The commercialization of OLED lighting continues to accelerate, with a growing list of companies announcing their intention to enter the market. Although traditional lighting companies are active, seeking to safeguard their position with regards to OLED lighting, there are many new entrants that want to challenge these incumbents and shift the dynamics of the industry. Companies are beginning to scale-up the manufacturing of OLED lighting panels, at the same time product performance is rapidly improving both will have an impact on the pricing, capacity, costs and volumes over the next 10 years.

OLED lighting is expected to become a strong competitor to LED lighting by 2016 one year earlier than previously thought. OLED lighting may have had a gentle start but it is now firmly gaining market traction as an increasing number of OLED panels and luminaires reach the market – with the efficacy and lifetimes of current OLED panels at a performance level to last more than ten years under normal operating conditions they are rapidly becoming an alternative to LED lighting.

The potential of the OLED market in the short-term may be debated but what our analysis shows is that during the 2020 – 2023 period OLED lighting is set to become a major alternative to LED lighting in terms of performance, price and lifetimes.

By 2020 OLED panels will be priced at EUR 200 per square meter (US $) and operate at a brightness of 5,000 cd per square meter and we could see OLED panels priced at less than €14/klm. By 2023 worldwide OLED panel production may exceed 500 million 100mm x 100mm panel equivalents.

The recent 66 percent price drop by LG Chem and brighter panels offered by Philips are clear signs that OLED lighting is here for the long-term as the two leading manufacturers seek to secure key market share in this rapidly growing market. Konica Minolta will launch the world’s first roll-to-roll OLED panel manufacturing line in the latter part of 2014, and this will see increases in capacity and increases in choice for luminaire manufacturers and end-users. Increased competition among OLED panel manufacturers will see greater product innovation and further price falls.

|

|

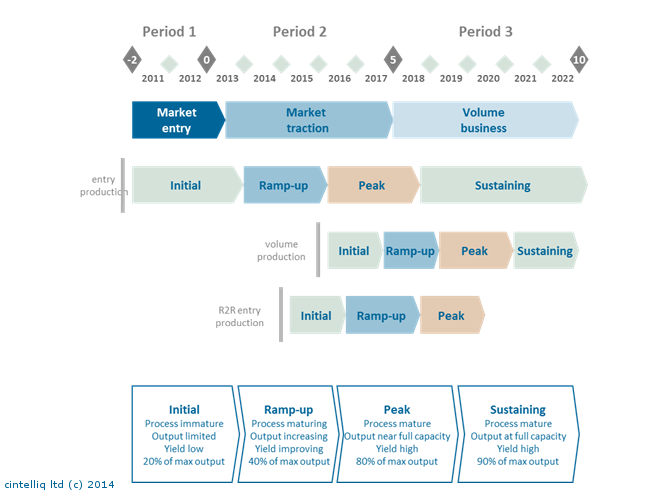

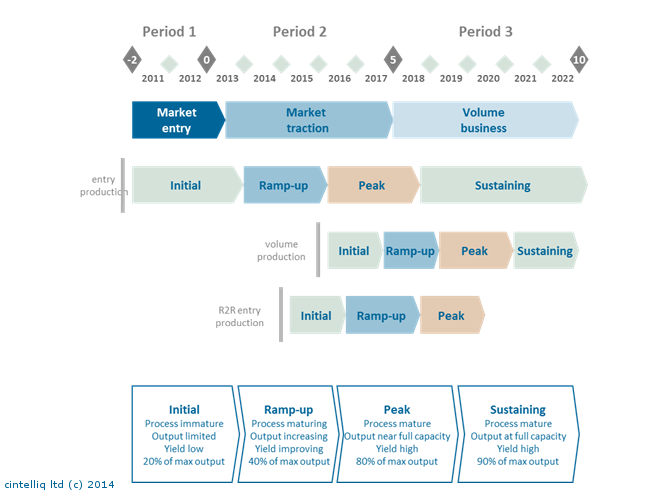

Figure 1: OLED lighting panel production capacity ramp-up. (Source: Cintelliq) |

“Now in its 3rd year this report provides a consistent review and analysis of how the market is changing annually, how big the market will grow, how many panels will be produced, how many machines will be required to meet the forecasted revenues”, said Craig Cruickshank, lead analyst with cintelliq limited, “this report is becoming an essential reference for those wishing to understand the current and future evolution of the OLED lighting industry.”