According to LEDinside, a research division of TrendForce, starting from August 2012, at least 5 M&A cases occurred in China and Taiwan; Epistar, for example, acquired 49% of Huga’s equity, and Sanan Opto acquired 120 million of FOREPI’s common stock. LEDinside indicated that starting from 2010, Chinese LED chip industries have aggressively invested in chips and caused severe oversupply in the market; chip price has continued to decline, and most industries have been struggling to survive in the industry. Even with the economic recovery, upstream LED chip manufacturers still failed to extricate themselves from the oversupply situation. Therefore, it is reasonable to conclude that M&A is the only solution to this problem.

Overheated investment results in oversupply, MOCVD’s utilization rate drops to less than 50% in 2012

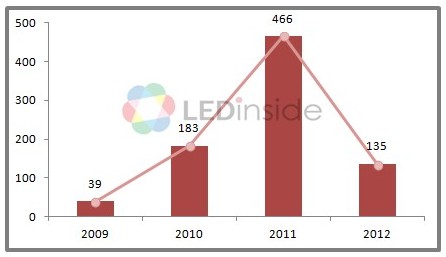

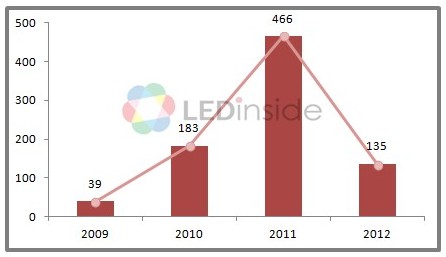

In 2009, the Yangzhou government first announced a subsidy policy for MOCVDs. Subsidies are issued to expansion projects with a one-time purchase 5 or more brand new MOCVDs for LED epi wafer production. The governments of Jiangmen, Wuhu, Hangzhou, and Wuhan have also successively announced similar policies. According to LEDinside’s statistics, as of the end of 2012, there were over 900 MOCVDs in China, but the utilization rate was less than 50%. The subsidy for MOCVDs has caused a sudden increase of new LED epitaxial wafer projects in China. According to statistics, 65 LED epitaxial wafer projects were established during 2009-2012, but due to the market downturn, over 30% of the projects have been held up or even terminated.

Fig. 1 New MOCVD Installation Volume in China from 2009-2012

Unit: Sets; Source: LEDinside

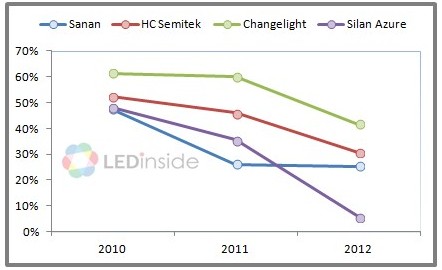

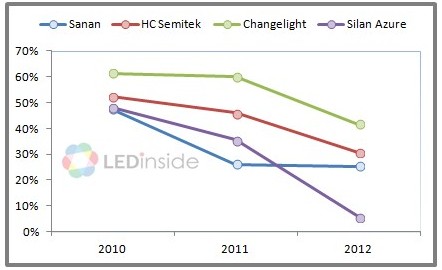

To companies facing a decline in gross profit, capital matters more than technology

Following the fierce competition caused by oversupply in the market, several chip manufacturers that received the government’s subsidy have reduced chip price in order to acquire a larger market share –a strategy which instantly caused a downturn and serious oversupply problem in the chip market.LEDinside discovered that Chinese LED chip price for display application has declined most severely in 2012; the price of several low-end products has even dropped by 50%. Most Chinese chip manufacturers who majorly target display market nearly faced deficit in 2012; Silan Azure, for example, only achieved a small gross margin of 5.7% in 2012, and several companies without sufficient funds even shut down. It is clear that the success of Chinese LED chip manufacturers no longer depends on advanced technology, but instead a huge capital and price competition.

Fig. 2 Gross margin of major LED chip manufacturers from 2010-2012

Source: LEDinside

Note: Sanan Opto’s gross margin in 2012 is brought by LED products, covering LED chips and LED application products

Manufacturers with a huge capital will survive the market downturn, M&A consistently occur in 2013

Oversupply in the market may still continue, and can not be solved in the short term. Observed from the slower decline in chip prices, most upstream manufacturers have already run out of funds. After several years of overdraft, the possibility of receiving new funds has dropped to the lowest point. However, the market recovery has encouraged well-funded manufacturers to invest again in the market by acquiring equities and merging with other companies. LEDinside estimates that in the coming year, M&A will be applied by most, if not all, LED chip manufacturers in China.