The latest

2016~2021 LED Industry Supply and Demand Database Report by

LEDinside, a division of

TrendForce, states that the introduction of Quad-LED True Tone flash on iPhone 7 and 7 Plus is expected to spur non-Apple branded smartphone vendors to make similar upgrades to camera flashes on their devices. Also, Quad-LED True Tone, which uses more flash LEDs than ever before, will help generate a new wave of demand in the global flash LED market. According to LEDinside, the value of the flash LED market worldwide is projected to grow from US$744 million in 2016 to $811 million in 2017, representing an annual growth of 9%.

Dual color LED camera flashes now come standard with high-end smartphones since Apple offered this feature on its iPhone in 2013. With the iPhone 7 series carrying camera flash module containing 4 flash LEDs, the usage volume of flash LEDs is anticipated to multiply again. Since Quad-LED True Tone flash can offer greater level of brightness and better at color rendering, iPhone 7 users are able to shoot excellent quality photos in dark environments. Other smartphone brands are expected to soon follow Apple’s lead and adopt this flash design to enhance the color rendering ability of their cameras.

However, the market for flash LEDs have high entry barriers, especially regarding optical design. Flash LEDs must be able to achieve high level of brightness on the center of the photographed object. At the same time, they must also produce illuminance uniformity that extends to the edges and high color rendering index. Additionally, there is pressure to shrink the sizes of flash LEDs due to the continuing demand for thinner and lighter smartphones. Maintaining luminous intensity is thus another design challenge for flash LED suppliers.

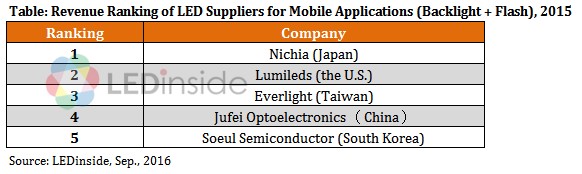

LEDinside’s analysis finds that there is a limited number of LED suppliers that can participate in the flash LED supply chain. Apple contracted Lumileds as the primary flash LED supplier in the past. In the case of the iPhone 7 series, however, Apple has also included a Japanese supplier to ensure that there is a steady supply of flash LEDs that meet specifications of the Quad-LED True Tone flash. Other Asian suppliers that are currently competing in the flash LED market include Taiwan’s Everlight and Lite-On Technology, China’s APT Electronics and Jufei Optoelectroncis, and South Korea’s Samsung LED. They are closely following the product development plans of major smartphone brands. When one or more vendors in the non-Apple camp decide to adopt quad-LED camera flash, the demand for flash LEDs will take off and their ASP will also start rising.

LEDinside Gold Member Report

|

LED Supply Chain - Backlight / Lighting / Automotive / Display / UV LED / IR LED

Major LED Package Ranking in Applications

|

LED Industry Demand and Supply Data Base |

Demand Market Forecast:

2015-2020 market demand in backlight, lighting, automotive, display, UV, infrared, SSL like and son on |

Excel |

1Q (February) / 3Q (August) |

Supply Market Analysis:

1. Chip market revenue (external sales, total sales)

2. WW new MOCVD chamber installation volume / WW accumulated MOCVD chamber installation / WW new and accumulated MOCVD by K465i

3. Epi wafer market demand (total / by size) |

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue |

LED Package Market Analysis:

LED package vendors' revenue and LED revenue

Top 10 LED package revenues in backlight, lighting, COB, automotive, and display |

|

LED Industry Price Survey |

Price Survey - Sapphire / Chip / LED Package / Bulb

|

Excel |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November) |

|

LED Market Demand and Supply Analysis |

Demand Market |

PDF |

2Q (May) / 4Q (November) |

|

Backlight |

|

General Lighting |

|

Automotive |

|

Display |

|

Infrared LED Market (2Q) / UV LED Market (4Q) |

|

Supply Market |

|

MOCVD Market |

|

Wafer and Chip Market, URT |

Supply and Demand Sufficiency Analysis

|

|

If you would like to know more details, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912