LEDinside recently had a chance to interview one of the top Russian electronic component distributor, Platan. Their spokesperson gave a very comprehensive overview of LED chip developments in Russia, and the LED market outlook in the aftermath of economic sanctions imposed on the country by Europe and U.S. during the Ukrainian Crisis last year.

Company Profile

PLATAN is one of the largest suppliers of electronic components in the Russian market, offering products from various globally-renowned brands, such as, International Rectifier, Murata, Mistubishi Electric, TE Connectivity, Epcos, Vishay, Bourns, Honeywell, Nationstar, Kingbright, Heraeus, Janitza, Panasonic, Crydom, Velleman, and others. It is also an authorized distributor of more than 20 honored companies.

Platan started selling electronic components in 1991, and with 20 years of experience in the Russian market, the company currently is one of the leading electronic components suppliers in Russia.

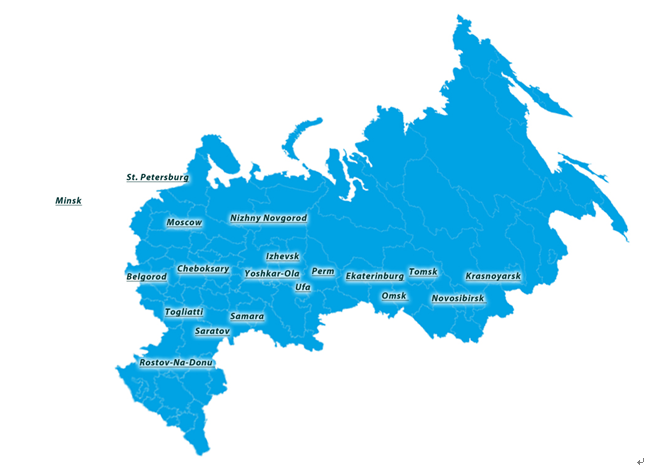

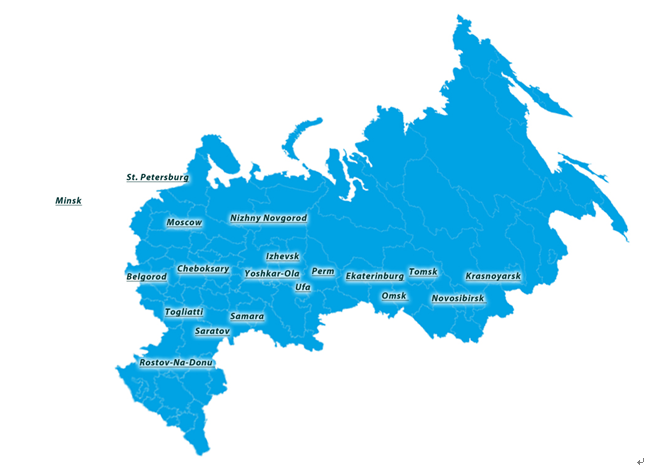

The company has grown from a small group of employees to one of the largest suppliers of electronic components in Russia, with several sales offices in Moscow, and establishing a new branch in St. Petersburg and Kiev. The company’s agency network covers major cities throughout Russia. Currently it has a total of 250 employees, and its customers cover thousands of enterprises involved in processing and production from all fields, such as communications equipments, electronic products, household appliances, automotive electronics, as well as repair shops, design firms and radio enthusiasts.

It attributes all of these achievements to its professional team, which provides customers with customized services. It offers an enormous variety of items from stock and provides professional technical support. These are our advantages to attract customers.

Meanwhile, it should be pointed out that our company also provides accessories to Russian manufacturing enterprises and processing factories. All supplies went as planned, including a series of process from confirming detailed specifications to customers receiving products. Error and delay in any step is likely to result in disrupting the entire production process. With the continued supply of accessories, a new department was gradually founded in the company to coordinate with manufacturing enterprises, following up the implementation of orders, timely handling various problems in the supply chain.

Moreover, Platan is one of the first companies to establish independent sales network in Russia, and offers favorable prices, advertising and technology support to subordinate distributors.

Now, customers in Novosibirsk, Ufa, Samara, Kazan, Cheboksary and other cities can enjoy Platan's products and services.

|

|

A map of Russia. (All photos courtesy of Platan) |

Looking back, we can proudly say that today's leadership has benefited greatly from the continued trust and support from customers. Platan’s business has maintained a good development momentum, but we are not content, so our team still insists on innovation.

1. Russian LED package market

LED package began to develop rapidly from the 1990s, and Platan began to supply accessories during early stages of development, in other words, Platan has witnessed the market's growth and maturity.

Gradually, Platan turned its main business in LED field to the sale of color and far-infrared LEDs, optical transmitters, modules and LED indicators produced by Vishay and Kingbright. Once the market matured, powerful and inexpensive white LEDs appeared.

In addition, the Russian Government strongly supported the application of new energy-saving technology for more rational use of energy. Through analyzing the national bids and individuals bids, we found that more a fluorescent lamps and other light sources were being replaced with LEDs. So we began to pursue this trend, increasing the purchasing and sales efforts of white lighting sources up to recent. We have cooperated with Nationstar (large Chinese enterprise) for three years. The production of LED lamps is subject to acts of the Russian Federation No.261 promulgated on November 23, 2009.

Russian domestic lighting manufacturers have maintained close contact with first-class SMD brand owners or brand agents, so each new product will be closely compared with similar product from other brands.

Only those manufacturers with all of the above characteristics can successfully develop in the Russian market.

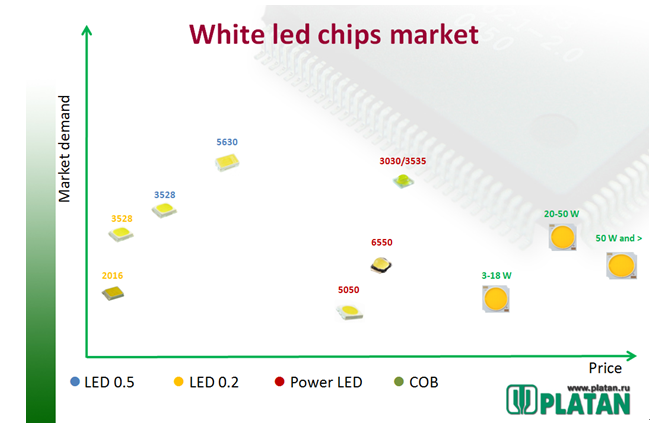

To further evaluate the Russian market, we will divide it into three segments:

- Low and medium power (1W or less) SMD market;

- High-power SMD market;

- High-voltage SMD market

1.1 Russian low and medium power (1W or less) SMD market

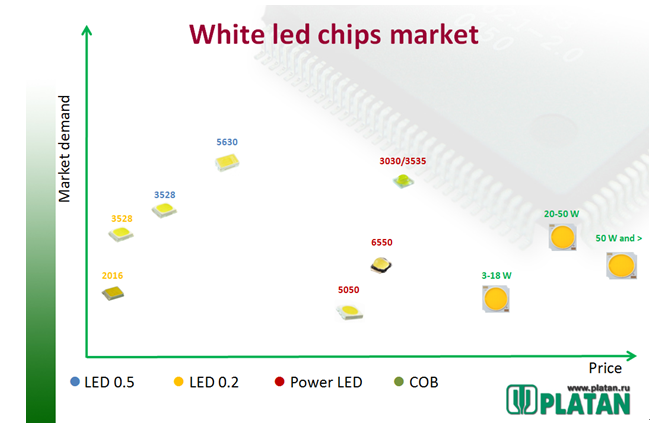

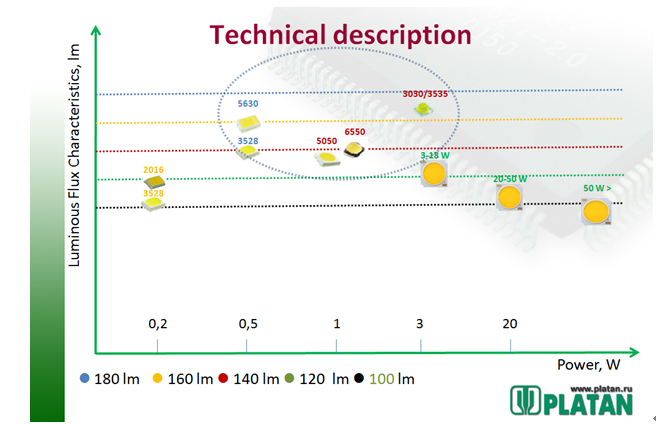

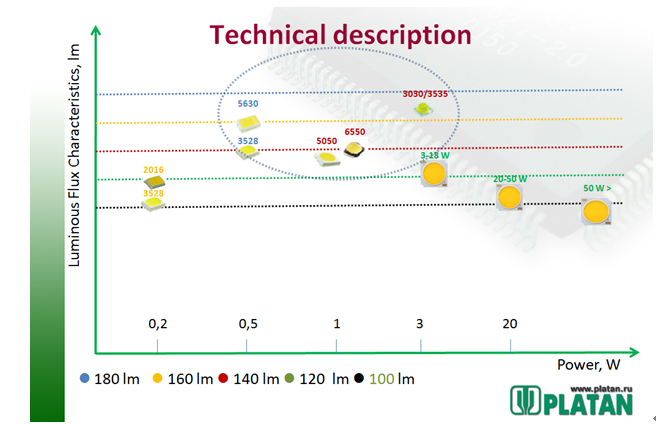

The following SMDs are classified to low and medium-power market: 0.2W, 0.5W, 1W, and model 3030 (1W), 3528 (0.5W, 0.2W), 5630 (0.5W), 4014 (0.2W), 3014 (0.2 W), 2016 (0.2W new).

|

|

(Source: Platan) |

According to our estimations, the monthly demand for SMD chips less than 1W in Russia is more than 100 million pieces. The total market value is approximately US $ 80-120 million per year.

The most common and the most in-demand LED chip is 0.5W 5630, which is widely used in commercial lighting (eg. the production of Armstrong-type lamps, in size of 600mm * 600mm), as well as public residential lighting and industrial lighting.

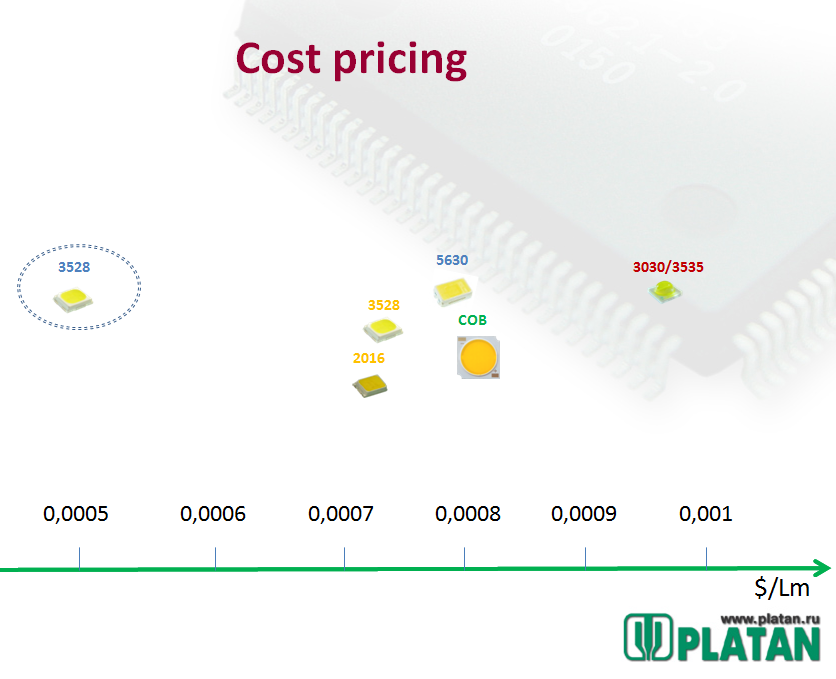

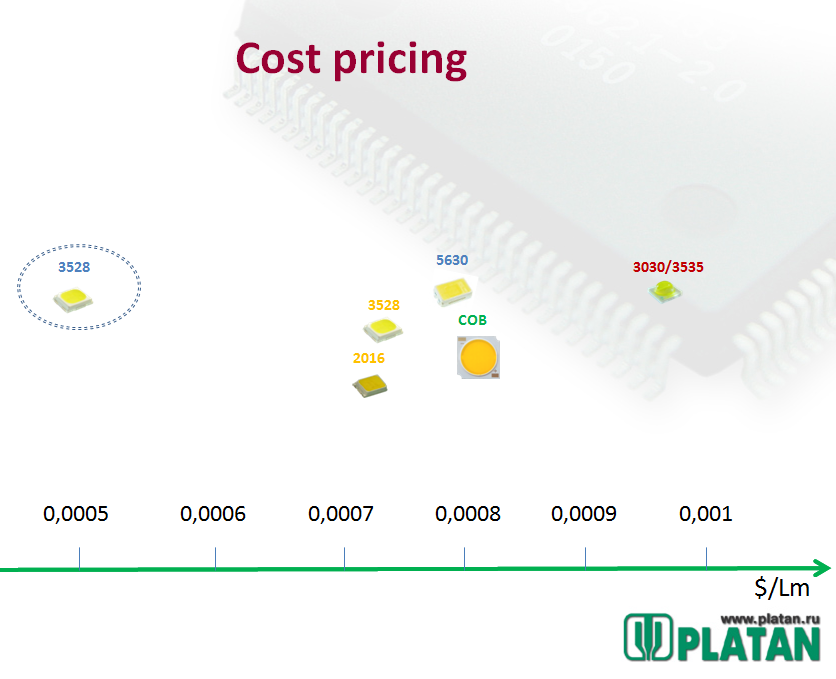

Last year, various manufacturers announced new 3528 SMD chips that has been accepted by consumers, and competing with 5630 LEDs. Although, 3528 parameter performance is worse than 5630 (65lm, 150mA VS 75lm, 150mA), it has lower costs than 5630.

|

|

(Source: Platan) |

Finally, one more important point regarding low and medium-power LED would like to be added that not only globally recognized brands have good LED sales, as well as unknown or no-name Asian brands. This is often because sales of lamps largely depends on low prices, instead of the brand or quality. The key factor impacting customers final purchase decision is lm / W / $.

|

|

(Source: Platan) |

1.2 Russian high-power LED market

Since industrial lighting and street lighting have higher end product requirements, for customers the most important factors are quality and luminous efficiency. Manufacturers have had to compromise with high prices, choosing the world's leading brands, such as in U.S., Japan, Germany, as well as a few in South Korea and Taiwan markets. Chinese brands have been unable to enter the energy-saving replacement market because their products lower lm / $ is uncompetitive in the Russian market.

To some extent, contracts for replacing traditional lamps like mercury arc lamp and arc sodium lamps are subject to Russian Federal Law No. 261. According to relevant regulations, companies that replace the traditional lamps with LED luminaires make money not from luminaire sales, but instead are paid by customers’ electricity savings.

As part of the incessant pursuit of lm / $ in technology, many manufacturers changed brands 3-4 times a year.

We provide differentiated solutions for different markets, because of different demands. Obviously, one brand is unable to meet the needs of all LED lighting manufacturers, so the competition is fierce among brands including Nichia, Cree, Osram, Seoul Semiconductors, Samsung and LG.

1.3 High-voltage LED market

Overall, customers pay more attention to lm / W / $ instead of LED type when selecting this kind of products.

We provide personalized solutions for every customer. If the customer has selected LED brand and model, it might allow us to profit in the short term. Yet, if we recognize it is unprofitable for the customer, we are willing to forsake some of the profits, and choose a more suitable solution for the customer.

Relying on an individual brand is clearly unable to meet all customers' need. Therefore, we also work with a number of other large manufacturer, such as Osram, Toshiba, Foryard and Samsung when promoting Nationstar series products. Moreover, we welcome new brands to join. As the competition for end customers among various brands is very fierce, there must be an attractive price.

2. Goals for 2015

Having bid farewell to 2014, we are more sensible when setting goals for this year. As we all know, the Ruble depreciated sharply by the end of 2014, and commodity demands in various industries slowed down. However, we are still satisfied with our own achievements. There are signs of healthy growth, and we strongly believe in our own choice. Compared with other industry peers we entered the white LED market much earlier, and have firmly consolidated our market position.

Specific goals for this year:

- To improve the sales to existing wholesale customers;

- To enhance the direct sales to new customers;

- To increase the sales to regional agents;

- To develop online small-batch and retail sales;

- To expand lighting department team members.

Despite the poor economic situation, we still expect annual growth of at least 25% -30% this year. We also hope to expand the product portfolio by introducing new brands to improve complementary features of products. Therefore, exhibitions are significant for us, and we are planning to visit exhibitions in Guangzhou and Shanghai. We have made appointments with some manufacturers.

Exhibitions are very effective, especially the Guangzhou International Lighting Exhibition (GILE), where we not only found partners, but also developed our customer base.

We pay close attention to currency exchange fluctuations and analyze the domestic market like all other Russian companies. Undoubtedly, the economic situation has negatively impacted the whole market, and affected distributors, lighting manufacturers and end consumers. So we cannot one hundred percent accurately forecast sales. In the context of the stagnant automotive industry, sales of low-power backlight LED has declined, and the overall LED market has been somewhat weak in the previous months of this year, we expect the demand to rebound in May and June.

From our perspective, the production growth of lamp bulb and searchlight in Russia this year is caused by objective reasons. The value of the Ruble has been halved, which is the most fundamental factor affecting exporting products. There are many manufacturers considering shifting the production of LED bulb to Russia to replace the OEM. This will certainly lead to a decline in total imports of these products.

4. Company perspectives and suggestions for Sino-Russian lighting trade

China and Russia has a long trade history, which has developed rapidly as Russian relations deteriorate with the West. Russian manufacturers place more attention on China these days. Probably more than half of Russian manufacturers use Chinese components, or shifted production to China. We encounter more Chinese manufacturers, who can communicate fluently in Russian and understand the Russian people's psychology well, making negotiations much easier. In addition, some people from Russian speaking countries, such as Russia, Ukraine, Belarus, Kazakhstan and others work in Chinese lighting companies, which can promote our collaboration. Therefore, growing number of Chinese companies are developing in the Russian market, and setting up agencies in Russia.

We suggest to enrich website information as much as possible, such as dates, company news, product catalogs, as well as presenting clear and bright structure diagrams. Although, many large Chinese manufacturers have entered the international market, so far it is still the obstacle for them to promote products in the Russian market.

(Editorial Notes: Platan is a electronic component distributor and not a LED chip manufacturer. Edits made as of April 17, 2015.)

CN

TW

EN

CN

TW

EN