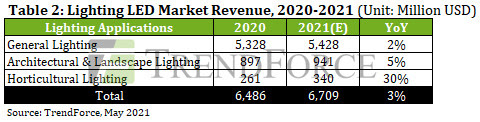

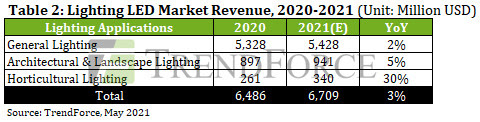

May 26, 2021 ---- Product prices across the overall lighting LED market are expected to increase by about 0.3%-2.3% QoQ in 2Q21, according to TrendForce’s latest investigations. This price hike can primarily be attributed to the fact that overall demand in the LED lighting market has been rebounding since 1Q21 and remaining in an uptrend since 2Q21. Furthermore, the industry-wide shortage of LED components in the upstream supply chain, caused by the onset of the COVID-19 pandemic, has yet to be addressed, thereby compelling lighting product manufacturers to ramp up their procurement activities this year in order to avoid a component shortage, which they suffered last year. TrendForce hence expects this bullish trend in the LED supply chain to result in a US$6.709 billion yearly revenue for the lighting LED market in 2021, a 3.43% growth YoY.

TrendForce further indicates that major suppliers of lighting LED packages, including Samsung LED, ams/OSRAM, CREE LED, Lumileds, Seoul Semiconductor, MLS, and Lightning Optoelectronic, have since 1Q21 seen soaring revenues, which are expected to persist through 2Q21, thanks to a swift rise in demand for HCL (human centric lighting), smart lighting, horticultural lighting, and niche lighting (such as lighting for nuclear power stations, pharmaceutical manufacturing facilities, and metal fabrication plants).

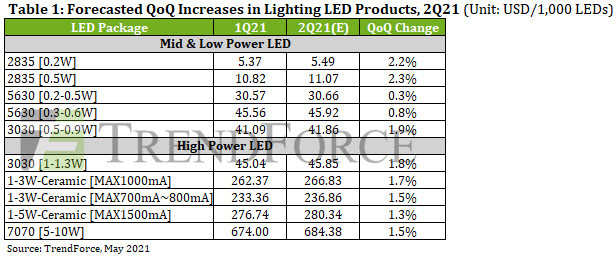

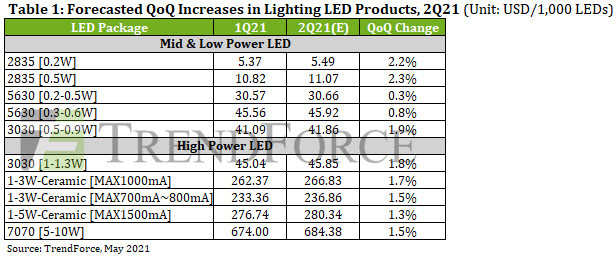

With regards to the specific LED packages that will experience a continued price hike, these products include mid- and low-power, indoor lighting LED products with under (not including) 1 watt in power consumption, such as 2835 LED, 3030 LED, and 5630 LED. Prices of these products are expected to increase by 0.3%-2.3% QoQ in 2Q21. On the other hand, a 1.3%-1.8% QoQ increase in prices for the same period can be expected for outdoor, industrial high-power lighting LED products with at least 1 watt in power consumption, such as LED with ceramic substrates and 7070 LED.

Companies are releasing products aimed at post-pandemic applications to secure their market shares in anticipation of high upcoming demand in the LED lighting market.

With regards to the movement of lighting LED product prices from the perspective of the LED supply chain, the pandemic caused a price hike across various materials, such as metals and LED chips required for lighting LED manufacturing last year. Faced with the upward pressure of prices in their upstream supply chains, certain suppliers of lighting LED products were subsequently forced to maintain their bottom lines by raising prices accordingly on lighting LED products, which had been sold at excessively low retail prices. On the whole, however, despite the price hike across various upstream components, suppliers of lighting LED products are still actively improving their products’ performances, including luminous efficacy and color saturation, and releasing products that fulfill the demand of post-pandemic applications in order to secure their market shares and competitiveness. Some examples include outdoor atmospheric lighting LED products from OSRAM and Lumileds, as well as horticultural LED products from CREE LED for indoor horticulture and plant factories.

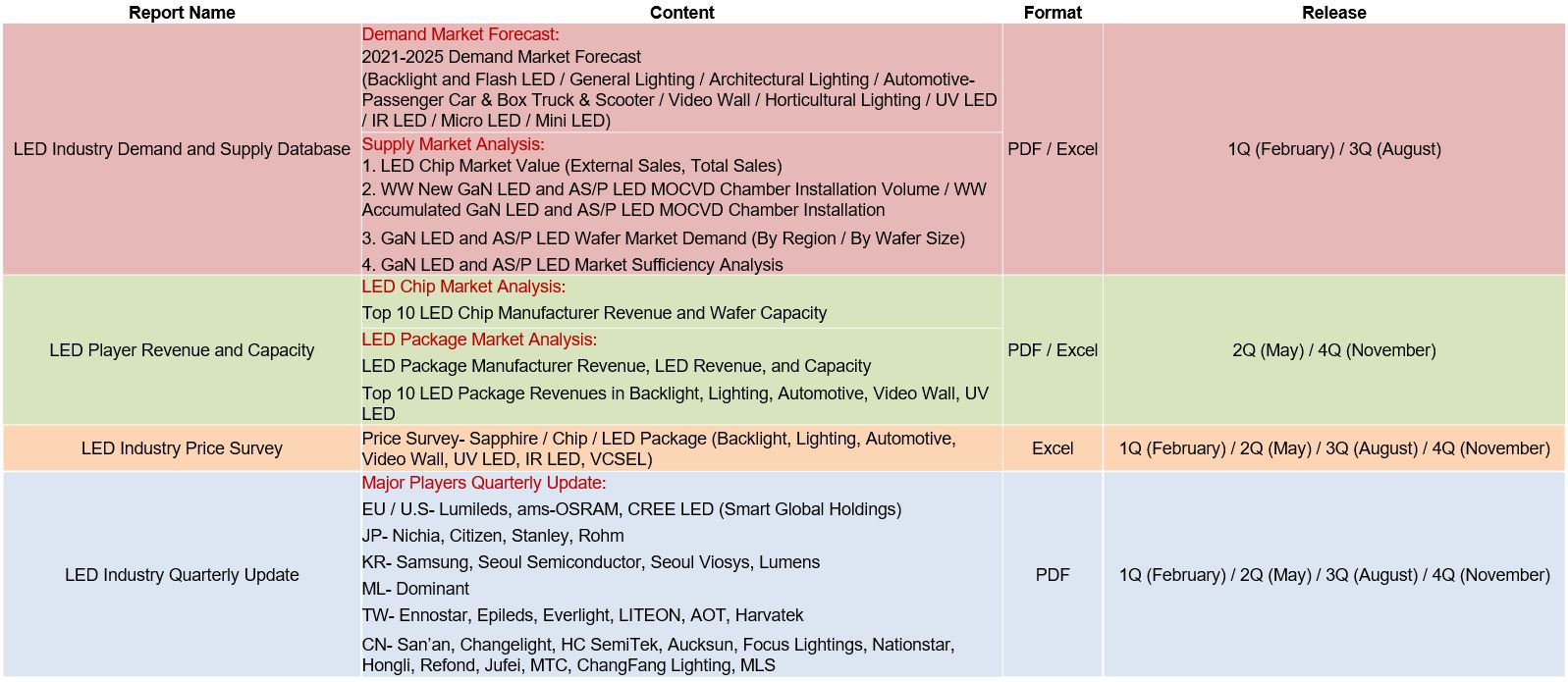

Gold+ Member Report

|

If you would like to know more details , please contact:

|