U.S. sapphire furnace and sapphire manufacturer GTAT, the primary sapphire supplier to Apple, filed for bankruptcy on October 6. As of September 29, GTAT reported having US $85 million in cash. Under the $578 million multi-year agreement GTAT and Apple signed last November, GTAT must supply a certain volume of sapphire ingots to Apple while Apple was to pay GTAT in four installments with the final $139 million payment scheduled for the end of October. But low sapphire yield rates have made Apple withhold the last payment. Additionally, GTAT lost an American Arbitration Association (AAA) lawsuit against Taiwanese sapphire manufacturer Tera Xtal Technology in August. AAA ruled GTAT should return payment totaling $ 24 million for faulty sapphire crystal growth furnaces, which greatly strained the firm’s finances.

There were some early warning signs of GTAT’s impending bankruptcy, said Roger Chu, research director of LEDinside, a subsidiary of the Taiwan-based market intelligence firm TrendForce. For instance, GTAT has nearly 2,000 sapphire growth furnaces, which in theory could equip 10 million 5.5” iPhone 6 Plus phones with sapphire cover glass. Yet the company’s sapphire yield rates were just 40%. Furthermore, the yield rate of the back-end glass process is still low and the problem cannot be solved before product release. That explains the lack of sapphire cover glass in the new iPhone 6 and iPhone 6 Plus. Many GTAT and Apple employees involved in the sapphire cover glass project have been terminated as a result.

Apple is differentiating itself from its competitors by using sapphire cover glass in its products, said Chu. “Apple has already heavily invested in the technology and applied for many related patents, which can be seen in sapphire in the iPhone’s camera lenses, home buttons, and Apple Watch covers,” he said. “Introducing sapphire cover glass to the iPhone is plausible but more time is required to surmount the technical difficulties of the process.” If all goes well, the new-generation iPhone equipped with sapphire cover glass will be released at the end of 2015, Chu added.

The three major challenges for sapphire cover glass are analyzed below:

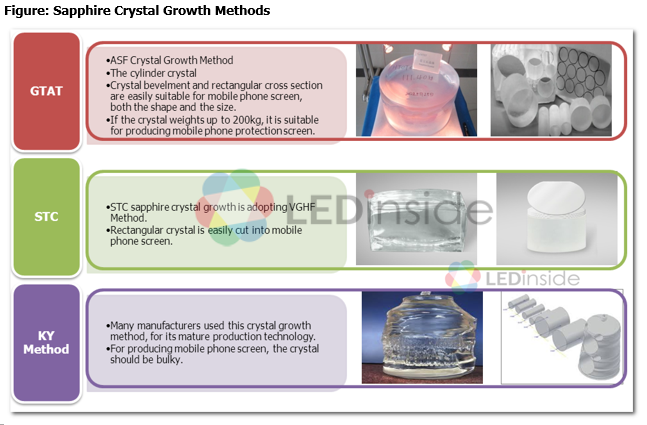

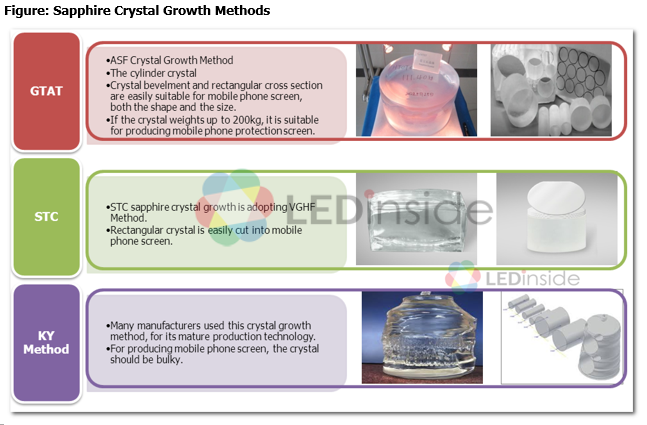

1) Sapphire crystal production capacity: Sapphire crystal growth technology is very important for suppliers in the sapphire supply chain, said Chu. Manufacturers that use the conventional Kyropoulos (KY) method, such as Monocrystal, Rubicon, Harbin Aurora Optoelectronics Technology and USI Optronics Corporation have mature sapphire crystal growth technology capable of reaching high yield rates. Despite the high yield rates, the KY method has low sapphire volume output, mainly since mass production would require many sapphire engineers to manually operate the equipment. Only a few manufacturers are capable of using this particular growth method to produce 90 kg grade sapphire crystal. “This is especially challenging for smartphones applications, which have relatively low product life cycle, and require mass production, and a main reason why KY manufacturers were ruled out by Apple in the first place,” Chu said.

In contrast, GTAT claims its Heat Exchanger Method (HEM) sapphire crystal growth furnace is highly automated. The company is also capable of growing 200 kg and above grade sapphire crystals, which explains why Apple chose it as a partner. However, HEM yield rates were far below GTAT’s reported figures, and more time is required to overcome the technical difficulties.

|

|

|

Comparison between three major sapphire crystal growth methods. (Source: LEDinside)

|

If Apple wants to develop sapphire cover glass in the future, it needs to have a sufficient sapphire ingot supply. Current HEM, KY and Vertical Horizontal Gradient Freezing (VHGF) sapphire suppliers have all been certified by Apple. Therefore, if experienced sapphire manufacturers continue to increase supplies to Apple, they might even reach a stable supply agreement.

2) Costs: A 5.5-inch and 500 um thick sapphire cover glass costs more than $60, accounting for 7 percent of the total cost for an $859 iPhone 6 Plus. For that reason, lowering costs is essential. GTAT has laser cutting technology which can make the sapphire cover glass thinner before laminating it with traditional glass. That can also help to lower costs. From a technological standpoint, it will still take some time before this method can be utilized in mass production. It is also important to look for additional ways to lower costs.

3) Glass Processing: Except for sapphire crystal growth issue, back-end glass processes include cutting, polishing, coating, and printing is quite crucial as well. The glass process is especially difficult because sapphire is a very hard material, but fragile at the same time and easily broken. Thus, processing manufacturers need to find solutions to reach mass production.

LEDinside 2014 Sapphire Substrate Market Report

Chapter I Sapphire Substrate Industry Overview

Preview

1.1 Technology Development History of Sapphire Substrate Industry

1.2 Sapphire Substrate Production Process

Chapter II Discussion on Advanced technology of Sapphire Substrate Industry

Preview

2.1 Mainstream Sapphire Ingot Technology

2.2 Mainstream Sapphire Substrate Technology

2.3 Mainstream Pattern Sapphire Substrate Technology

LEDinside reserves the right to change the content

Chapter III Discussion on Global Supply Chain Related to Sapphire Substrate

Preview

3.1 Sapphire Substrate Materials Overview

3.2 Sapphire Crystal Growth Furnace Equipment Overview

Chapter IV Supply-side Analysis of Global Sapphire Substrate Industry

Preview

4.1 Sapphire Substrate Industry Supply Chain Trend

4.2 Sapphire Ingot Manufacturer Capacity Overview

4.3 Sapphire Substrate Manufacturer Capacity Overview

4.4 Pattern Sapphire Substrate Manufacturer Capacity Overview

4.5 Major Manufacturer’s Business Performance and Market Development

4.6 Sapphire Manufacturer Business Strategies in LED and non-LED Markets

4.7 Sapphire Substrate Industry Sufficiency- Supply and Demand

Chapter V Global Sapphire Substrate Market Price Trend

Preview

5.1 Sapphire Industry Price Trend Analysis- Ingot, CSS, and PSS

5.2 Sapphire Industry Long-term Price Forecast- Ingot

Chapter V Global Sapphire Substrate Market Price Trend

Preview

5.1 Sapphire Industry Price Trend Analysis- Ingot, CSS, and PSS

5.2 Sapphire Industry Long-term Price Forecast- Ingot

Chapter VI Analysis on Demand for Sapphire Substrate in LED Market

Preview

6.1 LED Market Value and Volume Forecast

6.2 MOCVD Installation Volume Forecast

6.3 2013~2018 Global LED Market Demand (Total Sapphire Volume and By Region) and Wafer Size Trend

6.4 Chip Manufacturers' Sapphire Substrate and PSS Supply Chain

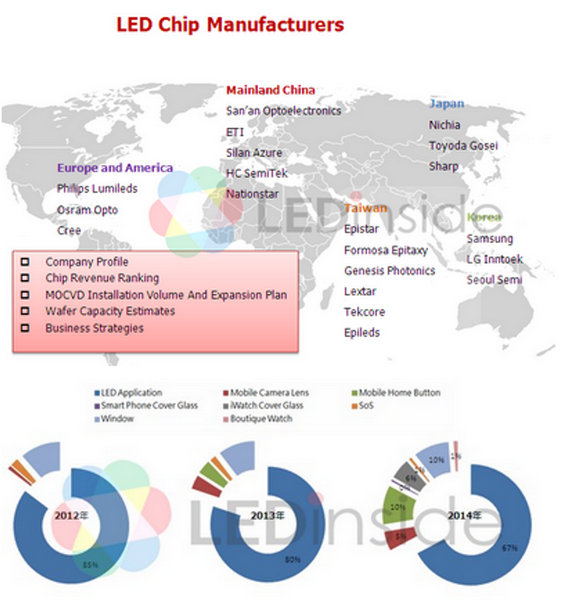

6.5 LED Chip Manufacturer Revenue Ranking and Capacity Estimates

6.6 Major LED Chip Manufacturer Profile

6.7 Chip House PSS Introduction Rate and in-house PSS Production Rate

6.8 Advanced LED Chip Technology

6.9 LED Chip Price Trend

6.10 Cost Analysis of Sapphire Substrate in LED Chip

6.11 Analysis on Advantages and Disadvantages of Four-inch and Six-inch Sapphire Substrates

6.12 Alternative Materials of Sapphire Substrate in LED Application Market

|

|

(Source: LEDinside) |

Chapter VII Sapphire Substrate in Emerging Applications

Preview

7.1 Window Film and Telecommunications Component Market and Technology Prospect

· Sapphire Substrate in SOS Market Overview

· SOS in RF IC and Sensor Application Market

· With SOS Technology, UltraCMOS® Has Better Performance

· SOS in CMOS Application- Peregrine

· SOS To Be Replaced by SOI Due to Better C/P Ratio

· Sapphire Substrate in Windows Film Market Overview

· Sapphire Substrate in Windows Film Market Overview

· Sapphire Substrate in Medium-Wave Infrared Windows Market Overview

7.2 Sapphire in Handset Device Market Outlook and Supply Chain Development

· Sapphire in Smartphone Overview

· Camera Lens: Sapphire Camera Lens in Smartphone

· Home Button: Fingerprint Recognition Applications on Smart Phones

· Sapphire Cover Glass Helps to Improve Capacitive Fingerprint Recognition System

· Other Manufacturers Ramping

· Camera Lens and Home Button Are the Major Application in 2014

· Sapphire Cover Glass in Smartphone

· Currently, Only a Few Companies Apply Sapphire As Cover Glass, There is Still a Long

· Way to Go For Mass Production

· APPLE Will Apply Sapphire to Protect Screen!

· Why Does APPLE Need to Apply Sapphire to Protect Screen?

· Challenges to Appear in Introducing Sapphire Screen that APPLE Has to Overcome

a. Increase Capacity: KY Method with Low Drilling Rate, GTAT and STC Methods are More Suitable for Square Panel for Sapphire Cover Glass

b. Increase Capacity: GTAT’s ASF is Helpful Sapphire Cover Glass in Phones

c. Reduce Cost Greatly: Sapphire Substrate Lamination Patent

d. Reduce Cost: Cutting Technology and Lamination Patent Makes Sapphire Cover Glass to Be Achieved in Short Time

e. Manage Supply Chain: Supply Chain Management: APPLE Ensures the Supply Source of Sapphire Ingot and Assures Quality, GTAT only Applies EMT’s Aluminium Trioxide

f. Manage Supply Chain: Analysis on APPLE Aggressively Secure Sapphire Supply Chain

· Phone Camera Lens and Home Button Supply Chain- iPhone 5S & 5C

· Estimated Apple Shipment Schedule

· How Sapphire Manufacturers Coordinate With Mobile Production Cycles Will Be a Major Test

7.3 Sapphire Substrates Market Value for Non-LED Applications

· Sapphire Substrates Market Value for Non-LED Applications: Demand Forecast of Sapphire Material in Window Film and Telecommunications Components Markets

· Sapphire in Mobile Device Market has Growth Potential

· Sapphire Demand Forecast in Mobile Application

· Analysis of APPLE iWatch’s Sapphire Screen

· The Increasing Proportion of Sapphire Substrate In All Kinds Of Non-LED Application: Handset Device Owns The Most Growth Potential

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972

joannewu@trendforce.com

CN

TW

EN

CN

TW

EN