According to TrendForce 2021 Global LED Video Wall Market Outlook and Price Cost Analysis, given the impact of the COVID-19 pandemic, TrendForce revised down the global market scale of LED video wall in 2020. However, it is still expected that in 2H20, outdoor video wall and municipal projects like security and control room will benefit from government’s financial policies and economic stimulus programs such as new infrastructural construction and more. As such, the market demand of outdoor transportation and control room will improve in 2H20.

It is estimated that the CAGR of LED video wall will be 16% during 2020 to 2024, maintaining a relatively faster growth rate. Among which, indoor fine pitch display is still the largest growth engine for the LED video wall market. With the marketing theory of 4Ps, TrendForce provides readers with a comprehensive understanding of the LED video wall market, manufacturer development, LED video wall product trends and prices.

2021 LED Video Wall Market Outlook and Highlight

According to TrendForce, the impact of COVID-19 has led to a worsening of world economic conditions with manufactures shutting down and unemployment rates rising. Fundamental changes will affect the development of across the world. As a result, governments will provide infrastructure projects as soon as possible to stimulate the economy, ensuring employment rate and stabilizing the country’s economic activities.

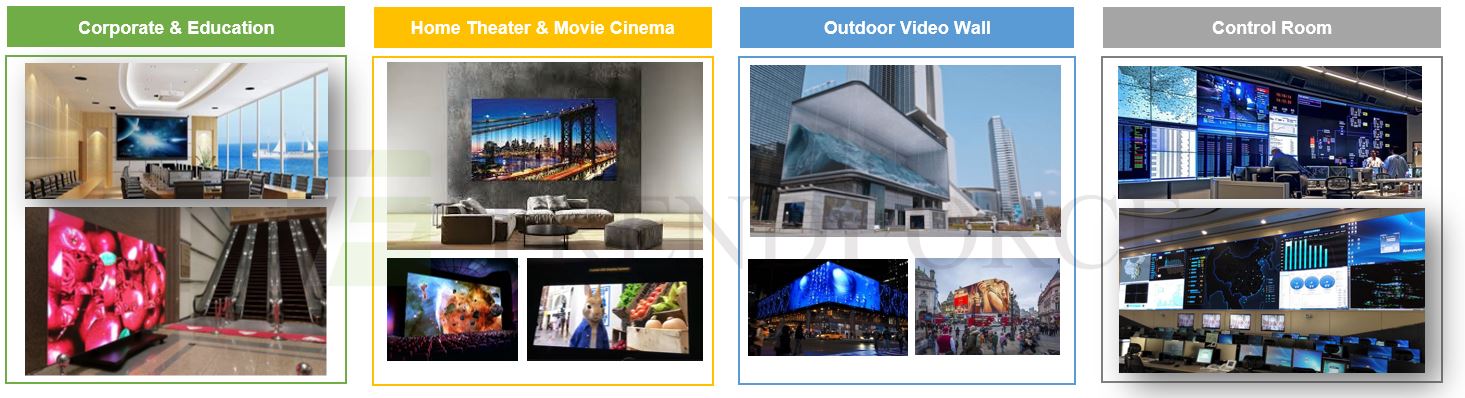

The market of outdoor video wall is seeing demands for transportation, billboard and landmark in 2H20-2021 due to government’s fiscal stimulus package.

In addition, indoor video walls benefit from the demand for advanced display performance covering high resolution and high dynamic range. Therefore, the market targeting corporate meeting spaces, cinemas and home theaters are growing steadily. Furthermore, the control room will be the market focus as well with fiscal stimulus package offered by governments around the world.

All-in-One LED Display Market Trend

All-in-One LED display integrates wireless transmission, video conference, and interactive writing functions. It can be applied to medium- and large-sized meeting rooms, lecture halls, multipurpose halls, multimedia rooms, exhibition and classrooms, to largely improve collaboration of meetings. With increasing demand for HD display as 5G transmission develops and consumption upgrades, LED commercial displays will be very promising in the coming future. In addition to office meeting, All-in-One LED display is also applicable to remote medical treatment, emergency command, distant education and home theater.

Unlike traditional tiled display, this is the integration of standardized product and controller, appearing to be thinner (common thickness is 3 to 5cm). It highlights fast on-site modular installation as installation and testing can be finished in 1 to 2 hours. Presently, the aspect ratio of the display is mainly 16:9 and sizes vary from 108-inch to 220-inch. This kind of display targets conference rooms containing more than 30 people and both 2K and 4K display are available. Generally, it has wall-mounted type and standing movable type, emphasizing quick on-site modular installation. All-in-One LED display has received increasingly high market attention since ISE 2020 and will become one of the major market trends in 2020-2021.

In response to intelligent meeting market demand, Leyard, Unilumin, LianTronics, Absen, MaxHub, LG and Calibre consistently develop All-in-One LED display.

2019-2020 Video Wall Player Revenue Performance

In 2019, the global market scale of LED video wall was USD 6.335 billion. On a revenue basis, six out of the top eight manufacturers are China-based except Daktronics (Ranking 3rd) and Samsung entering top seven for the first time. Top eight manufacturers occupied 54.1% of global market share. Due to the COVID-19 epidemic, TrendForce revised down the global LED video wall market value in 2020. Yet, as Samsung LED video wall shipment quickly increases in the recent two years, the company’s market share is expected to rise. Naturally, overall market will become more concentrated, and the market share of the top eight manufacturers will come up to 55.1%.

2020-2024 LED Video Wall Trends in North America, China and EMEA

According to TrendForce, in 2019, China’s LED fine pitch display market scale was US$ 1.273 billion, making it the world’s largest market for a single country. As the world’s largest LED video wall manufacturing base, LED video wall manufacturers have been continuously leveraging their regional advantages to develop the Chinese market and increase the penetration rate of LED video walls. As the price–performance ratio of LED video wall rises year by year, it will continue to drive demand in the high-end retail, conference room and other commercial display segments.

In addition, the main growth drivers for LED fine pitch displays in North America will be entertainment (including live music events), cinema and home theater, followed by corporate meeting space and retail and exhibition space. The CAGR of North America LED fine pitch display market scale will be 28% during 2020-2024.

The main high-growth application market in EMEA will come from commercial display space, including corporate meeting space and retail and exhibition space, followed by various cinema and home theater. It is estimated that the CAGR of LED fine pitch display market scale in EMEA will be 29% during 2020-2024.

≦ P1.0 Ultra Fine Pitch Display Product Trend

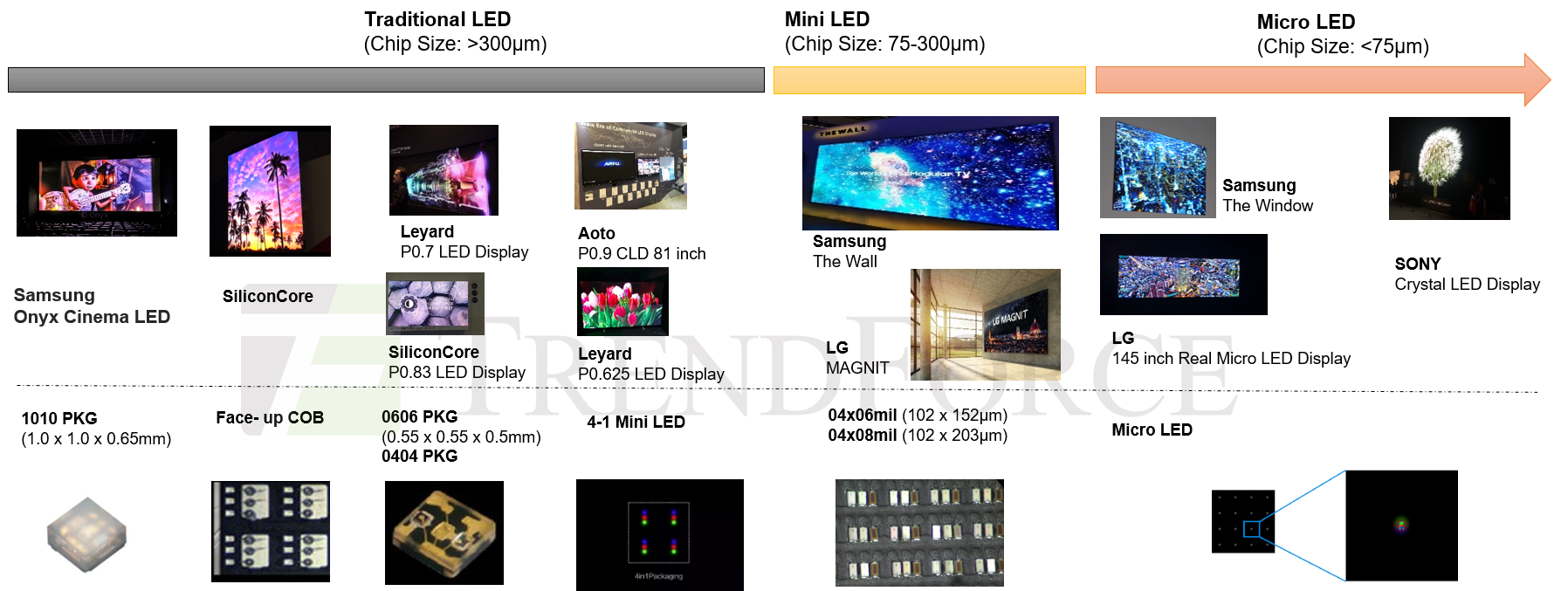

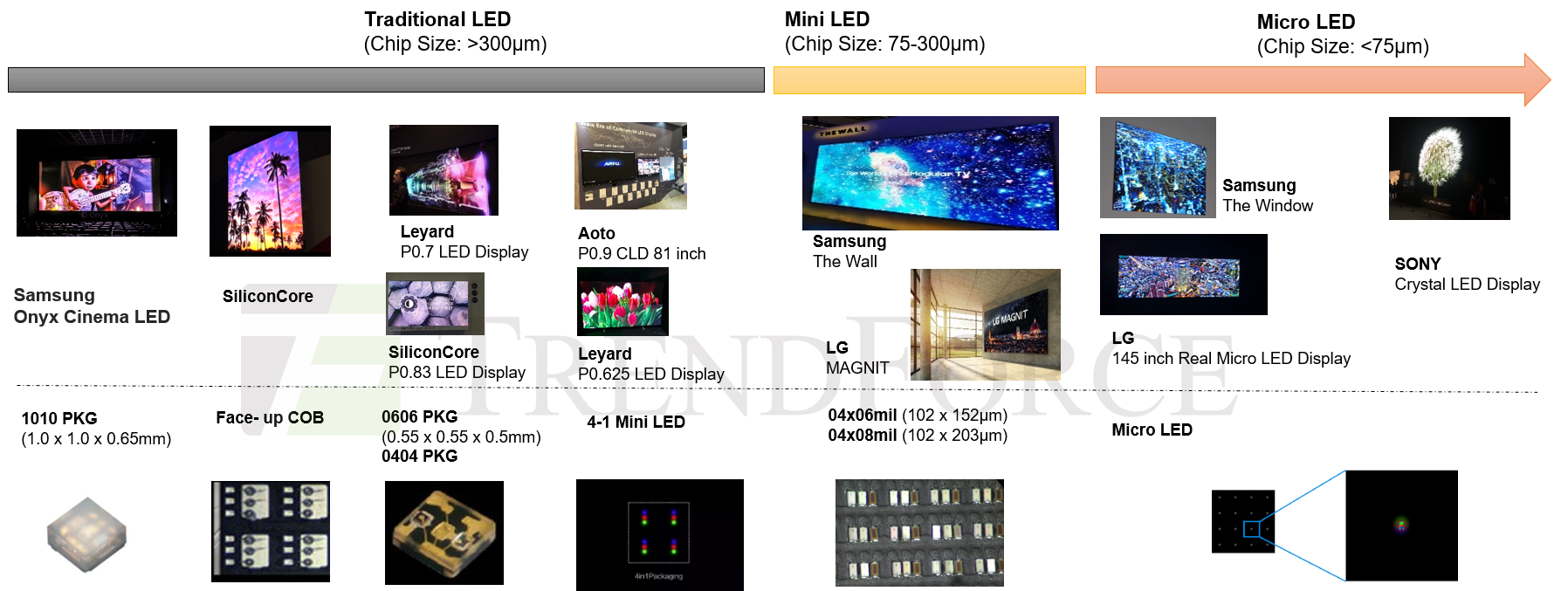

Due to the impact of COVID-19, the price of video wall products dropped significantly in 2020, potentially driving the end market towards P1.2 and ≦P1.0 ultra-fine pitch displays. Considering about display performance and price, P1.2 digital display is more suitable for use in control rooms. In addition, with the miniaturization of pitch, products such as various packages (4-in-1 Mini LED, 0606 LED, 0404 LED), Mini LED / Micro LED COB (POB) have entered the digital display.

Especially for ≦P1.0 ultra-fine pitch display, the need for energy saving has driven driver IC players to develop common cathode driver IC solutions. Suppliers include Macroblock, Chipone, and other. In addition to using common cathode driver ICs, video wall manufacturers can reduce power consumption by increasing LED efficiency (reducing current or voltage), improving PCB circuit design, or using high conversion efficiency power management.

Active matrix solution used in large display market spliced with multiple pieces needs to use TGV or wrap-around electroplate. The decision on either active matrix or passive matrix solutions depends on cost (material cost and splicing cost), display effect and product yield rate, as well as mass production speed and cost of ≦P1.0 PCB.

TrendForce’s analysis focuses on the market outlook and application market trends for LED video walls in 2021; the trends and sales channels for LED video walls in Europe, the US, and China; and the players and technology development of the Micro LED / Mini LED ultra-fine pitch display market. TrendForce aims to provide readers with a comprehensive understanding of LED video wall market marketing and sales.

2021 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: September 2020

Language: Traditional Chinese / English

Format: PDF

Page: 202

Chapter I. LED Display Market Size Trend and Analysis

• LED Video Wall Market Supply Chain and Requirement

• 2020-2024 Global LED Video Wall Market Scale Analysis

• 2019-2020(F) LED Video Wall Player Market Share Analysis

• 2018-2019 Chinese LED Video Wall Player Revenue and Shipment Analysis

• 2018-2020(F) Chinese LED Video Wall Player Shipment Ranking

• 2020-2024 Global LED Fine Pitch Display Market Scale by Pitch

• 2019-2020(F) LED Fine Pitch Display Player Market Share Analysis

• 2020-2024 Global LED Fine Pitch Display Shipment by Pitch

• 2019 Global Major LED Fine Pitch Display Player Shipment Ranking

• 2019-2020(F) LED Fine Pitch Display Market by Region

• 2019-2020(F) Global LED Fine Pitch Display Market by Application

• 2019-2020(F) P2.1-P2.5 LED Display Application Market Analysis

• 2019-2020(F) P1.7-P2.0 LED Display Application Market Analysis

• 2019-2020(F) P1.2-P1.6 LED Display Application Market Analysis

• 2019-2020(F) ≤ P1.0 Ultra Fine Pitch Display Application Market Analysis

Chapter II. Micro LED vs. Mini LED Video Wall Market Trend

• Micro LED vs. Mini LED Video Wall Product Advantages

• Micro LED vs. Mini LED Video Wall Technology Overview

• Micro LED vs. Mini LED Chip Size Analysis

• Micro LED vs. Mini LED COB Manufacturing Analysis

• Mini LED COB Chip Size Trend and Branding Target

• Mini LED Video Wall- Pick and Place Technology

• Micro LED Video Wall- LED Chip Size Trend and Product Efficiency Analysis

• Micro LED Video Wall- Mass Transfer Technology Analysis

• Active Matrix vs. Passive Matrix LED Video Wall Product Design

• Micro LED vs. Mini LED Video Wall- Backplane Analysis

• Micro LED vs. Mini LED Video Wall- Glass Backplane Analysis

• Micro LED vs. Mini LED Video Wall- Driver IC Design Analysis

• Active Matrix vs. Passive Matrix LED Video Wall Cost Analysis

• Micro LED vs. Mini LED Video Wall Market Landscape Analysis

• 2019-2020(E) Micro LED vs. Mini LED Video Wall Shipment Analysis

• Micro LED vs. Mini LED Video Wall Supply Chain

• Micro LED vs. Mini LED Video Wall Supply Chain

• 2020-2021 Mini LED Video Wall Product Specifications and Progress

• 2020-2021 Micro LED Video Wall Product Specifications and Progress

Chapter III. 2021 LED Video Wall Market Outlook and Highlight

• 2021 LED Video Wall Market Outlook and Highlight

3.1 Corporate & Education (Meeting Room)

• 2019-2020(F) Corporate & Education- Video Wall Specification Analysis

• Intelligent Meeting

• 2020-2024 LED Video Wall vs. Projector Market Scale in Meeting Room

• 2020-2024 LED Video Wall vs. Projector Market Scale in Meeting Room

• 2020 LED / LCD Video Wall vs. Projector Specification and Price

• 2020-2024 LED Video Wall vs. Projector Price Projection Analysis

• All-in-One LED Display Product Strength Analysis

• All-in-One LED Display Market Application Overview

• All-in-One LED Display Player Product Overview

• All-in-One LED Display Player Product Specification and Price Analysis

3.2 Home Theater vs. Movie Cinema

• 2019-2020(F) Entertainment- Video Wall Specification Analysis

• Home Theater Market Scale

• Home Theater Market Opportunity

• 2020-2026 Cinema Market Development Trend

• Premium Cinema Definition

• 2020-2023 Premium Cinema Screens Market Demand

• LED Video Wall Opportunities and Challenges in Movie Cinema Market

• LED Video Wall Market Opportunities in 3D Cinema

• LED Video Wall and Projector in Home Theater vs. Movie Cinema

• LED Video Wall Players Strategy Alliances in Cinemas and Home Theaters

• 8K LED Video Wall Analysis on Pixel Pitch and Dimension

3.3 Control Room

• Control Room Market Applications

• 2019-2020(F) Security & Control Room- Video Wall Specification Analysis

• Control Room Market Landscape Analysis

• Control Room System Design Program

3.4 Outdoor Video Wall

• 2019-2020(F) Outdoor Video Wall Product Specification Analysis

• Outdoor Display Market Landscape Analysis

• 2020 P3-P10 LED Outdoor Video Wall Price Analysis

Chapter IV. Video Wall Market Price and Cost Analysis

• Video Wall Market Price Survey- Methodology and Definition

• 2020 LCD vs. P1.0-P2.5 LED Video Wall Price Analysis

• 2019-2020 LCD vs. LED Video Wall Price Analysis

• 2018-2020 P2.5 LED Video Wall Price Analysis

• 2018-2020 P1.9 LED Video Wall Price Analysis

• 2018-2020 P1.5-P1.6 LED Video Wall Price Analysis

• 2018-2020 P1.2 LED Video Wall Price Analysis

• 2018-2020 P0.9 LED Video Wall Price Analysis

• 2018-2020 P0.7-P0.8 LED Video Wall Price Analysis

• 2018-2020 P0.6 LED Video Wall Price Analysis

• 2020 P1.2-P1.9 LED Video Wall Cost Analysis

• 2020 P0.7-P0.9 LED Video Wall Cost Analysis

Chapter V. Europe, USA, China LED Video Wall Trends and Sales Channel Analysis

• 2020-2024 China LED Fine Pitch Display Market Scale

• 2019-2020(F) China LED Fine Pitch Display Market by Application

• China Channel Analysis- Pro A/V System Integrators

• China Channel Analysis- LED Video Wall Dealers

• 2020-2024 North America LED Fine Pitch Display Market Scale

• 2019-2020(F) North America LED Fine Pitch Display Market by Application

• USA Channel Analysis- Pro A/V System Integrators and Dealers

• 2020-2024 EMEA LED Fine Pitch Display Market Scale

• 2019-2020(F) EMEA LED Fine Pitch Display Market by Application

• Europe Channel Analysis- Pro A/V System Integrators and Dealers

Chapter VI. LED Video Wall Player Strategies

• Fine Pitch Display Players Progress Analysis

• Video Wall Player OEM Supply Chain Analysis

• 24 Video Wall Players Revenue Performance and Product Analysis

• Leyard

• Lijingwei

• Unilumin

• Absen

• LianTronics

• Ledman

• Aoto Electronics

• Qiangli

• Shanghai Sansi

• Hoozoe Optoelectronic

• Cedar Electronics

• Infiled

• Konka

• BOE

• HCP Technology

• Samsung Electronics

• LG Electronics

• SONY

• Sharp

• Daktronics

• Watchfire Signs, LLC

• Lighthouse Technologies Limited

• BARCO

• Innolux

• OptoTech

• SiliconCore

Chapter VII. LED Market Trend and Product Strategies

7.1 Indoor Fine Pitch Display LED Product Analysis

• Display LED Product Application Market

• Indoor Fine Pitch Display LED Overview

• Indoor Fine Pitch Display LED Technology Overview

• Pixel Size vs. Pixel Pitch Analysis

• Mini LED vs. Micro LED Video Wall R&D and Mass Production

• 2020-2021 Display LED Development Trend

• 4-in-1 Mini LED Product Pros and Cons Analysis

• Mini LED COB Product Pros and Cons Analysis

• Mini LED COB Chip Size Trend and Branding Target

• 2020 Mini LED COB Supply Chain and Business Model

7.2 Display LED Market Scale and Player Strategies

• 2020-2024 Display LED Market Value Analysis

• 2020-2024 Display LED Market Volume Analysis

• 2020-2024 ≤P2.5 Display LED Market Value Analysis- By Product

• 2020-2024 ≤P1.2 Display LED Market Value Analysis- By Product

• 2018-2020 Display LED Price Trend- SMD LED

• 2018-2020 Display LED Price Trend- 4-in-1 Mini LED PKG

• 2018-2020 Display LED Price Trend- Mini LED COB

• LED Video Wall Market Landscape

• 2018-2019 Display LED Chip Player Revenue Ranking

• 2018-2019 Display LED Package Player Revenue Ranking

• 2020 Display LED Player Capacity and Market Supply Chain Analysis

Chapter VIII. Display Driver IC Market and Player Strategies

• 2020-2024 Video Wall Driver IC Market Value Analysis

• 2019 Video Wall Driver IC Player Revenue Ranking

• 2020-2024 Video Wall Driver IC Market Shipment Analysis

• 2019-1H20 Video Wall Driver IC Player Monthly Shipment Ranking

• Common Cathode Driver IC Market Opportunities and Challenges

• 2020 Drive IC Market Price Investigation

• Driver IC Player Product and Business Performance Analysis- Macroblock, Chipone, Sunmoon, Fine Made and LEDSIC Technology