May 27, 2014---The Chinese LED market has seen a rapid rise in demands. Expansion plans by several LED chip manufacturers boosted sapphire substrate demands. Sapphire substrate manufacturers are speeding up Chinese market strategies, due to high tariffs and emergence of Chinese LED chip manufacturers, according to the latest “2014 Global Sapphire Substrate Market Report” by LEDinside, a research division of TrendForce.

First-tier LED manufactures initiated expansion plans this year, benefiting from strong demands brought by the LED lighting market. Major chip manufacturers are pushing to increase production capacity in 2014 to stabilize market share and satisfy market demands, including Epistar, Nichia, and Chinese chip manufacturers San’an Opto, Nationstar, HC SemiTek, HuaLei Optoelectronics, and Tongfang Optoelectronics. Chinese first-tier LED manufacturers have been especially progressive in speeding up production expansion and raising production utilization rates in order to secure a larger share of the lighting market, which in turn has driven up sapphire substrate demands used in LED industry.

|

|

Source: LEDinside |

San’an Optoelectronics for example, currently has TIE wafer capacity of around 420,000 pieces /M for 2014. The company has already set in motion production expansion plans, and estimates production capacity can reach 650,000 pieces /M by 2015 if all 100 MOCVDs enter production. Additionally, Epistar secured a leading position in the LED chip industry’s production capacity and revenue after years of acquiring a number of LED chip manufacturers. However, with Chinese LED manufacturers right on their heels, the company is also actively expanding production capacity in order to maintain a competitive edge.

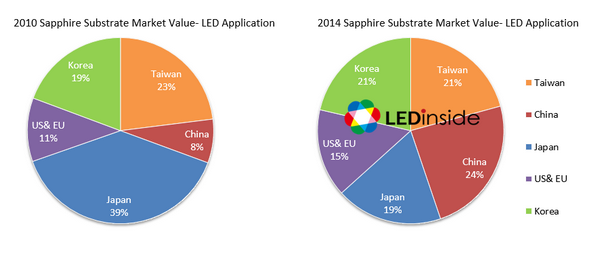

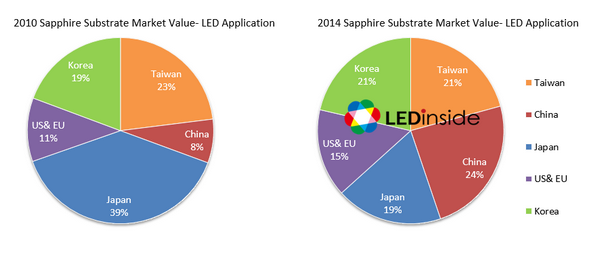

In regards to sapphire substrate market value in the LED application sector, China has grown substantially from 8 percent global market share in 2010 to 24 percent in 2014, according to data compiled by LEDinside. LEDinside projects future sapphire substrate demands for LED application will majorly come from China. Therefore, China is estimated to make up 33 percent of LED sapphire substrate market value by 2016. Consequently, global sapphire substrate manufacturers are quickly deploying business strategies in the Chinese market as demands in the China market take off, and import tariffs are taken into consideration.

Language: English

Date of Publication: May 15, 2014

Format : E-file

Chapter I Sapphire Substrate Industry Overview

Sapphire applications for mobile and wearable devices. (LEDinside)

Preview

1.1 Technology Development History of Sapphire Substrate Industry

1.2 Sapphire Substrate Production Process

Chapter II Discussion on Advanced technology of Sapphire Substrate Industry

Preview

2.1 Mainstream Sapphire Ingot Technology

2.2 Mainstream Sapphire Substrate Technology

2.3 Mainstream Pattern Sapphire Substrate Technology

LEDinside reserves the right to change the content

Chapter III Discussion on Global Supply Chain Related to Sapphire Substrate

Preview

3.1 Sapphire Substrate Materials Overview

3.2 Sapphire Crystal Growth Furnace Equipment Overview

Chapter IV Supply-side Analysis of Global Sapphire Substrate Industry

Preview

4.1 Sapphire Substrate Industry Supply Chain Trend

4.2 Sapphire Ingot Manufacturer Capacity Overview

4.3 Sapphire Substrate Manufacturer Capacity Overview

4.4 Pattern Sapphire Substrate Manufacturer Capacity Overview

4.5 Major Manufacturer’s Business Performance and Market Development

4.6 Sapphire Manufacturer Business Strategies in LED and non-LED Markets

4.7 Sapphire Substrate Industry Sufficiency- Supply and Demand

Chapter V Global Sapphire Substrate Market Price Trend

Preview

5.1 Sapphire Industry Price Trend Analysis- Ingot, CSS, and PSS

5.2 Sapphire Industry Long-term Price Forecast- Ingot

Chapter VI Analysis on Demand for Sapphire Substrate in LED Market

Major LED chip manufacturers across different regions. (LEDinside)

Preview

6.1 LED Market Value and Volume Forecast

6.2 MOCVD Installation Volume Forecast

6.3 2013~2018 Global LED Market Demand (Total Sapphire Volume and By Region) and Wafer Size Trend

6.4 Chip Manufacturers' Sapphire Substrate and PSS Supply Chain

6.5 LED Chip Manufacturer Revenue Ranking and Capacity Estimates

6.6 Major LED Chip Manufacturer Profile

6.7 Chip House PSS Introduction Rate and in-house PSS Production Rate

6.8 Advanced LED Chip Technology

6.9 LED Chip Price Trend

6.10 Cost Analysis of Sapphire Substrate in LED Chip

6.11 Sufficiency of Sapphire Substrate in LED Industry- Supply and Demand

6.12 Analysis on Advantages and Disadvantages of Six-inch Sapphire Substrate

6.13 Alternative Materials of Sapphire Substrate in LED Application Market

Chapter VII Sapphire Substrate in Emerging Applications

Preview

7.1 Window Film and Telecommunications Component Market and Technology Prospect

-

Sapphire Substrate in SOS Market Overview

-

SOS in RF IC and Sensor Application Market

-

Sapphire Substrate Market in SOS Application

-

SOS Supply Chain: SOS in CMOS- Peregrine

-

Compared with Traditional CMOS, UltraCMOS® Has Better Performance

-

SOS for CMOS: SOI (Silicon On Insulator) Technology will Continue to Substitute for SOS Market in Future

-

Sapphire Substrate in Windows Film Market Overview

-

Sapphire Substrate in Medium-Wave Infrared Windows Market Overview

7.2 Sapphire in Handset Device Market Outlook and Supply Chain Development

-

Sapphire in Smartphone Overview

-

Camera Lens: Sapphire Camera Lens in Smartphone

-

Home Button: Sapphire for Smartphone’s Fingerprint Recognition

-

Other Manufacturers Ramping

-

Camera Lens and Home Button Are the Major Application in 2014

-

Sapphire Cover Glass in Smartphone

-

Currently, only a Few Companies Apply Sapphire as Cover Glass, There is Still a Long Way Ahead for Mass Production

-

Apple Will Apply Sapphire to Protect Screens!

-

Why Does Apple Need Sapphire for Screen Protection?

-

Challenges Apple Needs to Overcome for Sapphire Glass Covers

-

Increase Capacity: KY Method with Low Drilling Rate, GTAT and STC Methods are More Suitable for Square Panel for Sapphire Cover Glass

-

Increase Capacity: GTAT’s ASF is Helpful Sapphire Cover Glass in Phones

-

Reduce Cost Greatly: Sapphire Substrate Lamination Patent

-

Reduce Cost: Cutting Technology and Lamination Patent Allows Sapphire Cover Glass to Be Achieved in Short Time

-

Manage Supply Chain: Supply Chain Management: Apple Ensures the Sapphire Ingot Supply Source and Assures Quality, GTAT only Uses EMT’s Aluminium Trioxide

-

Manage Supply Chain: Analysis on Apple Aggressively Secure Sapphire Supply Chain

-

Phone Camera Lens and Home Button Supply Chain- iPhone 5S & 5C

-

Estimated Apple Shipment Schedule

-

Apple iPhone Shipment Schedule and Sapphire Stocking Schedule

-

Probability Analysis of Applying Sapphire Cover Glass in Apple iPhone

7.3 Sapphire Substrates Market Value for Non-LED Applications

-

Sapphire Substrates Market Value for Non-LED Applications:

-

Demand Forecast of Sapphire Material in Window Film and Telecommunications Components Markets

-

Sapphire in Mobile Device Market has Growth Potential

-

Sapphire Demand Forecast in Mobile Application

-

Analysis of Apple iWatch’s Sapphire Screen

-

Increasing Proportion of Sapphire Substrate in All Kinds of Non-LED Application:

-

Handset Device Has Most Growth Potential

Contact

Taipei

Ms. Joanne Wu

Tel: +886-2-7702-6888 ext. 972

E-mail: joannewu@ledinside.com