Three out of six Chinese LED lighting manufacturers found themselves in an“awkward” financial situation in 2014, with many reporting plunging net profits in their recent fiscal report.

|

|

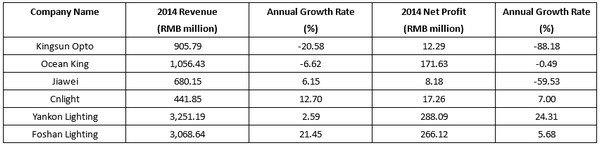

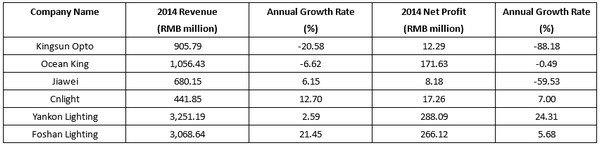

LED lighting manufacturers 2014 revenue performance. (US $1= RMB 6.21) (LEDinside) |

Although, LED lighting manufacturer Jiawei’s revenue was up, its profits did not. Kingsun and Ocean King fared far worse, reporting flat revenues and profits. Despite reporting an incremental revenue increase, Cnlight’s profit after deducting non-recurring gains was down 9.26% to RMB 9.19 million (US $1.48 million).

|

|

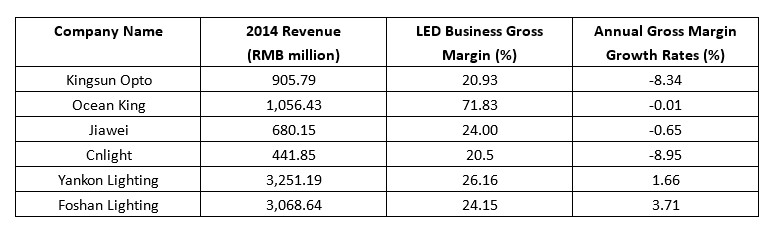

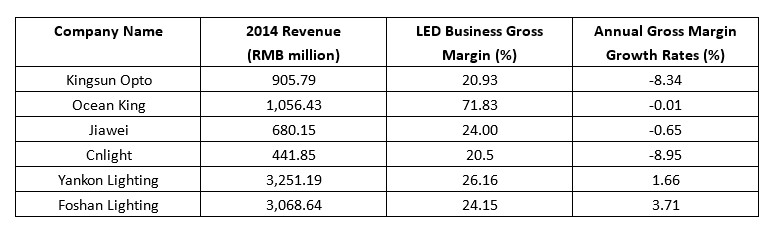

LED lighting manufacturers LED business gross margin. (LEDinside) |

|

A closer inspection of listed lighting manufacturers LED business gross margin in 2014 revealed Ocean King, a company specializing in explosion-proof luminaires and special environmental lighting, was the only company with high gross margins of 71.83%. Other manufacturers gross margins fell below 30%, and reported decreased or incremental growth compared to last years.

Many unlisted Chinese LED lighting companies told LEDinside, despite increased revenues in 2014, net profit growth has lagged behind. In addition, gross margins and net profits have dropped.

Intensifying market competition causes sliding profits

What is causing the collective profit loss? Manufacturers financial reports offer a few hints. Kingsun, which focuses on project lighting explained sliding revenues was mostly “affected by general economy, and intensifying LED market competition. The company’s 2014 orders fell short of expectations, overall 2014 sales was less than expected.” Jiawei, a company that transitioned from PV industry into LEDs, explained: “The company has completely invested in the LED industry, and is further segmenting its business area, while expanding its production line. This has caused escalating revenue and management costs that has in turn led to lower company net profits.”

“There are two major reasons that led to lighting manufacturers declining net profits last year,” said Ziyong Xiao, Marketing Director, BYD. “Firstly, clients have a thorough understanding of the market, while manufacturers were engaged in cutthroat competitions. Secondly, some large projects have been delayed because of certain government policies, but manufacturers have already invested in the initial phase of the project.” BYD’s net profit was not exempt from these market effects, even though LED revenues soared in 2014 to reach RMB 500 million, said Xiao.

A LED panel light manufacturer executive also echoed the same observation that sliding net profits were caused by “rising product volume, declining prices, and malignant competition.”

“In the past, I would consider a 5,000 panel order as a large order, but now I’m used to 10,000 to 20,000 LED panels orders,” he added. “If they gave me a 1,000 LED panel order, I probably wouldn’t even consider anymore.”

How competitive was the Chinese LED lighting industry in 2014? Last year the industry was prone with disappearing manufacturers and bankruptcies, which continued into 2015. Even large LED lighting manufacturers Zhongshan Phoenix Lighting Legend (凤光传奇) and Juliang Electrical Technology were not excluded from the demise. Regardless of the cause of each manufacturers eventual bankruptcy, there is no question all of them were affected by cutthroat competition.

“Compared to 2013, LED lighting product prices dropped more than 25% in 2014,” said Xiao, adding pricing situation has “worsened.”

“Prices have been halved,” he said. “In the past a panel light could be sold for RMB 700 to RMB 800, but it only sells for RMB 200 to RMB 300 right now. To acquire orders, manufacturers are often sacrificing profitability.”

SMEs face more difficult future

Cutthroat prices have also affected international lighting manufacturers. Osram recently announced its plans to spin-off or sell its lighting business, which includes traditional luminaires, bulbs, ballasts, as well as its Lighting Solutions (LLS) business. The main reason for the split was “overtly low profits.” Lumileds, which was recently spinned-off from Philips also said it intends to join the “ongoing price wars” and will be making cheaper LED tubes than Chinese manufacturers MLS or Foshan Lighting.

“Domestic LED manufacturers cutthroat price wars forced leading international manufacturers to adjust their policies, with large enterprises joining the low-price wars the lighting industry will be in an even more difficult situation,” said Xiao.

“There is still opportunity for LED product prices to drop to about the same range as in 2014, and accompanying technological advancements there is still 30% room for price declines,” said Yankong Lighting spokesperson recently at a 2014 financial results briefing.

Yankong Lighting mentioned in its 2014 financial report that in the next three to five years, LEDs will replace traditional light sources and luminaire market that have been around for the last 10 years. In the short term, the market will see large scale product release, but eventually as more manufacturers expand, mass scale production capacity and competition has dragged down product prices. This has further intensified the LED market competition, with some unregulated manufacturers even disrupting market orders, causing it difficult to achieve equilibrium in the short term.

“Large manufacturers sales are projected to be pretty good in 2015, but net profits did not improve much in 2014,” said Xiao. “If SMEs do not have technological or cost advantages, and is just entering the market like everyone else, it will be very hard for them.” Xiao believes when the industry is restructured to a certain level, than the number of manufacturers, quality, will reach an equilibrium and improve the situation.

Jianghua Ding, Vice Director of Howell Illuminating Technology, also shared the same view. “Professional and specialist SMEs will survive, while those without specialty SMEs will just be following market trends, and will find it difficult to survive. There certainly will be even more manufacturers that go into hiding or declare insolvency in 2015,” said Ding.

Ding attributed price wars as a partial cause of manufacturers plunging prices, he noted manufacturers were also affected by leading international manufacturers changing strategies. “At a deeper level, the main reason is traditional lighting industry has been marginalized, and will be merged by electronics, residential, construction materials and other industries. In the future, LED lighting manufacturers will need to improve products, businesses, services and management model.”

(Author: Sophie Liu, Editor, LEDinside China/ Translator: Judy Lin, Chief Editor, LEDinside)