The scale of China’s

LED package market is projected to expand 16% year on year to RMB 61.4 billion in 2015, according to the latest

Chinese LED Industry Market Report by

LEDinside, a division of

TrendForce. The growth of Chinese LED package market on the whole has slowed. With China being the production center of the global LED industry, the weakening of global economy this year has led to a larger slide in the exports of the country’s LED products. The year-on-year increase of Chinese

LED lighting product exports for this year’s first half is 21%, a steep decline compared with the 80% year-on-year growth for the first half of 2014.

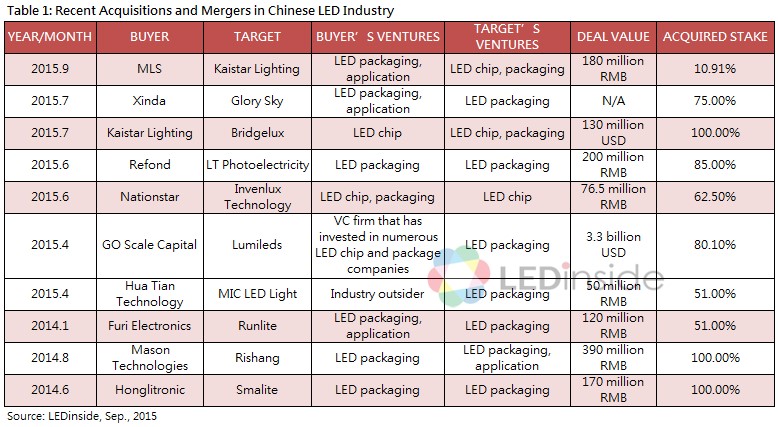

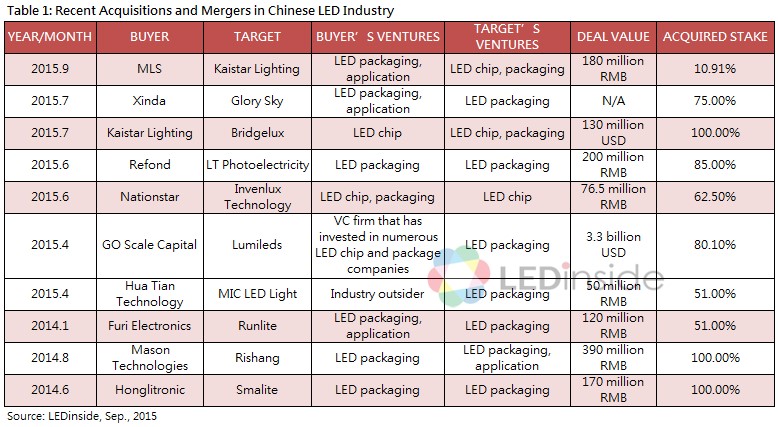

LEDinside analyst Allen Yu said that below expected growth of the lighting market demand has caused the current overcapacity for the LED package industry. As competition intensifies, prices of LED products will keep falling and operation pressure will mount for small and medium-size industry participants. Therefore, industry consolidation will also continue. With huge war chests already in place, some major Chinese LED companies have begun acquiring smaller players to strengthen themselves and transform their business models. Presently, most Chinese LED companies are competing in the low-end market. For Chinese LED product exporters, they will need to acquire international companies with a good number of patents in order establish a firm presence overseas. In sum, mergers and acquisitions will be frequent in the Chinese LED industry.

This recent and relentless wave of acquisitions is the result of the gradual maturation of the Chinese LED industry, and the process began with LED package companies in 2014. By 2015, the deal-making was officially in full swing with Lumileds, Bridgelux and other international companies becoming targets.

|

|

Yu pointed out that the competition in the Chinese LED package market has always been fierce, especially in the lighting LED segment. Chinese industry participants furthermore have lower margins for their products, reflecting their relatively weak profitability. Acquisition is thus one of the various methods that these players can use to help change their business models or boost their competitiveness. The following are some common types of deal-making that have taken place so far:

1. Horizontal integration: An LED company can either acquire or merge with another company belonging to the same industry or the same level of supply chain as to rapidly expand, pool resources and complement each other’s technological strengths. Notable cases in the Chinese LED industry are Honglitronic’s acquisition of Smalite and Refond’s acquisition of LT Photoelectricity.

2. Vertical integration: This type of deal-making involves buying companies up or down the supply chain as to obtain raw materials at cheaper prices or secure sales channels for end products. Examples in the Chinese LED industry include Natinstar’s deal with Invenlux Technology (LED chip maker), Honglitrongic’s deal with Lianyou (lead frame supplier) and Mason Technologies’ takeover of Rishang (LED advertising signage specialist).

3. Cross-industry merger/acquisition: Cross-industry deals help companies to spread their risks. One prominent example is Honglitronic’s attempt to enter the Internet of Vehicles sector via investments in DINA and Wisdom GPS. At the same time, Honglitronic is also branching into the Internet of Finance sector with its investments in Wang Li Finance Corporation.

In addition to these types of deal-making, Chinese LED companies that have amassed significant funds are establishing their own investment firms to rationalize their resources with various financial instruments and improve their overall competitiveness. For their acquisition targets, the injection of additional fund will relieve them of their cash flow pressure as well as helping them increase their production capacities and scale of their business operations.

|

LEDinside 2015 Chinese LED Industry Market Report

Published Date: 25 June 2015

Language: English

Page: 351

Format: Electronics

Chapter 3: LED market segments were added, covering the market scales on Chinese backlight LED, lighting LED and display LED fields. Also, Chinese LED package market scales in 2015-2019 by both manufacturer camps and power types are estimated. Furthermore, LED supply chain of backlight, lighting, and display markets are discussed.

Chapter 4: 18 Chinese LED package manufacturers business analysis are covered, covering business operation, financial performance, expansion and capacity, major clients, and LEDinside perspective.

Chapter 5: Total 18 International and Taiwanese LED manufacturers are discussed, including company revenue and profit, Chinese revenue performance, and major products and client in China.

Chapter 6: Adding market scale forecasts on chip, phosphor, and adhesive fields. In chip market sector, Chinese major five chip manufacturers business operation, and major clients in China are discussed. In phosphor market sector, major phosphor manufacturer product development is highlighted.

Market: Observed from market demand to see the opportunities and challenges of LED package industry.

Company: Talking the product, technology, scale, major client, and future development of major LED package manufacturers in China.

Strategy: Opportunities and Challenges for international and Taiwanese manufacturers.

Chapter I Industry Chain Overview

-

LED Industry History

-

LED Industry Chain

-

Definition of LED Packaging

-

Supporting Industries of LED Packaging

-

Lead Frame

-

Silicon

-

Phosphor

Chapter II China LED Industry Overview

The Upstream LED Chip Industry

-

New Expansion

-

Industry Polarization, and First-Tier Manufacturer is Bigger and Bigger

The Downstream Application Industry

-

Lighting Industry : Product Prices Fall, Driving Penetration Increased

-

Display Industry : Intense Competition, Entering into the Industry Reshuffle

-

Backlight Industry : Chinese Package Manufacturers Rise

Chapter III Chinese Package Industry Overview

3-1 LED Package Industry Trends in China

-

Chinese LED Package industry Overview

-

2014-2019 Chinese LED Package Market Scale

-

2014-2019 Chinese LED Package Market Scale- By Market Camps

-

2014-2019 Chinese LED package Market Value By Power Types

-

Prominent LED Manufacturers Market Position and Revenue Rankings

3-2 Chinese LED Industry Segments, Market Scale, Product Specifications and Supply Chain

-

Mid to large-Sized Backlight Market

-

Smartphone Backlight and Flash LED Markets

-

Lighting Market

-

Display Market

-

Decorative Lighting Market

Chapter IV Major Chinese LED Package Manufacturers Analysis

-

Nationstar

-

Honglitronic

-

Refond

-

Jufei

-

Mason

-

ChangFang Lighting

-

MLS

-

Ledman

-

Kinglight

-

Smalite

-

Hkled

-

Wenrun

-

Dongshan Precision

-

Lightning Opto

-

Runlite

-

Shineon

-

MTC

-

APT

Content

-

Revenue and Profit

-

Product Mix

-

Production Capacity Expansion Plan

-

Business Summary for 2014

-

Profitability Analysis

-

Operating Analysis (Days sales of inventory, Days of Sales Outstanding)

-

Debt Paying Ability Analysis (Debt Asset Ratio)

-

Product Specification

-

Overall Evaluation

-

Product

-

Technology

-

Scale

-

Main Customers

-

LEDinside’s Perspective

-

Note: Not specified currency in this chapter regarded as RMB

Chapter V International LED Manufacturers Business Operating Activities in China

-

European and U.S. LED Manufacturers Operating Activities in China

-

Lumileds, Osram Opto, Cree, Bridgelux, Luminus Devices

-

Japanese LED Manufacturers Operating Activities in China

-

Korean LED Manufacturers Operating Activities in China

-

Samsung LED, LG Innotek, Seoul Semiconductor

-

Taiwanese LED Manufacturers Operating Activities in China

-

Everlight, Lextar, Lite-on, Unity Opto, AOT, Harvatek, Edison Opto

-

Company Profile, Product and Business Strategy

-

Revenue and Gross Margin

-

Revenue from Chinese Market and Share

-

Major Clients in China

Chapter VI China’s LED Package Manufacturers Competitiveness

-

Chinese and International Manufacturers’ Competitiveness

-

China’s Domestic Manufacturers Competitiveness

-

Maturity in The Industry

-

Industry Concentration

-

Industry Integration Trend

-

Industry Growth Opportunities and Threats

Chapter VII Major Supporting Business in LED Package Industry

-

Section One:Equipment Industry

-

Die Bonder

-

Wire Bonder

-

Adhesive Dispensing Machine

-

Section Two:Major Materials

-

Chip

-

Phosphors

-

Lead Frame

-

Adhesive (Silicon, Epoxy)

-

Gold Wire

Chapter VIII New LED Packaging Technology and Hot Topics

-

COB Package

-

EMC Package

-

Flip Chip LED Package

-

Overview

-

Strengths

-

Market Trend

-

Conclusion

Chapter IX Conclusions and Suggestions

For further information please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972