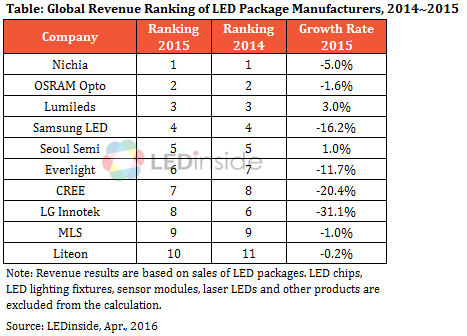

Fierce competition caused major shifts in the global LED package revenue ranking for 2015, according to LEDinside, a division ofTrendForce. Nichia remained the leader, followed closely by OSRAM Opto and Lumileds. Samsung LED and other South Korean manufacturers suffered revenue declines due to the price war and the contraction of LED backlight market. By undercutting each other, most manufacturers ended up with lower revenues last year. Some companies’ revenues also decreased when measured in U.S. dollars due to the dollar’s appreciation.

Automotive LEDs – an emerging blue ocean market with high entry barriers and very few players

The top three manufacturers performed very well in the automotive LED market, noted Roger Chu, LEDinside research director. Together, Nichia, OSRAM Opto and Lumileds currently control about 70% of the world’s automotive LED market. This application sector thus has very high entry barriers and is susceptible to market concentration. Pricing matters less here as customers pay more attention to product reliability, optical design and supply chain management. Therefore, many manufacturers regard the automotive LED application as the new blue ocean market and are eager to gain a foothold there.

South Korean manufacturers were hit hard as their group companies shifted focus away from backlight applications and towards OLED

The shrinking LED backlight market was a major factor behind sliding revenues for South Korean manufacturers last year. Furthermore, group companies Samsung and LG concentrated on promoting OLED panels and paid less attention to the development of their LED products. Even worse, Samsung and LG also outsourced the manufacturing of some LED products that will be replaced by their OLED solutions to competing LED suppliers.

Price war led to revenue declines for LED lighting manufacturers

Branded lighting vendors constantly pressured their LED suppliers to cut prices last year. Major LED lighting manufacturers such as CREE saw a sharp decline in its package revenue on account of falling product prices and losing orders to competitors. Everlight and MLS were also affected by lower prices despite having cost advantages. Their revenue declines came after having long periods of steady growth.

Gold Member

|

LED Supply Chain - Backlight / Lighting / Automotive / Display / UV LED / IR LED

Major LED Package Ranking in Applications

|

LED Industry Demand and Supply Data Base |

Demand Market Forecast:

2015-2020 market demand in backlight, lighting, automotive, display, UV, infrared, SSL like and son on |

Excel |

1Q (February) / 3Q (August) |

Supply Market Analysis:

1. Chip market revenue (external sales, total sales)

2. WW new MOCVD chamber installation volume / WW accumulated MOCVD chamber installation / WW new and accumulated MOCVD by K465i

3. Epi wafer market demand (total / by size) |

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue |

LED Package Market Analysis:

LED package vendors' revenue and LED revenue

Top 10 LED package revenues in backlight, lighting, COB, automotive, and display |

|

LED Industry Price Survey |

Price Survey - Sapphire / Chip / LED Package / Bulb

|

Excel |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November) |

|

LED Market Demand and Supply Analysis |

Demand Market |

PDF |

2Q (May) / 4Q (November) |

|

Backlight |

|

General Lighting |

|

Automotive |

|

Display |

|

Infrared LED Market (2Q) / UV LED Market (4Q) |

|

Supply Market |

|

MOCVD Market |

|

Wafer and Chip Market, URT |

|

Supply and Demand Sufficiency Analysis |

|

Further information, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912