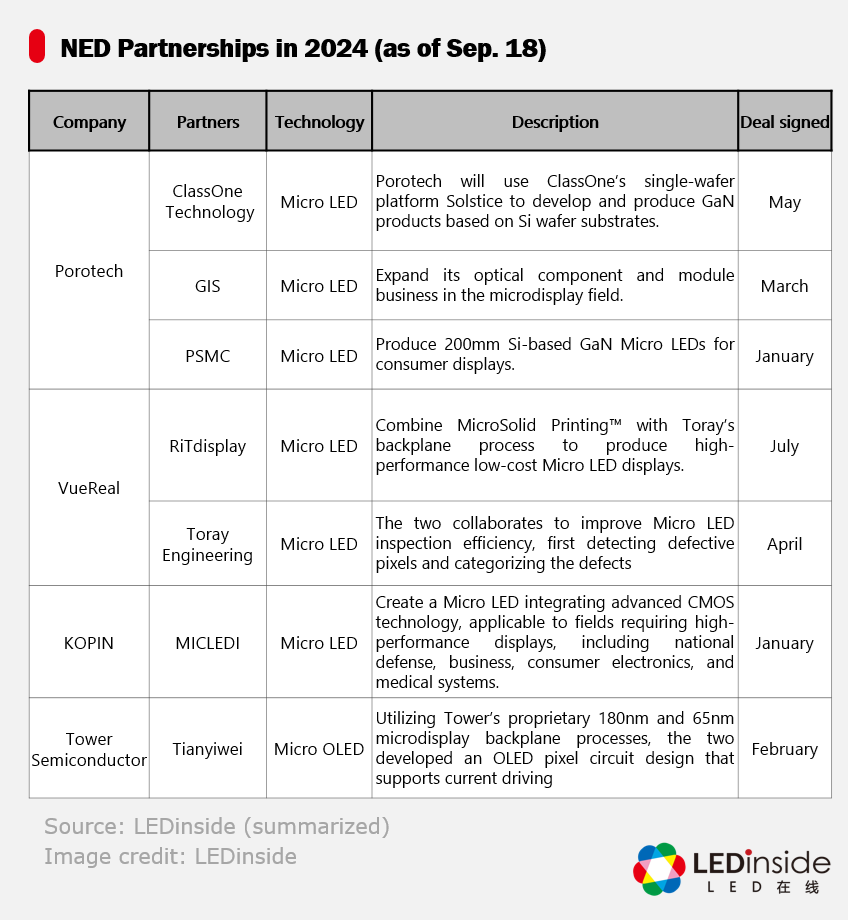

Despite continuous technological breakthroughs in the Micro LED and OLED microdisplay areas this year, companies are still seeking ways to enhance development efficiency. Collaboration between manufacturers throughout the entire industry chain has become one of the main strategies.

For instance, in 2024, Micro LED technology provider Porotech has collaborated with U.S.-based wafer equipment supplier ClassOne, touchscreen solution provider GIS, and wafer foundry service provider PSMC to develop and manufacture GaN products using silicon wafer substrates. The partnerships aim to accelerate the production of high-brightness, high-pixel-density, small-sized, and low-cost Micro LEDs, accelerating the commercialization of Micro LED microdisplays.

Similarly, Canadian Micro LED technology developer VueReal has formed collaborations this year with well-known display company RiTdisplay and Japanese semiconductor equipment manufacturer Toray Engineering. These collaborations aim to improve the production and testing efficiency of Micro LED microdisplays.

-Microdisplay Manufacturers Secure Near-eye Display Orders

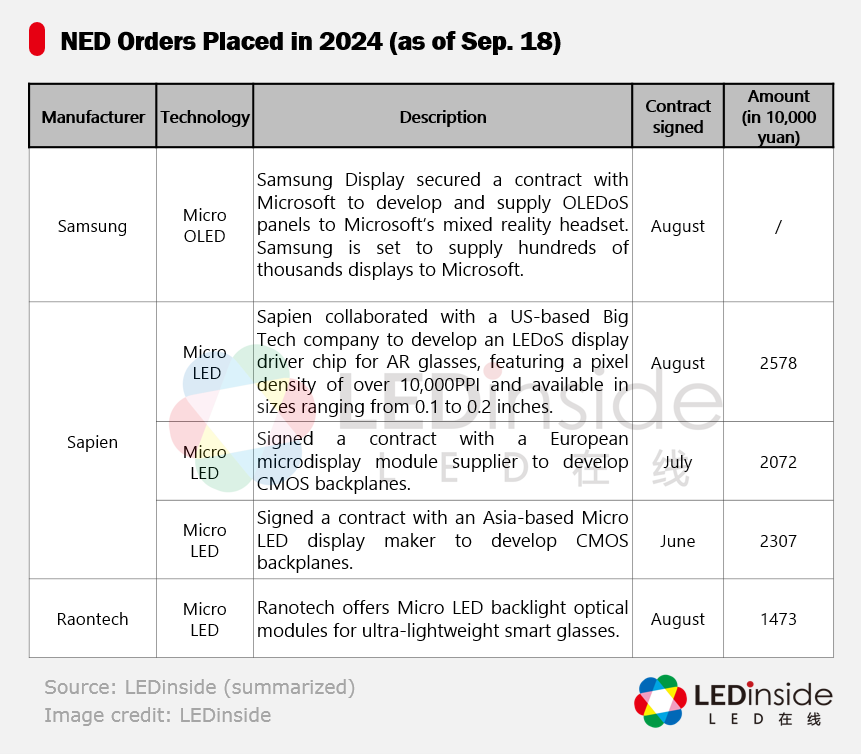

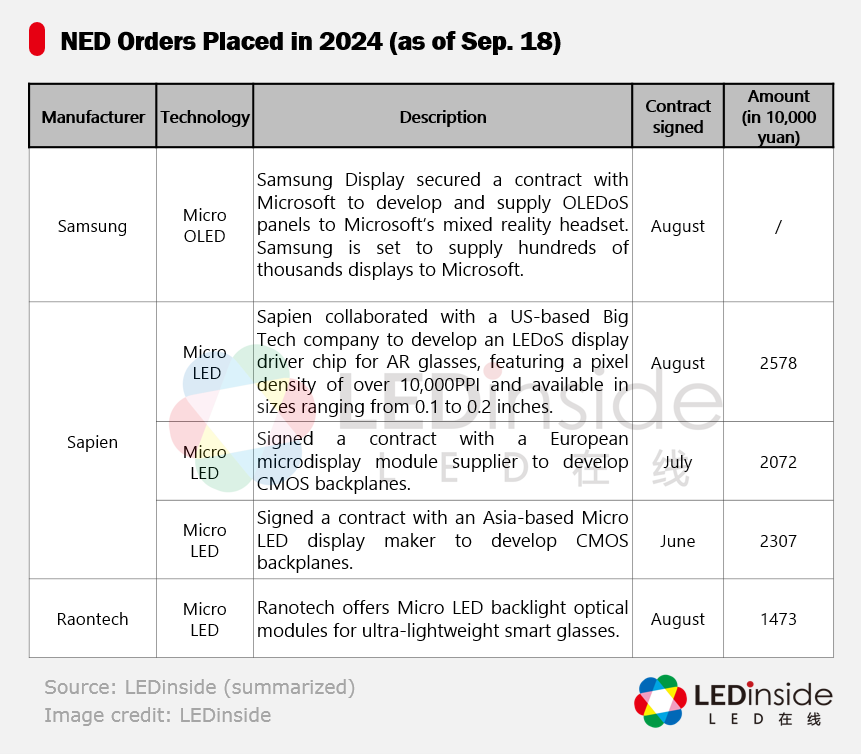

As Micro LED and OLED microdisplay technologies mature, microdisplay manufacturers are beginning to receive more orders.

Regarding Micro OLED technology, South Korean media reported in August that Samsung Display and Microsoft signed a new partnership deal. Samsung Display will develop and supply Micro OLED panels for Microsoft’s upcoming mixed reality (MR) headset. The expected production is around several hundred thousand units, but the exact financial terms were not disclosed.

In terms of Micro LED technology, South Korean Micro LED driver chip manufacturer Sapien Semiconductor has signed contracts this year with a US-based Big Tech company to develop Micro LED display driver chips for AR glasses. Sapien has also signed CMOS backplane development contracts with an Asian Micro LED display manufacturer and a European microdisplay module supplier. The contract amounts are 4.8 billion won, 4.395 billion won, and 3.939 billion won, respectively (approximately 25.78 million yuan, 23.07 million yuan, and 20.72 million yuan).

-Eight Key Micro LED and OLED Microdisplay Technologies Enter a New Stage

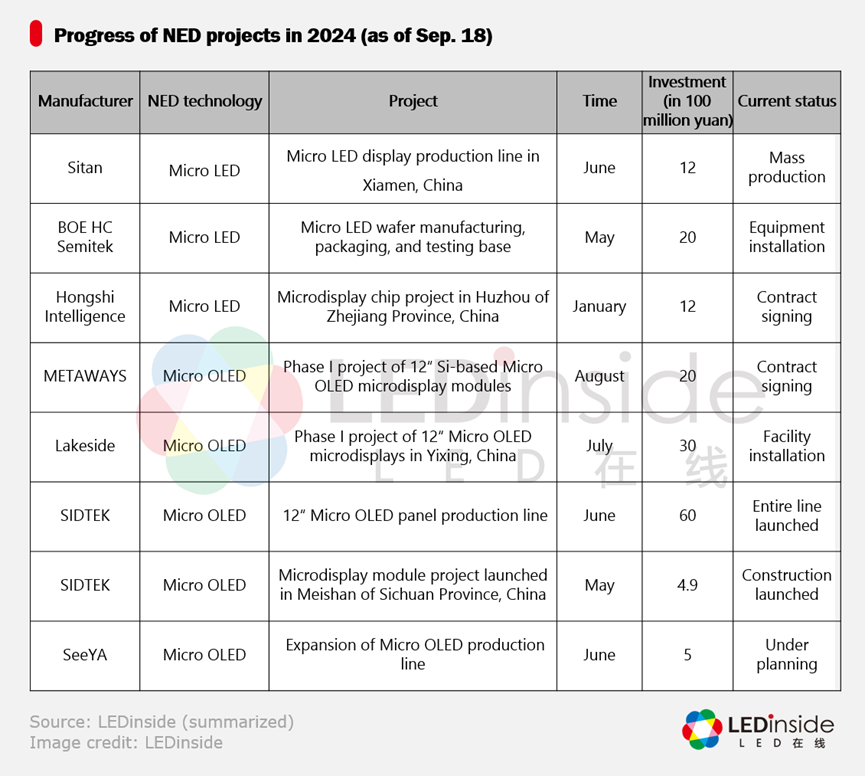

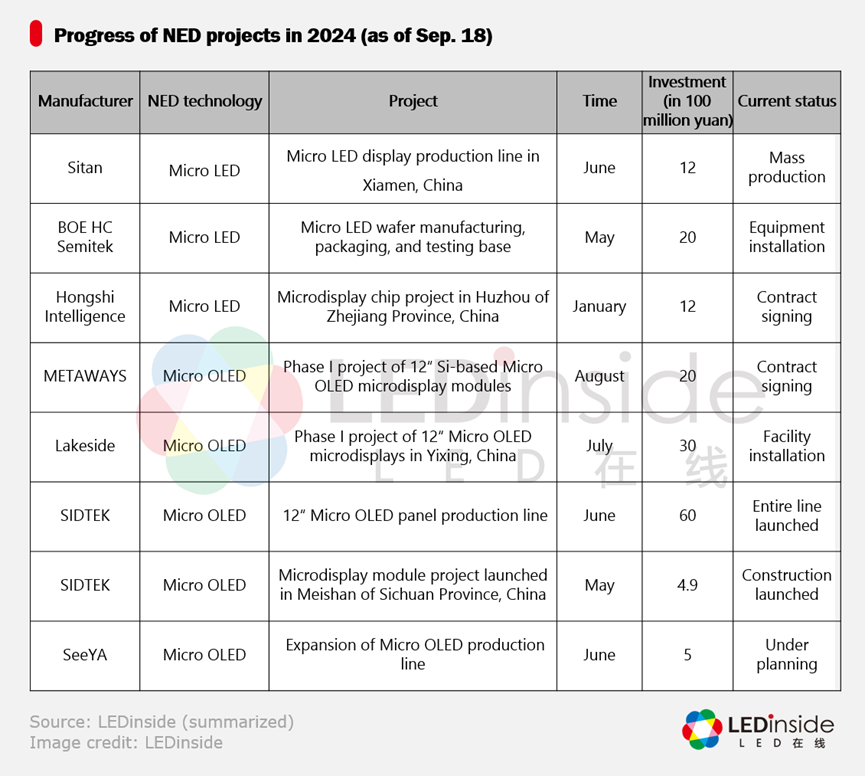

To meet future market demand and the needs of potential major clients, microdisplay companies have begun accelerating the development of new technology production capacities in 2024. For example, Sitan, BOE HC Semitek, Hongshi Intelligence, METAWAYS, Lakeside, SIDTEK, and SeeYA will see their Micro LED or OLED projects entering various stages from contract signing, construction, equipment installation, to mass production.

Regarding Micro LED, Sitan’s Micro LED production line in Xiamen began mass production in June, with a total investment of 1.2 billion yuan. The production line is able to produce nearly ten million sets of Micro LED display chips every year, covering three product specifications: 0.13 inches, 0.2 inches, and 0.45 inches. It primarily targets the AR/XR and automotive display markets, with the expected product yield exceeding 80%.

BOE HC Semitek’s Micro LED wafer manufacturing, packaging and testing base, with a total investment of 2 billion yuan, began moving in equipment at the end of May this year and is expected to achieve mass production by December. Once completed, the project will have an annual capacity of 58,800 wafers and 45,000,000 Micro LED components, catering to applications in large-size TVs, commercial displays, AR/VR head-mounted displays, and wearable devices.

As for Micro OLED, SIDTEK’s 12-inch Micro OLED panel production line, with a total investment of 6 billion yuan, achieved full line operation and product manufacturing in June. The first-phase capacity planned is 6000 wafers per month (based on the tandem OLED structure), and the project reached mass production in August this year.

In July, Lakeside’s Phase I project in Yixing, with a total investment of 3 billion yuan, commenced facility installation. It is expected to kick off trial production in the first half of 2025 and enter mass production in the second half. Once operational, the project will have an annual production capacity of 9 million 1.31-inch Si-based OLED displays.

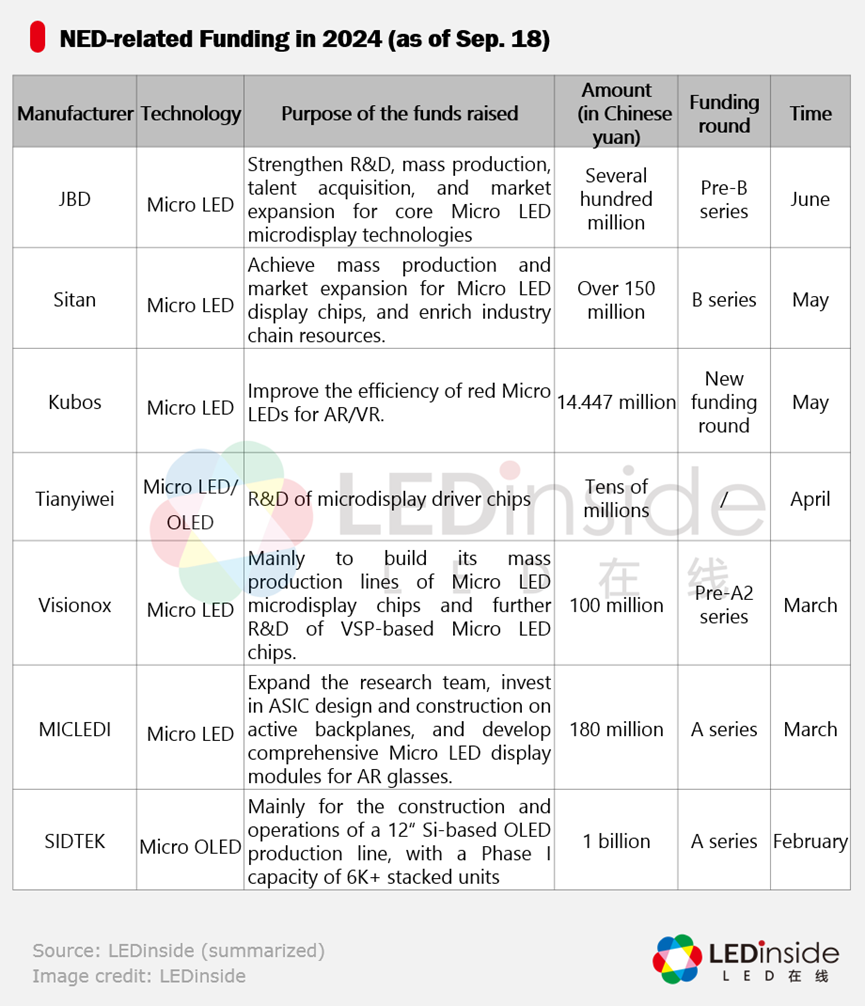

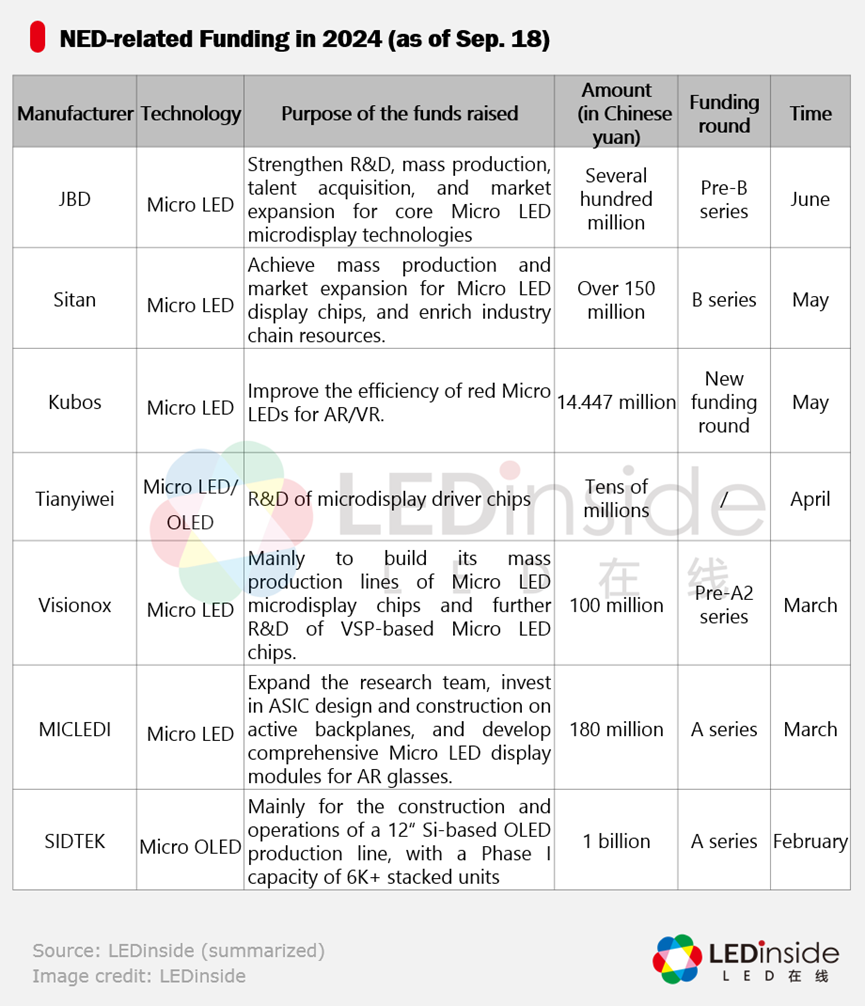

-Seven Microdisplay Businesses Complete New Funding Rounds, Raising Up to 1 Billion Yuan

Amid the continuous upward trend of Micro LED and Micro OLED technologies, capital investment in the microdisplay sector has grown more enthusiastic. As of now, seven microdisplay enterprises have completed their latest round of funding in 2024, with some raising over 100 million yuan. These funds provide new momentum for research and development, mass production, talent acquisition, and market expansion in their microdisplay business.

Conclusion

In 2024, both Micro OLED and Micro LED technologies for microdisplays have made progress in different areas.

Micro OLED technology has gradually established a firm foothold in the microdisplay market, with Chinese manufacturers increasing their production capacity related to Micro OLED technology to be well-prepared for future market demand.

Micro LED technology for microdisplays continues to achieve new breakthroughs in overcoming technical issues associated with light efficiency and full-color displays. There have been positive developments in production capacity, market demand, and funding. Despite its late start, Micro LED’s inherent advantages of ultra-high definition give it undeniable momentum in the microdisplay field.

As the demand for AR, VR, and MR devices continues to grow, questions remain: Will Micro OLED continue to accelerate its penetration into the near-eye display market? Will Micro LED be able to challenge Micro OLED’s position? Only time will tell. (Article by Irving from LEDinside).

TrendForce 2024 Micro LED Market Trend and Technology Cost Analysis

Release: 31 May / 30 November 2024

Language: Traditional Chinese / English

Format: PDF

Page: 160-180

TrendForce 2024 Near-Eye Display Market Trend and Technology Analysis

Release Date:2024 / 07 / 31

Languages:Traditional Chinese / English

Format:PDF

Page:164

|

If you would like to know more details , please contact:

|