According to LEDinside, a research division of TrendForce, due to the oversupply of LED chips and other key raw materials, LED lighting product price has dropped to a more reasonable level. LEDinside’s statistics showed that in the Chinese market, 7W bulb price was between 45RMB-55RMB (10USD per Klm ), showing a price decline of more than 40% within one year. Knowing that the price-performance of LED lighting products has been accepted in the Chinese market, many LED lighting companies have started to do brand management and seize market channels. Traditional lighting manufacturers with brand resources and market channel advantages have also increased the LED lighting product lines in order to compete with new comers.

Currently LED lighting marketing in China is mostly based on project and distribution channels. After 4 years of LED promotion by the government, the distribution channel has expanded from traditional shops to exclusive LED lighting stores and shopping centers. Moreover, in order to provide customers with a familiar shopping platform, lighting manufacturers have also started to sell LED lighting products with high replacement needs (such as light bulbs and light tubes) via the internet. LEDinside estimates that by 2015, the ratio of distributors and online shopping malls will increase to around 40%.

In 2013, most of the LED lighting companies have started to re-examine their market channels. To traditional foreign trade enterprises, distributors are their domestic customers; to online businesses, distributors are their direct consumers; to companies that transferred from package to LED lighting, distributors are their downstream customers. Lighting distributors have clearly become the critical market channel of all types of LED lighting industries; realizing the economic advantages of LED lighting, they have continued to expand their LED lighting product line and participate in tenders of each LED lighting brand. Related industries are all aggressively investing in LED lighting in order to seize the business opportunities brought by the popularization of LED lighting.

Source : LEDinside

Chinese Lighting Market Report -2013 Version

Chapter 1 Chinese Lighting Market Development Forecast

-

Introduction

-

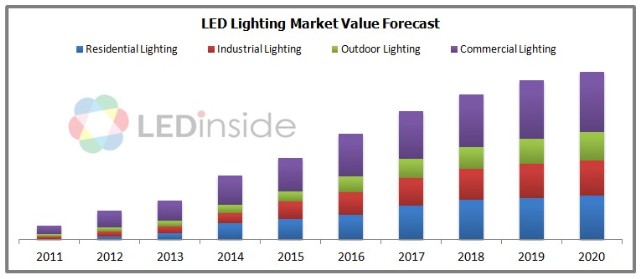

Section 1 Chinese Lighting Market Value Forecast

-

Section 2 Chinese Lighting Export Analysis

-

Section 3 Chinese Lighting Market Demand Forecast

-

Section 4 Major Chinese Luminaire Manufacturers

Highlight: Revenue Scale, Capital, Product Segment, Market Segment, Company Profile, Business Status, Revenue And Profit, Product Mix, Yankon Lighting, Foshan Lighting, Changfang Lighting, Kingsun Lighting, Cnlight, Nationstar, Honglitronic, And Feilo Acoustics

Chapter 2 Chinese LED Lighting Industry Policy Support And Regional Development

-

Introduction

-

Section 1 Major Chinese Government Polices To Support the LED Lighting Industry

-

Section 2 LED Promotion and Implementation Plans in Various Areas

Chapter 3 Analysis of Lighting Market Segments and Channels

-

Introduction

-

Section 1 Chinese LED Sales Channel Pricing Strategy Analysis

Highlight:

1. LED Lighting Channel Ratio And Trend Forecast

Internet Channel Supply Chain Survey- Channel Introduction, Launched Product Specifications, Retail Price And Analysis

JD.com

Taobao.com

China.alibaba.com (1688.com)

2. Store Channel Survey

Survey On Product Prices And Specifications In Retail Stores

3. Distribution Channel Survey

2012 LED Luminaire Manufacturer Development In Distribution Channel

Dealer/Direct Sales Store -NVC

Analysis and Conclusions:

-

Section 2 Commercial Lighting- Retail, Hotels, Office Lighting and Entertainment Lighting

-

Section 3 Residential Lighting

-

Section 4 Industrial Lighting

-

Section 5 Outdoor Lighting

Highlight:

LED Product List And Market Field

Environment And Request

Channel Analysis

Chinese LED Market Segment Analysis

Major Manufacturer Overview

Chapter 4 Chinese LED Lighting Supply Chain Overview

-

Introduction

-

Section 1 ODM / OEM Supply Chain International Lumainire Manufacturers

Highlight: Philips、Osram、GE、Toshiba、Sharp、NEC

-

Section 2 Basic Requirements For Entering the ODM / OEM Supply Chain

-

Section 3 Case Analysis and Discussion on ODM / OEM Projects And Conclusions

Chapter 5 Major Energy Management Business Models For LED Energy Saving Project

-

Section 1 Energy Management Contract (EMC) Model

-

Section 2 Build and Transfer (BT) Model

-

Section 3 EMBT Model

Chapter 6 Analyzing Characteristics And Cost of LED Lighting Products

-

Introduction

-

Section 1 Analyzing The Features Of LED Lighting Products

-

Section 2 Analyzing The Key Materials Of LED Lighting Products

-

Section 3 LED Lighting Products BOM Cost Analysis

Highlight: 40W Equiv. LED Lamp, T8 Light Tube, 100W LED Street Lamp, 12W PAR30, And 5W MR16

-

Section 4 LED Energy Saving- Case Analysis

Chapter 7 Lamp Accessories and Major Manufacturers Overview

-

Section 1 LED Driver IC Development Situation and Major Manufacturers

-

Section 2 LED Power Supply Development Situation and Major Manufacturers

-

Section 3 LED Lighting Thermal Module Development Situation and Major Manufacturers

Chapter 8 Investment Suggestions and Trend Analysis

-

Introduction

-

Section 1 Suggested Investment Strategy

-

Section 2 Trend Analysis

Published Date: June 30, 2013

Language: English

Format: Electronic File (PDF)

Page: 229

If you would like to know more details, please contact :

|

Taipei:

|

|

|

|

Joanne Wu

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |