According to TrendForce’s latest report “2021 Global Lighting

LED and

LED Lighting Market Outlook-2H21”, the LED general lighting market has comprehensively recovered with increasing demand for niche lighting, leading to growth in global markets of LED general lighting, horticultural lighting, and smart lighting in 2021–2022 to different extents.

A Remarkable Recovery in the General Lighting Market

As vaccination coverage increases in various countries, economies worldwide begin to recuperate. Since 1Q21, the LED general lighting market has witnessed a strong recovery. TrendForce estimates that the global

LED lighting market size will reach USD 38.199 billion in 2021 with a YoY growth rate of 9.5%.

The following four factors have made the general lighting market thrive:

1. With increasing vaccination rates worldwide, economic recoveries have emerged; Recoveries in the commercial, outdoor, and engineering lighting markets are particularly fast.

2. Rising prices of LED lighting products: As raw material costs rising, lighting brands businesses continue raising product prices by 3%–15%.

3. Along with governments’ energy conservation and carbon reduction policies targeting carbon neutrality, LED-based energy conservation projects have kicked off, thereby stimulating growth in LED lighting penetration. As TrendForce indicates, market penetration of LED lighting will reach 57% in 2021.

4. The pandemic has prompted LED lighting companies to shift to produce lighting fixtures with digitalized smart dimming and controllable functions. In the future, the lighting sector will focus more on product value added by the systemization of connected lighting and human centric lighting (HCL).

A Promising Future for the Horticultural Lighting Market

TrendForce’s latest research shows that the global LED horticultural lighting market rocketed by 49% in 2020 with the market size hitting USD 1.3 billion. The market size is projected to top USD 4.7 billion by 2025 with a CAGR of 30% between 2020 and 2025. Two factors are expected to drive such substantial growth:

1. Because of policy incentives, LED horticultural lighting in North America has expanded to recreational and medical cannabis markets.

2. An increase in the frequency of extreme weather events and the COVID-19 pandemic have highlighted the importance of food safety for consumers and localization of produce supply chains, which then stimulate food growers’ demand for cultivating crops like leaf vegetables, strawberries, and tomatoes.

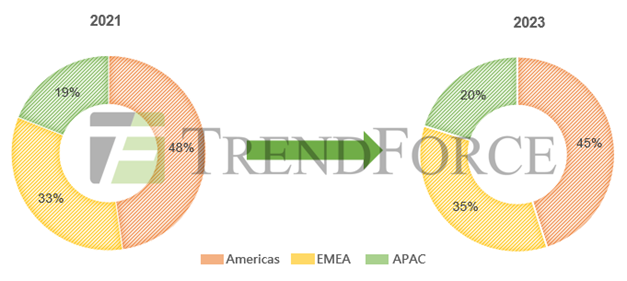

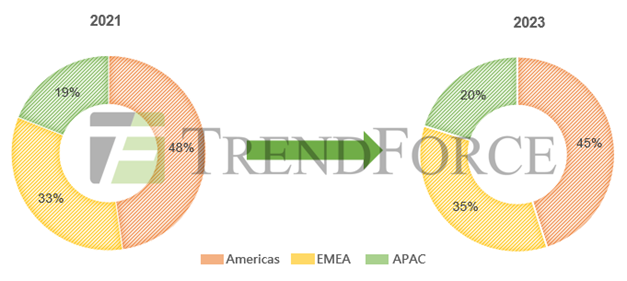

Figure. Percentages of horticultural lighting demand in Americas, EMEA, and APAC 2021–2023

Globally, Americas and EMEA will be the top markets of horticultural lighting; the two regions will add up to 81% of global demand in 2021.

Americas: During the pandemic, marijuana legalization has been accelerated in North America, thereby boosting demand for horticultural lighting products. In coming years, horticultural lighting markets in Americas are expected to expand rapidly.

EMEA: European countries including the Netherlands and UK are striving to promote the construction of plant factories with relevant subsidies, which has thus motivated agricultural companies to establish plant factories in Europe, leading to increased demand for horticultural lighting. Additionally, countries across Middle East (typically represented by Israel and Turkey) and Africa (South Africa being the most representative)—where climate change is getting worse—are increasing investments in facility agriculture to enhance domestic agricultural production.

APAC: In response to the COVID-19 pandemic and increasing demand for local food, plant factories in Japan have regained the public’s attention and focused on growing leaf vegetables, strawberries, grapes, and other high-value cash crops. Plant factories in China and South Korea have turned to grow valuable Chinese herbs and ginseng to improve the cost-effectiveness of produce.

Constant Growth in the Penetration of Smart Streetlights

To overcome economic turmoil, governments worldwide have expanded infrastructure construction projects, including those in North America and China. Particularly, road construction is the most heavily invested. Further, penetration rates of smart streetlights have risen as well as of the price increases. Accordingly, TrendForce forecasts that the smart streetlight market will expand by 18% in 2021 with a 2020–2025 CAGR of 14.7%, which is higher than the overall average of general lighting market.

Finally, despite uncertainties over global economic effects of COVID-19, numerous lighting manufacturers managed to create healthier, smarter, and more convenient lighting experiences using professional solutions that combine lighting products with digital systems. These companies have thus witnessed steady growth in their revenue. Revenue in lighting companies is projected to increase by 5%–10% in 2021.

Written by Christine Liu, Analyst of TrendForce Corp.

For more details of the lighting market, please refer to the latest TrendForce 2021 Global LED Lighting Market Outlook.

TrendForce 2021 Global LED Lighting Market Outlook- Light LED and LED Lighting Market Trend - 2H21

Release Date: August 4, 2021

File Format: PDF / Excel

Language: Traditional Chinese / English

Page: 134

Chapter 1 Lighting LED Market

• 2021-2024 Lighting LED Market Scale- by Application

• 2021-2024 Lighting LED Market Scale- by Package

• 2019-2021 Lighting LED Market Scale- by Power

Chapter 2 Global Lighting Market Trend

• TrendForce LED Lighting Market Scale- Methodology

• TrendForce LED Lighting Market- Production Definition

• 2021-2025 Global LED Lighting Market Scale: by Product

• 2021-2025 Global LED Lighting Market Scale: by Region

• 2021-2025 Installed Global LED Lighting Market and Penetration

• 2019-2021 Global LED Lighting Market Forecast: by Product

• 2020 Global LED Lighting Market-Value Based: by Region vs. by Product

• 2020 Global LED Lighting Market-Volume Based: by Region vs. by Product

• 2021 Global LED Lighting Market-Value Based: by Region vs. by Product

• 2021 Global LED Lighting Market-Volume Based: by Region vs. by Product

• 2021-2025 Global LED Lighting Application Market Trend

• 2021 Lighting Market’s Development Opportunities and Challenges

Chapter 3 Regional Market Trend and Regulation

• 2021 LED Lighting Market

• Consumer Demand for Lighting Becomes Diversified

• European Lighting Market Trend

• Wave of Renewal of Non-residential Buildings Will Drive Continued Growth of Commercial and Outdoor Smart Lighting

• Focus on Sustainability and Energy Efficiency

• Zhaga’s New Lighting Standard

• North America Lighting Market Trend

• Infrastructure Reconstruction Growth Drives Demand for LED Outdoor Lighting

• DLC New Lighting Standards

• Japanese Lighting Market Trend

• Develop Smart Lighting & Enhance Added Value of Products

• Market Influence of the Minamata Convention on Mercury

• Chinese Lighting Market Trend

• 2021 Chinese LED Lighting Market Recovering and Several Factors Foster LED Smart Lighting Market

• 2021 Chinese LED Stadium Lighting and Outdoor Lighting markets are Promising

• 2020 China’s Exports of LED Lighting Products

• APAC Lighting Market vs. Market Trend by Country

• Vietnam

• Thailand

• Singapore

• Indonesia

• Australia

• Middle East & Africa Lighting Market vs. Market Trend by Country

• Saudi Arabia

• Egypt

• South Africa

• Latin America Lighting Market vs. Market Trend by Country

• Brazil

Chapter 4 Horticultural Lighting and LED Market Trend

• 2021-2025 Global LED Horticultural Lighting Market Scale vs. Penetration Rate

• 2021-2025 Global LED Horticultural Lighting Market Size- by Application

• 2021-2023 Global LED Horticultural Lighting Market Size- by Region

• Analysis on Regional Market of LED Horticultural Lighting- Americas

• The Legalization of Cannabis in North America

• US Current Situation of Plant Factory and Development Trend

• Analysis on Regional Market of LED Horticultural Lighting- EMEA

• Major Vertical Farms List in Europe

• Analysis on Regional Market of LED Horticultural Lighting- APAC

• Large Plant Factories with Artificial Lighting (PFALs) in China

• Comparison of Artificial Light Sources for Horticultural Lighting

• Main Luminaire Categories of LED Horticultural Lighting

• LED Horticultural Lighting Specification and Price- Greenhouse

• LED Horticultural Lighting Specification and Price- Vertical Farming

• Horticulture Lighting LED Market Requirements

• Specification Requirements of Horticultural Lighting LEDs from Major Applications

• Five Driving Forces for Global LED Horticultural Lighting Market

• DLC New Technical Standards for Horticultural Lighting Products

• Distribution of Main Horticultural Lighting Markets

• Case Study of Plant Cultivation – Cannabis

• Case Study of Plant Cultivation- Strawberry

• 2021-2025 Horticultural Lighting Market Size- LED Package

• Mainstream Horticultural Lighting LED Product Specifications

Chapter 5 Smart Street Lighting Market Trend

• 2021-2025 Global Smart Streetlight Market Scale

• 2020-2022 Global Smart Street Light Market- by Technology

• Changes in Street Light Development

• Definition of Smart Street Light

• Smart Street Light Installation is Assigned on Demand

• Smart City Construction Drives the Rapid Implementation of Smart Street Light Projects

• Smart Street Lighting Control System

• Smart Street Light Value Chain and Main Players

• Analysis on Construction Cost and Price of Smart Street Light

• Chinese Urban Road Light Inventory Market Analysis

• Chinese Smart Street Light Main Participants Analysis

• European Smart Street Light Market Status

Chapter 6 Lighting Product and LED Market Requirements

• Filament Light Specification and Price Overview by Regions

• Filament Lamp Market- LED Specification Requirements

• Street Light Specification and Price Overview by Regions

• Panel Light Specification and Price Overview by Regions

• Panel Light Market- LED Specification Requirements

• Market Development Trend of Panel Light

• Troffer Light Specification and Price Overview by Regions

• Troffer Light Market- LED Specification Requirements

• High Bay Specification and Price Overview by Regions

• High Bay Market- LED Specification Requirements

• Explosion-proof Light Specification and Price Overview by Regions

• Explosion-proof Light Market- LED Specification Requirements

Chapter 7 Lighting Player Revenue Ranking

• 2019-2020 Top 20 Lighting Player Revenue Ranking:Total Lighting

• 2019-2020 Top 20 Lighting Player Revenue Ranking:LED Lighting

• 2020-2021(E) Top 20 Lighting Player Revenue Ranking

• Effects of Price Increases in Lighting Products on Businesses

• Signify

• Zumtobel

• Fagerhult

• Glamox Group

• Acuity Brands

• Hubbell

• GE Current

• Valmont Industries

• Panasonic

• Endo Lighting

• IWASAKI

• 2020-2021(E) Top 10 Chinese Lighting Player Revenue Ranking

• MLS/LEDVANCE

• Yankon Lighting

• Unilumin

• Huati Technology

• Kingsun

|

If you would like to know more details , please contact:

|