Top automotive lighting manufacturers gave LEDinside team some insight about the market outlook and challenges at the 31st Taipei International Auto Parts and Accessories Show (Taipei AMPA), which ran from April 8-11, 2015 at TWTC Nangang Exhibition Hall and TWTC Exhibition Hall 1 Area A in Taiwan.

Automotive lighting makers agreed HID automotive lights would gradually be replaced by LED headlamps. Still this may take some time. According to Carlos Ting, Senior Vice-president, Sales, TYC, a high quality LED headlamp option costs above NT $100,000 (US $3,199), or double the price of a normal HID or halogen headlight, so it will take some time for it to come down to an affordable price and penetrate the market. There is still a large untapped LED headlight market.

|

|

LED headlights and taillights displayed at Reliable Auto-Parts booth. (LEDinside) |

It can also take some time before laser headlights make their way from high class cars to affordable car models. Laser lights will probably only be used in far lights at first, while low beam lights and turn lights will be LED or HID light sources, he explained. This observation was also echoed by Jack Shih, President of Mycarr Lighting Technology, who projected lasers automotive lights will not pick up for the next five to 10 years.

As cars electronic components become more complicated, it will also be important for automotive lighting makers to turn their focus from optics to the electronic design, such as the car’s CPU designs, said Ting. However, acquiring digital codes and keys from car makers to work with automotive electronic systems can be very difficult, said Michael Hu, Executive Vice General Manager, Depo Auto Parts.

|

|

Eagle Eyes LED taillights use guide lights to give it a uniform and even lighting distribution. (LEDinside) |

Sometimes an aftermarket manufacturers lighting product will not be recognized by the original car’s system, and deafening warning signals will follow after installing the light. The can box in cars poses particular challenges, as well as making lights that can adjust automatically in a car with Adaptive Front-light Systems (AFS), said Gary Lin, Assistant Vice President, Eagle Eyes.

Other challenges for automotive lighting manufacturers focused on the aftermarket include original car brand manufacturers improving lighting technology, and coming up with new standards, said Lin. Car mirror light makers have been hit hard by car brands focus on more aesthetic designs, which has caused declining sales in this sector, said Dennis Dai, Sales Representative, Chuang Hsiang Technology. According to Dai, the market for daylight running lamps has become very tough over the last three to five years, and the same situation was observed in LED taillight market.

|

|

LED mirror lights, DRL, taillights and others with lower technology entry levels are feeling the pressure from intense market compeition. Pictured above are Chuang Hsiang Technology's mirror lights. (LEDinside) |

“Taiwanese automotive lighting manufacturers products are usually priced higher than Chinese or Thailand manufacturers,” said Kathleen Tsai, Sales Vice Manager, Sirius Light Technology. Taiwanese manufacturers have to innovate, said Julia Teng, Manager, Reliable Auto-Parts. Some of these innovative products can be seen in an earlier report, but in general most are aiming for integrated headlight designs that combine low/high beam lights, position lights, and daytime running lights (DRL).

Most manufacturers LEDinside interviewed were focused on the European and U.S. market, due to larger market demands. For the niche 4x4 off-road vehicle or truck lighting, most manufacturers were focused on markets with large land area. Rural areas in Europe and U.S. for example often do not have enough streetlights, so the demand for additional vehicle lighting can be greater than other regional markets. In addition, Japan’s aftermarket can be quite hard to enter because of car brands more stringent patent protection that prevents aftermarket manufacturers from changing headlight or taillight styles, said Hu.

|

|

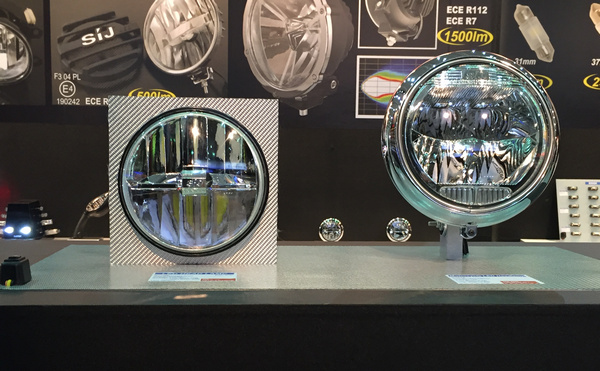

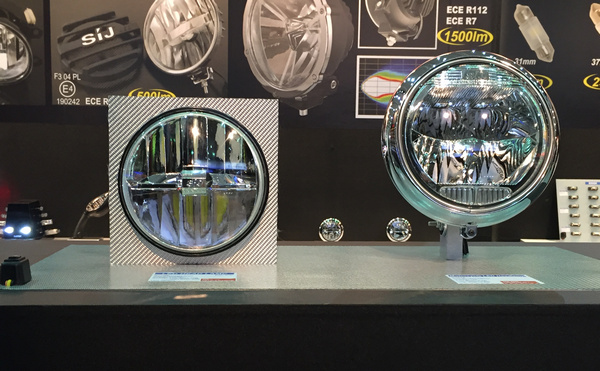

Mycarr has developed LED headlights for jeeps and motorcycles (on the right). (LEDinside) |

When it came to developing distribution networks, most LED manufacturers were working with local agents or distribution channels, and some with auto repair shops. Only a few were directly working as OEM for original car brands, such as TYC, Depo, Niken and Mycarr. Depo is cooperating with automobile Geely in China, while TYC has large international clients in both automobile and motorcycles, such as BMW, Ducarti and Suzuki. Mycarr is cooperating with Harley Davidson for some of its motorcycle headlights, said Dai. Niken did not disclose the car brand they were supplying LED fog lights to.

Despite the many challenges Taiwanese aftermarket faced, Dai was optimistic that Taiwanese manufacturers would still be able to maintain a competitive edge for the next three to five years.

(Author: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN