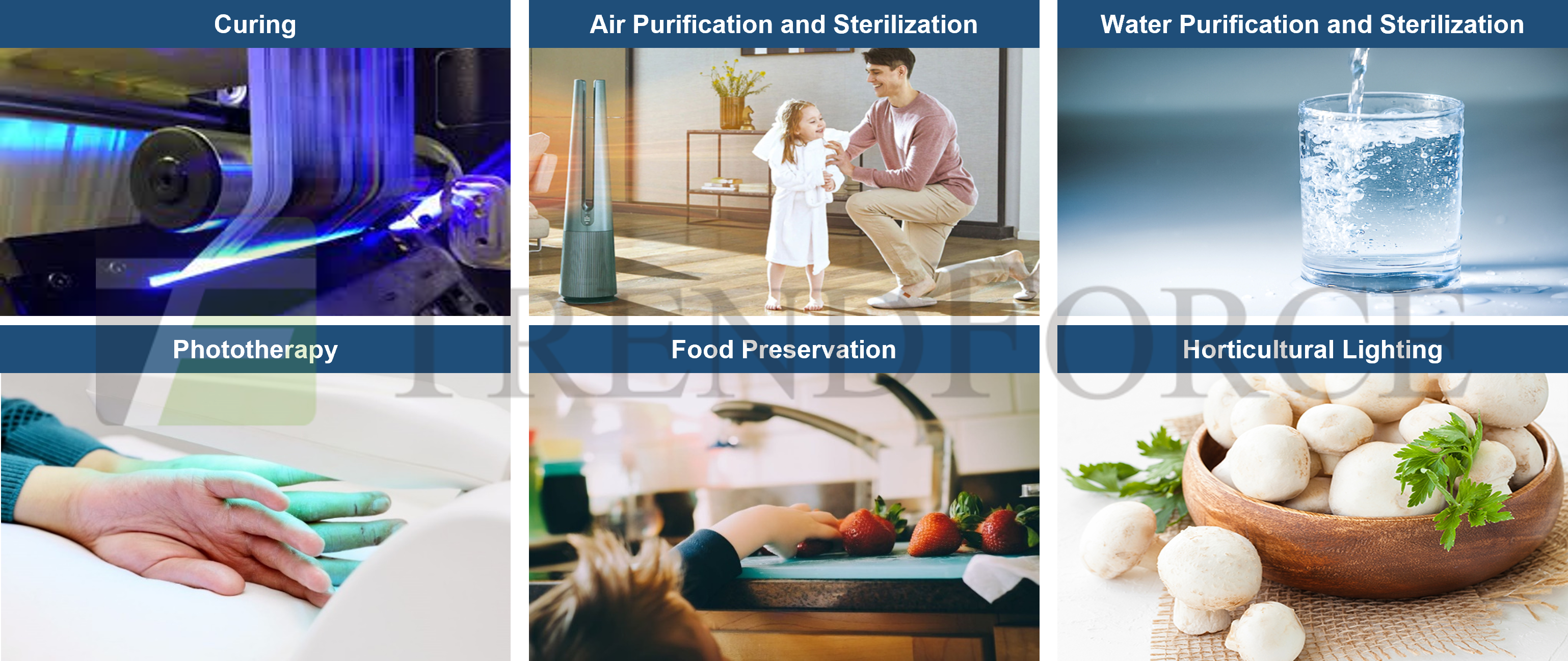

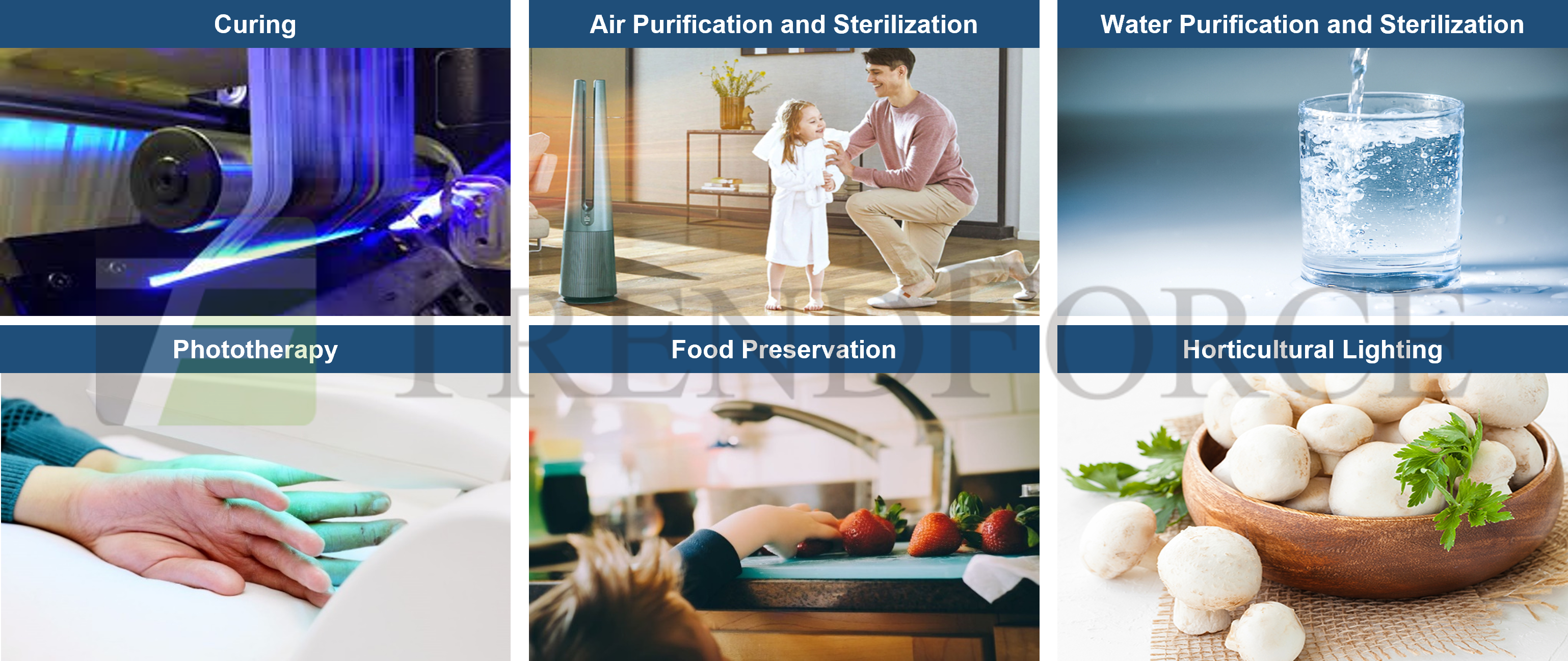

According to TrendForce’s report “2024 Deep UV LED Market Trend and Product Analysis", the UV LED market value is expected to reach USD 309 million in 2028, thanks to application expansion to fields such as curing, medical, disinfection/purification, photocatalytic air purification, and tanning/horticultural lighting/food preservation.

Seoul Viosys continued to generate the highest UV LED revenue between 2019 and 2023 in consecutive, securing its top position. Furthermore, ams OSRAM saw an increase in revenue from UV-C LED business in APAC, entering the top ten for the first time. Most UV LED manufacturers still hold a conservative stance on market performance in 2024, but they believe that a revenue growth of 5-10% is achievable.

UV LED Application Market Analysis

UV Curing: Consumer market demand is expected to gradually recover in 2Q24, reinvigorating the demand for curing applications such as inkjet printing, offset printing, 3D printing, and resin / adhesive curing. In the long term, UV-B / C LED technologies will likely mature and potentially enter the UV curing market, reducing the effects of oxygen inhibition.

Photocatalytic Air Purification: UV-A LED combined with photocatalytic technology can achieve air purification function and kill bacteria with long-term use, which has been long applied to home appliances such as refrigerators, air conditioners, wardrobes, and lighting.

Tanning / Horticultural Lighting / Food Preservation: UV-A / B LEDs are applied in this market, with companies such as Nichia, Seoul Viosys, Violumas, and UVT actively introducing UV-B LED products to drive market demand.

Medical: UV LED’s small size makes it highly suitable for portable phototherapy products. With the increasingly mature 308 / 310nm UV-B LED technology, medical device manufacturers have started to adopt UV-B LED and implement relevant healthcare certifications. Despite such certification process often being strict and time-consuming, medical device and UV LED makers continue to cooperate with each other. Therefore, this market has good potential in the coming years.

Disinfection / Purification: UV-C LED manufacturers will continue to unveil single-chip high power products (≥80mW) and UV-C COB LED integrated packages, which are likely being introduced to home appliance and flowing water disinfection applications in 2H24-2026. Moreover, the Huawei-affiliated EV brand AITO is scheduled to adopt UV-C LED air disinfection, with which orders are placed between 2023 and 2025. This act could prompt other car makers to implement automotive air disinfection. In the long run, UV LEDs, compared to UV lamps, have a longer lifetime and simpler optical design. When the wall-plug efficiency (WPE) of UV LEDs reaches ≥10% with prices close to USD 0.1/mW, they are likely to be applied to industrial water treatment. After the optical power and product lifetime of UV-C LEDs reach the level of industrial / commercial use, they are likely to enter the industrial / commercial flowing water disinfection market in 2026-2027.

Nichia, ams OSRAM, NKFG, LITEON, and UVT have rolled out ≥100mW UV-C LED (single-chip) products. Specifically, the UV-C LEDs of Nichia, ams OSRAM, and NKFG offer desirable optical power while maintaining product reliability, along with a lifetime of 10,000 hours (R70).

Deep UV LED includes UV-B LED and UV-C LED, and that various applications have constantly emerged. The report “2024 Deep UV LED Market Trend and Product Analysis” explores the market value, product specifications and prices, reliability, and application market trend. The report offers comprehensive insights for readers regarding development and marketing of deep UV LED applications.

Author: Joanne / TrendForce

TrendForce 2024 Deep UV LED Market Trend and Product Analysis

Release: 31 March, 30 September 2024

Language: Traditional Chinese / English

Format: PDF / EXCEL

Page: 50-60 / Semi-Annual

Chapter I. UV LED Market Scale and Application Trend

-

UV Wavelength vs. Application Market Analysis

-

2024-2028 UV LED Market Value

-

2024-2028 UV LED Market Value- Application Market Analysis

-

2022-2024(E) UV LED Demand Market Value- Regional Market Analysis

-

2022-2024(E) UV-A LED Demand Market Value- Regional Market Analysis

-

2022-2024(E) DUV LED Demand Market Value- Regional Market Analysis

-

2022-2024(E) China / Japan / Korea UV LED Demand Market

-

2024-2028 UV-C LED Package Market Volume- Optical Power Analysis

-

2014-2024(E) UV-A LED Market Price Analysis- Quartz

-

2014-2024(E) UV-A LED Market Price Analysis- Silicone Resin

-

2015-2024(E) ≤10mW UV-C LED Market Price Analysis

-

2015-2024(E) 10-20mW UV-C LED Market Price Analysis

-

2019-2024(E) >20mW UV-C LED Market Price Analysis

-

2015-2028 UV-C LED Price Trend

-

Curing Market

-

Phototherapy Market

-

Horticultural Lighting Market

-

Life Science Market

-

Disinfection / Purification Market

-

UV-C LED / UV Lamp Product Features Analysis

-

UV-C LED / UV Lamp Flowing Water Sterilization Reactors Analysis

-

Home Appliance Eco System and Supply Chain Flow Analysis

-

UV-C LED Home Appliance Product Requirements

-

European / American Brands- UV LED Product Introduction Results

-

Japanese Brands- UV LED Product Introduction Results

-

Korean Brands- UV LED Product Introduction Results

-

Chinese Brands- UV LED Product Introduction Results

-

When Will UV-C LED Enter Industrial Water Treatment Market?

-

2024 UV-C LED Sterilization Market- Potential Client List

Chapter II. UV LED Player Revenue Ranking

-

UV-C LED Market Value Chain Analysis

-

2021-2023 UV LED Player Revenue Ranking

-

2021-2023 UV-A LED Player Revenue Ranking

-

2021-2023 DUV LED Player Revenue Ranking

Chapter III. Deep UV LED Product Specification and Price Analysis

-

2024 Deep UV LED Wavelength vs. Optical Power Analysis

-

2024 UV-C LED Optical Power vs. Wall-Plug-Efficiency (WPE) Analysis

-

2023-2024 Deep UV LED Product Specification and Price Analysis

-

2024 UV-C LED Product Reliability (Lifetime) Analysis

Chapter IV. UV-C LED Technology and Patent Analysis

-

2024-2028 UV-C LED Technology Roadmap

-

UV-C LED Technology Analysis- Epitaxy

-

UV-C LED Technology Analysis- Chip

-

UV-C LED Technology Analysis- Package

-

100mW UV-C LED Single / Multi-Chip Package Pros-Cons Analysis

-

2016-2023 UV-C LED Patent Litigation

If you would like to know more details , please contact: