According to TrendForce, “2020-2021 Global Automotive

LED Product Trend and Regional Market Analysis,” automotive LED market demand steadily increase by advanced technologies, such as intelligent headlamp, central tunnel taillights, HDR automotive display, ambient light, etc. TrendForce analyze automotive LED market development by five directions, including automotive lighting and display product trend, automotive lamp player revenue and development strategies, LED player revenue performance and product price, in order to provide readers with a comprehensive understanding of automotive LED market trend.

Automotive Lighting Product Trend

Influenced by the COVID-19 pandemic, the global auto demand plummeted in 2020, after which automotive providers worldwide have strived to enhance the LED penetration rate, aiming to achieve competitive differentiation for a higher market share. Consequently, developing the automotive lighting market has become a common goal shared by car makers, automotive lamp manufacturers, and LED manufacturers.

According to TrendForce, the LED penetration rate for global passenger cars has reached 53.1% in 2020, amongst those, the LED penetration rate for electric cars reached 85% in 2020, respectively; the two figures are likely to hit 60% and 90% in 2021.

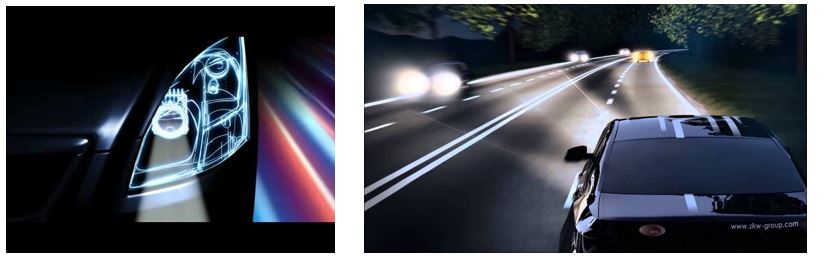

As a favorite in the automotive industry, ADB headlights—a type of intelligent headlights—mainly have two benefits as follows:

a. Extended range of vision at night, giving drivers more time to react to obstacles at front.

b. Glare-free high beam helps reduce discomfort glare for the vehicle in front, oncoming vehicles, and pedestrians.

Presently, the matrix LED design is dominant in ADB headlight development. This method allows for individual control of high-performance LEDs, which helps the driver to illuminate more clearly of the road and more accurately avoid dazzling other road users. According to TrendForce analysis, the market penetration rate of ADB headlights is estimated to achieve a spectacular growth from 0.7% in 2020 to 2.7% in 2025.

Image Source: Toyota, ZKW Group

Automotive Display Product Trend

Panel suppliers reveal that the future trend of automotive display design will focus on the whole-car display that is 1.5-m wide, display with an unusual form, transparent display, or high-resolution display (250 PPI). In the long run, the automotive display market is highly promising.

-

HDR Market Demand: Given the demand for local dimming and cost requirements, mainstream local dimming will have 60-384 dimming zones. Major players include General Motors, Geely, Innolux, AUO, Macroblock, Nichia, OSRAM, Everlight and Lextar. Cadillac LYRIQ, owned by General Motors, adopts a 34-inch automotive display with >3,000 local dimming zones driven by active matrix. The major suppliers are Innolux and Everlight. TrendForce anticipated that the trend of HDR and Local Dimming technologies will generally increase in high-class car model.

Image Source: Cadillac LYRIQ

-

Full Car Display: Limited by automotive safety regulations (Ensure no glass fragments when the airbag inflates.), auto makers currently can only use OLED display if they want to extend automotive panel from cluster to CID and co-pilot seat (A pillar-left to A pillar-right). As Micro LED is RGB self-emitting display, risk and damage caused by glass fragments can be avoided. Thus, it can be seen that when Micro LED technology grows matured, Micro LED will occupy the market share of OLED display for the whole vehicle.

-

Transparent Display: Micro LED, the next-generation display technology, can be equipped with flexible display and transparent display to be used in smart vehicle in the future, and the information display will appear in almost everywhere in the car. Micro LED display will create a new era of mobility and communication for ADAS, autonomous vehicle and car sharing.

Automotive Lamp Market Scale and Player Strategies

According to TrendForce’s investigation and analysis, due to the COVID-19 pandemic, the global automotive lighting market scales dropped to USD 27.652 billion in 2020 (−5% YoY). The top five vendors were Koito, Valeo, Marelli Automotive Lighting, Hella, and Stanley, of which the market share totaled 71.7%.

Most vendors targeting European and North American countries and Japan witnessed a plunge of revenue by 9%–12% in 2020. By contrast, Xingyu and MIND—thanks to high demand in China—reached a 21% and 17% YoY growth, respectively.

Because of the smart-car-driven upgrades of LED and ADB headlights and rising value of individual cars, Xingyu has received orders from luxury car brands including BMW, Audi, and Jaguar Land Rover.

MIND launched its DLP ADB + laser headlight and installed it in WEY VV6 and WEY VV7, two mass production models of Great Wall Motor’s brand WEY. With more than 1 million addressable lighting pixels, the smart lighting product allows smart computation amid complex traffic to detect pedestrians, vehicles, and other objects, thereby achieving optical path programming pixel-level control.

Automotive LED Player Revenue Performance

The COVID-19 pandemic heavily impacted the global auto market and in turn damaged the automotive LED industry in 1H20, according to TrendForce’s latest investigations. In 2H20, however, the gradual recovery of vehicle sales as well as the development of NEVs provided some upward momentum for the automotive LED industry, whose revenue for the year reached USD 2.660 billion, a 0.45% decline YoY.

According to TrendForce Analysis the automotive LED player revenue ranking of 2020, OSRAM Opto Semiconductors, Nichia, and Lumileds remained the top three largest automotive LED suppliers, respectively, with a combined market share of 71%. In particular, European and American automakers favored OSRAM’s solutions for their high-end vehicle models and NEVs due to the high quality of OSRAM products.

Adoption by these automakers subsequently became the main revenue driver of OSRAM’s automotive LED business. OSRAM has accounted for 34.8% of global automotive LED market share in 2020.

According to TrendForce analysis, global automotive market demand has remained at high level in 2Q21. In this context, LED manufacturers achieve full capacity and prolong the lead time of products without raising prices. On orders about new automobiles, despite that customers still ask for price reduction, LED manufacturers maintained the original quotation and continue observing the possibility of double booking.

Author: Joanne, Allen / TrendForce

TrendForce 2020-2021 Global Automotive LED Product Trend and Regional Market Analysis

Release Date:

1. PDF- 30 June 2020 (14 Pages Updated on 30 June 2021)

2. EXCEL- 30 June 2021 and 31 December 2021

[PDF Content]

Chapter I. Automotive Lighting Market Trend Analysis

• Headlamp Product Trend

• Headlamp Product Technology Requirement

• AFS vs. ADB Product Analysis

• Intelligent Headlamp Product Trend

• ADB Headlights Advantage and 2020-2025 Penetration Rate Analysis New

• LED Matrix vs. LCD Intelligent Lamp

• DMD Technology

• Micro LED Pixel Array Manufacturing

• Micro LED Pixel Array Market Landscape New

• Micro LED Pixel Array Market Value

• Intelligent Headlamp Characteristics and Comprehensive Analysis

• Laser Headlamp Product Trend New

• Pros and Cons of the Integration of LiDAR and Headlamp

• RCL Product Trend

• OLED-Like LED Surface Light RCL Product Trend New

• Mini LED RCL Pros and Cons Analysis

• Ambient Light Product Trend vs. Pros and Cons Analysis

• Mini LED vs. Micro LED Automotive Lighting Planning Overview

Chapter II. Automotive Display Market Trend Analysis

• 2020 Four Automotive Display Product Trends

• 2020 Automotive Display Product Trend- By Application

• Automotive Display LED Product Specification and Value Chain Analysis

• 2020 HDR vs. Local Dimming Trend and Supply Chain Analysis

• 2020 Edge-Type vs. Direct-Type (HDR / Local Dimming) Automotive Display Cost Analysis- Case Study

• Cadillac LYRIQ 33-34 inch Automotive Display- Product Specification, Cost and Supply Chain Analysis New

• 2020-2025 Mini LED Automotive Display Shipment Analysis

• Micro LED vs. OLED Full Car Display Product Trend

• Micro LED Automotive Transparent Display Trend

• 2020 Micro LED Automotive Transparent Display Cost Analysis

• HUD Product Trend and Major Player Market Share Analysis

• E-Mirror Product Trend

• 2020 Driver Monitoring System / Occupancy Monitoring System Market Trend

• 2020 Automotive Air Sterilization Market Trend

Chapter III. Global Automotive Lamp Player Revenue and Movements

• Major Auto Lamp, Module, LED Value Chain Analysis New

• 2018-2020 Global Top 11 Auto Lamp Player Revenue Ranking New

• 2018-2020 Global Auto Lamp Player Market Share New

• Automotive Lamp Player Revenue and Product Strategies

• Koito Manufacturing Co., Ltd.

• Valeo

• Marelli Automotive Lighting New

• Hella

• Stanley

• HASCO Vision

• ZKW Group

• Varroc Lighting Systems

• Xingyu

• SL Corporation

• MIND

• Nanning Liaowang

• Tong Ming

• Automotive Lamp vs. Module Factories in China New

Chapter IV. Global Automotive LED Player Revenue and Strategies

• 2018-2020 Global Top 15 Automotive LED Player Revenue Ranking New

• 2019-2020 Automotive LED Player Market Share Analysis New

• Automotive LED Player Revenue and Product Strategies

• OSRAM

• Nichia

• Lumileds

• Stanley

• Seoul Semiconductor

• Dominant

• Samsung Electronics New

• Everlight

• CREE

• Hongli

• Jufei

• LatticePower

• Sunpu

• Refond

Chapter V. The Impact of COVID-19 on Global Automotive Industry

• 2019-2020 Global Passenger and Box Truck Market Shipment

• The Impact of COVID-19 on Global Auto Manufacturing

• COVID-19 Analysis of the Impact on China’s Automobile Manufacturing and Consumption Policy by Province

• 2020-2021 Automotive Lighting Market Trend and Supply Chain Trend New

New Updated in June 2021

[EXCEL Content]

PART One. 2020-2021 Car Market Shipment Forecast- By Region

• Europe

• USA

• Japan

• China

• Emerging Market (India, Brazil, Southeast Asia)

PART Two. 2020-2025 Automotive LED Market Value, Volume and Penetration- By Product

• Conventional Passenger Car (OE)

• Conventional Passenger Car (AM/PM)

• Electric Passenger Car (OE)

• Electric Passenger Car (AM/PM)

• Conventional Box Truck (OE)

• Conventional Box Truck (AM/PM)

• Electric Box Truck (OE)

• Electric Box Truck (AM/PM) "

Automotive Exterior

• RCL

• DRL

• Position / Signature

• High / Low Beam

• Fog / Side Marker

• Direction

• CHMSL

• Mirror Lamp

Automotive Interior

• Cluster

• Reading Lights

• CID (AC, DVD)

• Panel (GPS, Entertainment)

• Others (Decoration, etc.)

PART Three. 2020-2021 Automotive LED Market Value, Volume and Penetration- By Product

Regional Markets

• Europe

• USA

• Japan

• China

• Emerging Market (India, Brazil, Southeast Asia)

Products

Automotive Exterior

• RCL

• DRL

• Position / Signature

• High / Low Beam

• Fog / Side Marker

• Direction

• CHMSL

• Mirror Lamp

Automotive Interior

• Cluster

• Reading Lights

• CID (AC, DVD)

• Panel (GPS, Entertainment)

• Others (Decoration, etc.)

PART Four. Automotive Lamp vs. Automotive LED Revenue Performance

• 2017-2020 Automotive Lamp Player Revenue Ranking

• 2017-2020 Automotive LED Player Revenue Ranking

• 2020-2021 Automotive Lamp Price Survey

• 2018-2021 Automotive

LED Price Trend- Headlamp, RCL, Automotive Display

|

If you would like to know more details , please contact:

|