Strong

LED market demands this year have led to patterned sapphire substrate (PSS) manufacturers expanded production capacity, according to “2014 Global Sapphire Substrate Market Report” by LEDinside, a LED research division of TrendForce. The 4-inch PSS market current supply shortage situation was mostly caused by Taiwanese and Chinese LED chip manufacturers introduction of large volume PSS into products, and manufacturers shift towards 4-inch PSS production. However, since manufacturers are expected to expand PSS production by the end of the year, tightened market supply conditions are expected to ease.

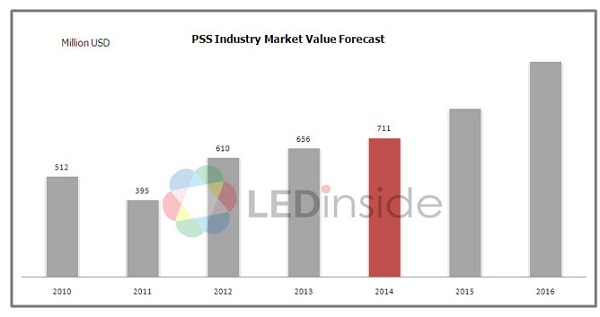

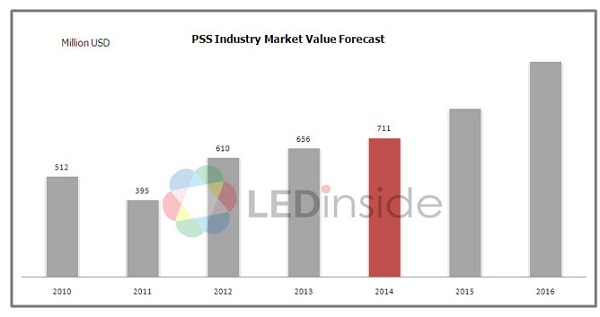

“PSS market value in 2014 is expected to up 8% Year-on-Year (YoY) to reach US$ 711 million,” said LEDinside Research Associate Manager Joanne Wu. The industry is mainly benefiting from leading Taiwanese chip manufacturer Epistars patent license alliance with Philips,which has torn down previous patent barriers. Additionally, Taiwanese and Chinese LED chip manufacturers are allocating more production capacity to 4-inch wafer production, which is leading to supply shortages.

|

Graph 1: 2010-2016 PSS Industry Market Value Forecast |

|

|

Source: LEDinside |

Under PSS supply shortage conditions triggered by high market demands, Taiwanese and Chinese manufacturers have all responded with plans of scaling up PSS production capacity. Taiwanese sapphire manufacturer Crystalwise Technology aims to boost PPS production capacity expansion from 510K/M in 2013 to 800K pcs/M this year. Another Taiwanese manufacturer Rigidtech Microelectronics plans to raise production to 1200K pcs/M before the end of 2014, while Crystal Applied Technology 260K pcs/M during the same period. Other makers including Tera Xtal Technology, Sino Nitride Semiconductor and Zhejiang Crystal-Optech are planning to raise production capacity through strategic alliance or production expansions. LEDinside estimates, PSS production capacity will expand 8% YoY to 52.9 million pcs in 2014 as a result.

Despite tightened PSS supplies, there has not been any significant price upticks, observed Wu. The 2-inch PSS prices remaining at US$12.40-12.90 during second quarter of 2014, while 4-inch PSS prices have remained at around US$52-55. Due to intense market competition from Chinese manufacturers, LED chip manufacturers are in a difficult spot when it comes to profitability, and are strongly against PSS manufacturers raising prices, added Wu.

2014 Sapphire Substrate Market Report

Language: English

Date of Publication: May 15, 2014

Page: 276

Format : E-file

Chapter I Sapphire Substrate Industry Overview

Preview

1.1 Technology Development History of Sapphire Substrate Industry

1.2 Sapphire Substrate Production Process

Chapter II Advanced Technology in Sapphire Substrate Industry

Preview

2.1 Mainstream Sapphire Ingot Technology

2.2 Mainstream Sapphire Substrate Technology

2.3 Mainstream Pattern Sapphire Substrate Technology

Chapter III Discussion on Global Supply Chain Related to Sapphire Substrate

Preview

3.1 Sapphire Substrate Materials Overview

3.2 Sapphire Crystal Growth Furnace Equipment Overview

Chapter IV Supply-side Analysis of Global Sapphire Substrate Industry

Preview

4.1 Sapphire Substrate Industry Supply Chain Trend

4.2 Sapphire Ingot Manufacturer Capacity Overview

4.3 Sapphire Substrate Manufacturer Capacity Overview

4.4 Pattern Sapphire Substrate Manufacturer Capacity Overview

4.5 Major Manufacturer’s Business Performance and Market Development

4.6 Sapphire Manufacturer Business Strategies in LED and non-LED Markets

4.7 Sapphire Substrate Industry Sufficiency- Supply and Demand

Chapter V Global Sapphire Substrate Market Price Trend

Preview

5.1 Sapphire Industry Price Trend Analysis- Ingot, CSS, and PSS

5.2 Sapphire Industry Long-term Price Forecast- Ingot

Chapter VI Analysis on Demand for Sapphire Substrate in LED Market

Preview

6.1 LED Market Value and Volume Forecast

6.2 MOCVD Installation Volume Forecast

6.3 2013~2018 Global LED Epi Wafer Volume and Wafer Size Trend

6.4 Chip Manufacturers' Sapphire Substrate and PSS Supply Chain

6.5 LED Chip Manufacturer Revenue Ranking and Capacity Estimates

6.6 Major LED Chip Manufacturer Profile

6.7 Chip House PSS Introduction Rate and PSS in-house Production Rate

6.8 Advanced LED Chip Technology

6.9 LED Chip Price Trend

6.10 Cost Analysis of Sapphire Substrate in LED Chip

6.11 Analysis on Advantages and Disadvantages of Four-inch and Six-inch Sapphire Substrates

6.12 Alternative Materials of Sapphire Substrate in LED Application Market

Chapter VII Sapphire Substrate in Emerging Applications

Preview

7.1 Window Film and Telecommunications Component Market and Technology Prospect

Sapphire Substrate in SOS Market Overview

SOS in RF IC and Sensor Application Market

With SOS Technology, UltraCMOS® Has Better Performance

SOS in CMOS Application- Peregrine

SOS To Be Replaced by SOI Due to Better C/P Ratio

Sapphire Substrate in Windows Film Market Overview

Sapphire Substrate in Medium-Wave Infrared Windows Market Overview

7.2 Sapphire in Handset Device Market Outlook and Supply Chain Development

Sapphire in Smartphone Overview

Camera Lens: Sapphire Camera Lens in Smartphone

Home Button: Fingerprint Recognition Applications on Smart Phones

Sapphire Cover Glass Helps to Improve Capacitive Fingerprint Recognition System

Other Manufacturers Ramping

Camera Lens and Home Button Are the Major Application in 2014

Sapphire Cover Glass in Smartphone

Currently, Only a Few Companies Apply Sapphire As Cover Glass, There is Still a Long Way to Go For Mass Production

APPLE Will Apply Sapphire to Protect Screen!

Why Does APPLE Need to Apply Sapphire to Protect Screen?

Challenges to Appear in Introducing Sapphire Screen that APPLE Has to Overcome

-

Increase Capacity: KY Method with Low Drilling Rate, GTAT and STC Methods are More Suitable for Square Panel for Sapphire Cover Glass

-

Increase Capacity: GTAT’s ASF is Helpful Sapphire Cover Glass in Phones

-

Reduce Cost Greatly: Sapphire Substrate Lamination Patent

-

Reduce Cost: Cutting Technology and Lamination Patent Makes Sapphire Cover Glass to Be Achieved in Short Time

-

Manage Supply Chain: Supply Chain Management: APPLE Ensures the Supply Source of Sapphire Ingot and Assures Quality, GTAT only Applies EMT’s Aluminium Trioxide

-

Manage Supply Chain: Analysis on APPLE Aggressively Secure Sapphire Supply Chain

Phone Camera Lens and Home Button Supply Chain- iPhone 5S & 5C

Estimated Apple Shipment Schedule

How Sapphire Manufacturers Coordinate With Mobile Production Cycles Will Be a Major Test

7.3 Sapphire Substrates Market Value for Non-LED Applications

Sapphire Substrates Market Value for Non-LED Applications:

Demand Forecast of Sapphire Material in Window Film and Telecommunications Components Markets

Sapphire in Mobile Device Market has Growth Potential

Sapphire Demand Forecast in Mobile Application

Analysis of APPLE iWatch’s Sapphire Screen

The Increasing Proportion of Sapphire Substrate In All Kinds Of Non-LED Application:

Handset Device Owns The Most Growth Potential

Joanne Wu+886-2-7702-6888 ext. 972

CN

TW

EN

CN

TW

EN