(Author: Judy Lin, Chief, Editor, LEDinside)

The LED market contracted for the first time in 2015, reporting a decline of 3%, due to drastic price cuts. However, the dire market condition is not expected to persist this year, said Roger Chu, Director of Research, LEDinside at a forum the company organized at Nangang Exhibition Hall in Taipei, Taiwan during Taipei International Lighting Show (TILS 2016), which runs from April 13-16, 2016.

He forecasted the LED market would grow at CAGR 4% from 2015 to 2020. In a more optimistic scenario where new applications emerge on the market, where UV LED matures and price falls ease the CAGR might be push up to 8%, but in a more conservative outlook where the industry enters a mature plateau phase it might be a mere CAGR 1%.

From 2007 to 2012, the LED market was in a fast growth phase on average CAGR 20%, but growth eased after 2013 due to oversupply. By 2015, plunging retail prices and strong US dollar caused market growth decline for the first time, which impacted Japanese and Korean players revenues the most.

|

|

Roger Chu, Director of Research Department at LEDinside. (All photos courtesy of LEDinside) |

“Large brands low pricing strategy disrupted LED bulb retail prices last year,” said Chu. “Philips decision to launch two-packed LED bulbs for $ 4.99 lowered single bulb prices to less than $2.50.”

Philips decision to slash bulb prices in April last year urged second tier manufacturers to clear out inventory, and ask OEMs to provide similar priced products, which led to LED bulbs declining Free on Board (FoB) prices. It is reported the current FoB price has been pushed down to $0.6. Crashing LED bulb prices in 2Q15 caused rapid declines.

The steep price decline is expected to halt in 2016, due to limited room for further price cuts in materials and bulbs. Moreover, industry manufacturers have now reported high utilization or full utilisation rates, and current rebound in market demands is expected to last till 2Q16.

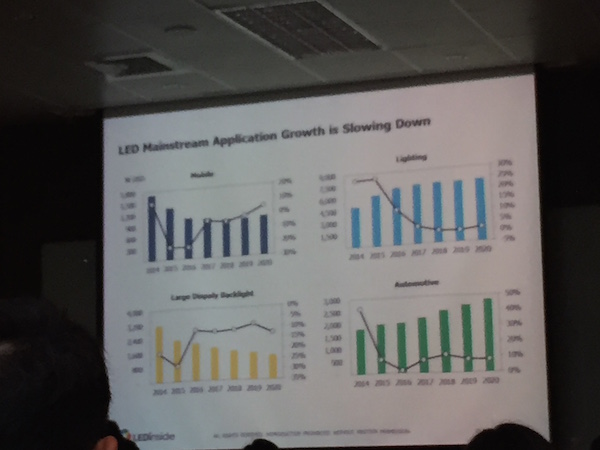

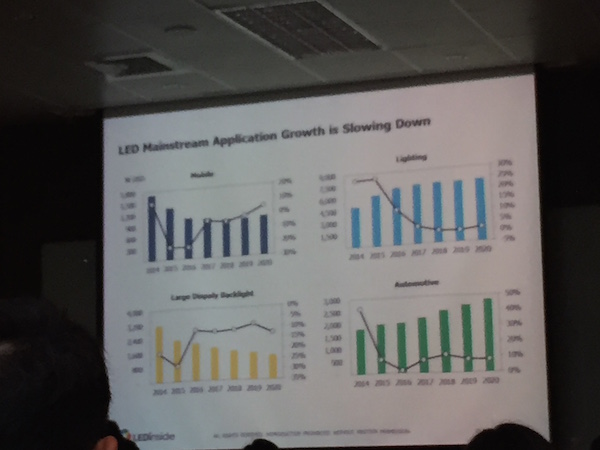

On top of this, traditional LED applications including large display backlight, lighting, mobile and automotive lighting growth is easing or declining in the backlight sector. More manufacturers are entering niche lighting markets include IR and UV LED as traditional lighting application growth shrinks.

|

|

LED growth in mobile, lighting, large display market backlight and automotive lighting market sectors have eased, according to data compiled by LEDinside. |

Decline in the backlight application sector has impacted Korean manufacturers the most, such as Samsung LED, which lost its global top three position in 2015. The company has been focused on TV backlight market in the past, but is now in the process of readjusting its business strategy and transferring from a LED brand to a component supplier. LG and Samsung’s development of OLED panels and their decision to withdraw earlier from low profit LED applications markets, has resulted in their declining market share in the LED market sector, he added.

As OLED panels applications increase in smartphone displays, Nichia, though, will need to reevaluate its market strategy where about 30% to 40% of the company’s revenue is from mobile LEDs (backlight and flash combined), said Chu. As OLED manufactures ramp up production capacity for mobile applications, Japanese manufacturers are expected to be impacted the most after 2017.

By 2015, the top five ranked global LED manufacturers Nichia, Osram, and Lumileds all have large market share in automotive lighting sector. The automotive lighting sector remains an oligarch market that is difficult to enter, additionally it has a longer certification period and higher reliability demands, he noted. Korean LED manufacturers might have entered Hyundai’s OEM market, but it will still be difficult for Samsung LED or other Asian manufacturers to enter international car brands OEM.

In 2016, low profits in the low to mid power LED market is projected to persist due to growing numbers of Chinese manufacturers in the market, that has started to erode global LED manufacturers Nichia, Osram, Cree and Lumileds market share in the low to mid power LED.

To conclude, Chu forecasted most manufacturers have experienced a rude awakening from their dream of benefiting from the lighting market, and less market competitive manufacturers are expected to exit the market.