First of all, the author doesn’t agree with the opinion that Sanan’s high gross profit is due to the CFO’s financial skill. As the saying goes, if you don’t have a hand, you can’t make a fist. No matter how master the financial skills is, revenue cannot be created and as well as the direct cost is hardly hidden. In addition, even though it is available to handle some fiscal items skillfully within 1-2 years, it is unlikely to use such skills to remain its gross profit ratio higher than that of competitors within a few years.

When it comes to the sources of Sanan’s high gross profit, the explanations are as following.

LED chip manufacturing also attaches much importance to assets though its threshold is not as high as that of Semiconductor manufacturing, with prominent manufacturing scale effect.People clearly know that the MOCVD equipment is expensive. Actually, infrastructures like high-purity gas supply system and ultra clean workshop specially prepared for chip manufacturing are more indivisibly specific assets, which will largely raise LED chip manufacturers’ fixed production cost. In the long term, MOCVD is more like variable cost.

While Sanan possesses the largest LED chip production capacity in the world, accounting for 20% of the global chip production capacity. Sanan can amortize these fixed costs with larger chip output so long as its production capacity reaches a reasonable level. Sanan’s average cost can be 10% lower than that of its competitors.

R&D scale effect can be reflected from the scale of Sanan’s R&D team and R&D capital investment. Sanan has over 470 doctors or technology experts from Japan, Korea and Taiwan, around 502 superior engineers and talents with master degree or even higher degree. Simply in regard to talent reserve in LED opto-electronics industry, Sanan possesses the largest talent pool around the world. It is conservatively estimated that the direct R&D capital investment and indirect R&D employment costs total more than RMB 300 million, which equal the annual turnover of a medium chip factory several years ago. Such enormous R&D expenses is huge burden to a company with limited production scale. But for Sanan, the R&D cost amortized to each chip is insignificant and it can be completely counteracted by the premium created from product performance.

3. Customer Quantity Scale Effect

It can be explained by many economic terms, taking network effect as an example, the more people use the same system, the more people will be absorbed to use it. Essentially, however, this phenomenon can be explained by customer scale effect. After all, network effect relies on user quantity. The customer base Sanan has accumulated chronically objectively promotes the network effect when the customers trade with San’an.

LED chip is a kind of compound semiconductor and its manufacturing process is unable to be as accurate as that of Si-based semiconductor (the difference between 5 nine and 11 nine). So the photoelectric performance of chip presents normal distribution in a specified area, while LED manufacturers need to classify the products according to bin of photoelectric performance before selling them to customers.

San’an has abundant products within single bin, who can provide a certain bin to a single customer. Sanan has large customer base and each of them can get centralized bin sets. From customers’ perspectives, Sanan’s products are qualified with excellent consistency. Only several chip manufacturers like Sanan and HC SemiTek can deliver chips in similar method.

Besides, package manufacturer like MLS can provide LEDs to its customer in the same bin but it doesn’t distinguish bin when purchasing chips, which results from the enough big scale and the large and scattered customer base. With this advantage, the premium can increase at least 5%.

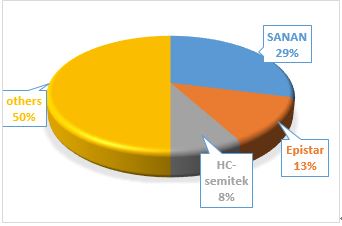

The three points mentioned above contribute to that San’an has gross profit of 15% to 25% higher than that of competitors. Moreover, regarding the market structure, San’an takes up share nearly 30% in Chinese chip market (29% by LEDinside’s statistics). It possesses the right to make price as a price leader, so no wonder San’an can maintain high gross profit.

|

Sanan's Market Share in Chinese Chip Market

|

|

|

|

(Data Source: LEDinside)

|

Apart from these, two other factors cannot be ignored although they are not the main reasons for Sanan’s high gross profit in comparison with the above mentioned factors, so there will give brief introduction. One is that San’an has its own substrate and PSS factory (Jing’ an Optoelectronics Co., Ltd.), which preferentially ensures Sanan to gain better raw materials supply at a price not higher than market price, which contributes to the competitiveness of Sanan’s products and ensures its higher yield, but it cannot be considered as core competitiveness. At the most extent, it is just the skill to transfer pricing inside the group, dispersing its profits over different production chains. In other words, the same supply can be obtained from the market but cannot be guaranteed as in house as long as the price is high enough.

Another factor is that San’an usually gets some orders of street lights. Engineering-oriented lighting products generally have high gross profit (according to Minkave Technology and Kinda Limited subordinated by Leyard), which depends on the industry attribute. Even though it can pull up Sanan’s overall gross profit, its contribution to gross profit and net profit is relatively limited due to its low proportion. In addition, its high uncertainty makes it to be a factor of seasonally fluctuating at the most.

Part2.Analysis on Sanan’s High Net Profit Ratio

Sanan’s net profit is much higher than that of its competitors, which results from its relatively satisfying gross profit (as stated above), which won’t be explained again. The following paragraphs mainly discuss the non-operating revenue that contributes great to its net profit.

Massive subsidies for MOCVD equipment in LED chip industry has always been criticized. Except that a minority of liberal economists oppose subsidy in any form and government interference, common mainstream opinion doesn’t object to government’s supportive policy for emerging industry.

Under the national condition of China, it is comparatively sensible to support LED industry through providing subsidy for MOCVD equipment. There are some countries who promote LED industry by subsidizing consumers, such as Japan and America. However, the regulatory cost of subsidizing consumers and the risk of defrauding subsidy are both very high in China. Subsidy for new energy car is a best negative example.

For equipment subsidies in LED industry, government directly supervises those enterprises who get subsidies, which takes lower regulatory cost and plays better effect. What’s more, specialized equipment purchased by subsidies can greatly ensure that financial subsidy capital is used in this industry instead of being abused.

Even if the policy itself is reasonable, why San’an can get so much? Is there inside story or unfairness? Frankly speaking, all government have tried best to avoid customizing subsidy policy for MOCVD equipment. Policy maker must obey the principle of justice, impartiality and publicity. All eligible corporations have the opportunities. For instance, Wuhu factory and Xiamen factory of Sanan acquired the most subsidies, ETi in Wuhu and CHANGELIGHT and KAISTART in Xiamen also enjoyed the same subsidy policy.

San’an has good credit in government, which is the reason why it earns a mass of subsidies. San’an has successfully maximized the efficiency of equipment purchased by subsidies. Thanks to favorable operation condition, it can really contribute taxes (income tax of RMB 450 million in 2016) to the local government. Therefore, the local politicians are certainly willing to bring in and support such corporation. And in this way, the governments around the country battle for corporations like San’an by providing abundant subsidies.

With Sanan’s credit accumulation, national capitalists including CBD and major funds companies are very glad to cooperate with San’an, which enables San’an to enjoy superiority in financing costs to competitors, and its fiscal expenses are lower than that of the peer corporations, it even achieved fiscal expenses of RMB -107 million in 2016, which contributes a lot to its net profit.

The factors mentioned above are probably the reasonable excuses of Sanan’s extremely high net profit.