The average monthly price of sapphire has fallen by more than 30% year on year this September, according to the latest

2015 Global Sapphire and LED Chip Market Report by

LEDinside, a division of

TrendForce. This decline is the result of suppliers expanding their production capacities despite the weaker-than-expected demand.

“Due to the increasing competition, sapphire suppliers can no longer just specialize in one part of the supply chain,” said Joanne Wu, assistant research manager for LEDinside, “They have undergone vertical integration and are now able to provide pattern sapphire substrates (PSS) to LED chip manufacturers, bypassing other supply chain participants. As LED chip businesses are themselves facing immense operating pressure, major international manufacturers are now working to raise the yield rate of their 6-inch LED wafer process. They want to widen their lead over their Chinese competitors via product differentiation.”

Weak demand prompts vertical integration efforts along the 4-inch sapphire supply chain

Price fluctuations in the 4-inch sapphire market are mainly caused by the demand changes in the LED market. Though the 4-inch wafer production has become the market mainstream, their prices are negatively affected by the lower-than-anticipated demand and price pressure in the end market. Thus, prices of 4-inch sapphire ingots have plummeted with the year-on-year decline in September reaching 45% at around US$8.5~8.8/mm. Both the 4-inch sapphire wafer and PSS markets have seen a 30% year-on-year price drop in the same month, with their average prices respectively at US$18~20.5/pc and US$30~32/pc.

With the LED chip manufacturers migrating from the 2-inch to the 4-inch wafer process, the LED chip industry’s total output is estimated increase by about 20~30%. Chinese competitors that have migrated to 4-inch wafer production include San’an Opto, Elec-Tech, Changelight, HC SemiTek, Tongfang and Aucksun. Currently, the 4-inch sapphire ingot and sapphire wafer markets are crowded with suppliers. At the same time, LED chip manufacturers exact more stringent requirements for products. Sapphire suppliers therefore are starting to develop their PSS products in house or collaborating with PSS OEMs. This will allow them to be in a better position to enter LED chip supply chain while avoiding their prices from being cut at every level of negotiation. Overall, the trend of vertical integration in the 4-inch sapphire supply chain will become even more noticeable in the future.

Developing 6-inch sapphire market can help create product differentiation if LED chip businesses can improve wafer yields

Oversupply is also impacting the 6-inch sapphire market with the South Korean suppliers taking a lead in cutting product prices. The average price of 6-inch sapphire ingots have fallen 30% year on year in September to around US$30~35/mm. In the 6-inch sapphire wafer segment, there is some room for negotiations, and prices are decided by product quality and suppliers’ bargaining power. The average price of 6-inch sapphire wafers is now at US$ 95~100/pc. Prices of 6-inch PSS products have dropped to an average of US$140/pc this September due to the adoption of micron imprinting technology, a process with much lower cost than the traditional etching technologies.

While prices are continuing their slide in the 6-inch sapphire market, a general increase in the 6-inch LED wafer yield rates may help generate demand. If the 6-inch LED wafer process had the same yield rate as the 2-inch, it could reduce the cost per unit by 69% because of advantages such as greater wafer surface for epitaxy and increased edge utilization rate. Thus, raising the yield rate on the 6-inch LED wafer process will expand the market demand for sapphire and effectively lower the inventory level. However, migrating to the 6-inch process is also a huge investment involving buying new equipment and overcoming technical hurdles in the backend chip manufacturing process. Transitioning from the 2-inch wafer production to the 4-inch is therefore much more cost effective right now than moving to the 6-inch. Raising the 6-inch LED wafer yield rate will depend on the technological capability of industry participants. LED chip manufacturers that are presently investing the 6-inch wafer production include Lumileds, Osram Opto, LG Innotek, Epistar, Nichia, Toyoda Gosei and Sharp. Chinese companies such as San’an Opto and Elec-Tech are also doing pilot runs on their 6-inch wafer production.

LEDinside 2015 Global Sapphire and LED Chip Market Report

Language: English

Date of Publication: May 28, 2015

Page: 255

Format : E-file

Chapter 3: PSS specification trend, major equipment vendors in LED and handheld industries

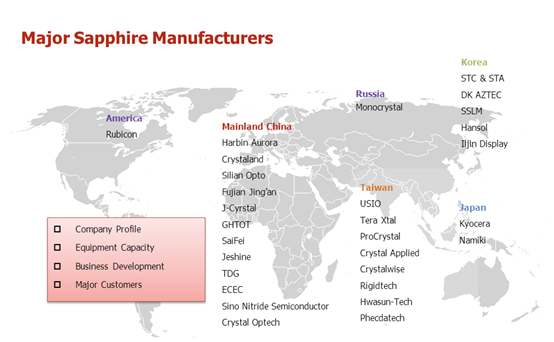

Chapter 4: Major 29 sapphire manufacturers movement are stressed, covering capacity, major customers, business status. Amongst, 12 Chinese sapphire manufacturers are covered.

Chapter 5: imprint PSS price trend are included

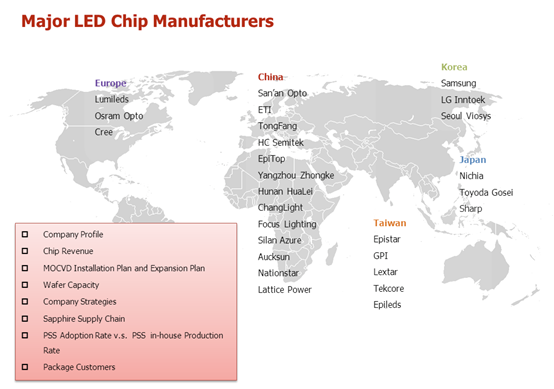

Chapter 6: Major 27 LED chip manufacturers are emphasized, covering MOCVD installation plan, wafer capacity, wafer production plan, sapphire supply chain, PSS adoption rate, PSS in-house production rate, business status, and package customers. Amongst, 13 Chinese chip manufacturers are listed in the report.

Chapter 7: Sapphire market trend in handheld industry, including sapphire material requirement, market trend, opportunities and challenges. Furthermore, sapphire market trend in applications are analyzed.

Chapter I Sapphire Industry Overview

1.1 Sapphire Technology Development

1.2 Sapphire Production Process

Chapter II Advanced Technology in Sapphire Industry

2.1 Mainstream Sapphire Ingot Technology

2.2 Mainstream Sapphire Wafer Technology

2.3 Mainstream Pattern Sapphire Substrate Technology

Chapter III Global Sapphire Equipment

3.1 Sapphire Ingot Furnace

3.2 Overview of Sapphire Sawing, Lapping, Grinding and Polishing Machine, Chamfering Machine, Printing, and Coating Machine

3.3 PSS Equipment

Chapter IV Supply-Side Analysis of Global Sapphire Industry

4.1 Sapphire Industry Supply Chain Trend

4.2 Sapphire Ingot Manufacturer Capacity and Market Value Analysis

4.3 Sapphire Wafer Manufacturer Capacity and Market Value Analysis

4.4 Pattern Sapphire Substrate Manufacturer Capacity and Market Value Analysis

4.5 Major Sapphire Manufacturer’s Business Performance and Market Development

4.6 Sapphire Industry Development Strategies

4.7 Sapphire Substrate Industry Sufficiency- Supply and Demand

Chapter V Global Sapphire Market Price Trend

Sapphire Ingot Market Price

2” Sapphire Wafer and PSS Market Price

4” Sapphire Wafer and PSS / mPSS Market Price

6” Sapphire Wafer and PSS Market Price

Conclusion

Chapter VI Sapphire Market Demand in LED Industry

6.1 LED Market Outlook and Perspective

6.2 MOCVD Installation Volume Forecast and LED Epi Wafer Market Trend

6.3 LED Chip Manufacturer Revenue Ranking and Capacity Estimates

6.4 Major LED Chip Manufacturer Profile

6.5 Chip House PSS Introduction Rate and PSS in-house Production Rate

6.6 Chip Manufacturers' Sapphire Substrate and PSS Supply Chain

6.7 Cost Analysis of Sapphire Substrate in LED Chip

6.8 Pros and Cons on Four-inch and Six-inch Wafer Production

6.9 Alternative Materials in LED Application Market

Chapter VII Sapphire Market Trend in Mobile Device Industry

7.1 Sapphire Requirement in Mobile Device Applications

7.2 Major Suppliers and Supply Chain Development

7.3 Sapphire Market Perspective in Applications

For further information please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972