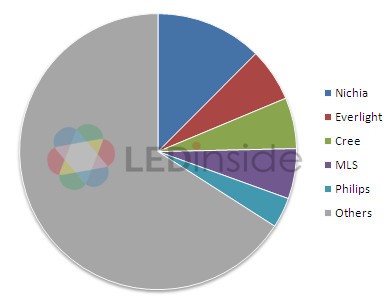

China’s LED package industry market scale reached US $7.2 billion in 2013, up 20 percent from the year before, according to the recent “2014 China Package Industry Market Report” from LEDinside, a green energy research division of TrendForce. China has become the largest manufacturer of LED products. Rapidly increasing LED lighting penetration rate is driving up LED component demand volume, making China the most contended market among LED package manufacturers. Prior to 2013, the top five companies with the largest market share in China ranked in order were Nichia, Everlight, Cree, MLS Lighting, and Philips, combined they controlled around one third of the market.

Graph 1: China LED package market share

Source: LEDinside

Chinese LED manufacturers rising among the ranks

Chinese LED package manufacturers began to rapidly develop in 2010 on the back of expanding upstream production capacity and downstream application market. MLS Lighting successfully ranked among the top five manufacturers with the biggest market share in the Chinese packaging market. This made MLS Lighting a leader among Chinese package manufacturers. The company developed fastest among other Chinese manufacturers, with their revenue in the LED component sector growing at a Compound Annual Growth Rate (CAGR) of 53 percent from 2010-2013. Other Chinese manufacturers including Refond Optoelectronics, Jufei Optoelectronics, and Changfang Semiconductor Light revenue increased at CAGR of 30 percent. Booming downstream application demand volumes became the development foundation for Chinese package manufacturers. LEDinside anticipates the current fast growth trend will continue over the next several years.

International LED manufacturers see most growth in China revenue

International package manufacturers revenue totaled US $2 billion in the Chinese market in 2013, an increase of 40 percent YoY due to patent advantages and benefit from the rising lighting market. Japanese manufacturer Nichia saw substantial revenue growth of over 70 percent. The company’s revenue share in China increased to 29 percent. Korean manufacturer Seoul Semiconductor also saw considerable growth, with revenue up 80 percent and revenue share increased 19 percent in China. Other manufacturers including Cree, Sharp, Philips, and Osram recorded good revenue performance in the Chinese market. Taiwanese manufacturers, however, did not share in the success. Aside from Everlight and Harvatek, Taiwanese manufacturers’ Chinese market revenue share dropped. “Chinese package manufacturers rapid rise has first impacted and threatened Taiwanese manufacturers, but has very little impact on international manufactures in the short term,” said LEDinside Analyst Allen Yu.

Chapter One: Industry Chain Overview

Chapter Two: China LED Industry Overview

Chapter Three: China LED Package Industry Overview

Chapter Four: Major Chinese LED Package Manufacturers

Chapter Five: International LED Enterprises Investment And Business in China

Chapter Six: Important Supporting Industries Related to LED Package Industry

Chapter Seven: Competitiveness of Chinese LED Package Industry

Chapter Eight: New LED Packaging Technology and Hot Topics

Chapter Nine: Conclusions and Investment Suggestions

Published Date: May 31 2014

Language: English

Format: Electronics

Page: 244

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@ledinside.com

CN

TW

EN

CN

TW

EN