According to the latest report of Trendforce, titled “ 2019 China IGBT Industry Development and Market Report”, China IGBT market scale in 2018 is expected to be RMB 15.3 billion, representing a year-on-year increase of 19.91%. As HEV/EV demand and industrial demand enjoy large growth, China IGBT market scale will continuously increase and it is expected to stand at RMB 52.2 billion by 2025 with a CAGR of 19.11%.

HEV/EV Demand Market Ranks Top

In 2012, as the State Council of the People's Republic of China issued Energy-Saving and HEV/EV Industry Development Program, China HEV/EV industry experienced explosive growth. According to the data published by China Automotive Industry Association, the output of China HEV/EV rose from 17,000 cars in 2013 to 780,000 cars in 2017, with CAGR coming to 160.26%.

In 2017, Ministry of Industry and Information Technology issued Automobile Industry Medium and Long-Term Development Program, pointing out that China HEV/EV production will reach 2 million cars in 2020 and 7 million cars in 2025. In light of the data exposed in this program, the CAGR of China HEV/EV yield is expected to stand at 16.95% from 2017 to 2025. Besides, China Automotive Industry Association data shows that by the end of June, 2018, China HEV/EV output in 2018 amounted to 408,900 cars and sales volume was 410,500 cars. In addition, HEV/EV ownership reached 1.99 million cars.

As IGBT roughly accounts for 10% of the cost of HEV/EV, it is estimated that the market scale of IGBT used in China HEV/EV will come to RMB 21 billion by 2025. Newly-added market scale will add up to RMB 90 billion in eight years.

In November, 2015, four ministries and commissions like Ministry of Industry and Information Technology jointly issued the notice of EV Charging Infrastructure Development Guidelines, which clearly mentions that aiming to gratify the charging demand for 5 million EV nationwide, over 12,000 new centralized battery charging stations and more than 4.8 million new decentralized charging piles will be increased by 2020. Additionally, China Power Consortium data indicates that 662,000 charging piles have been set up by the end of July, 2018, among which 275,000 are public charging piles while 387,000 are personal ones. Up to 4 million charging piles are to be built as planned, showing huge market space.

IGBT accounts for around 20% of the cost of charging piles. According to Trendforce, the market scale of IGBT used in charging piles is expected to stand at RMB 10 billion by 2025. Newly-added market scale will amount to RMB 30 billion in eight years.

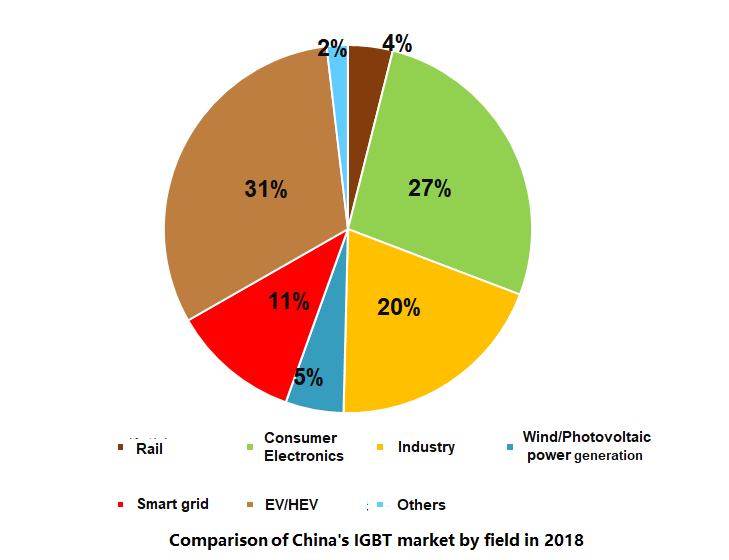

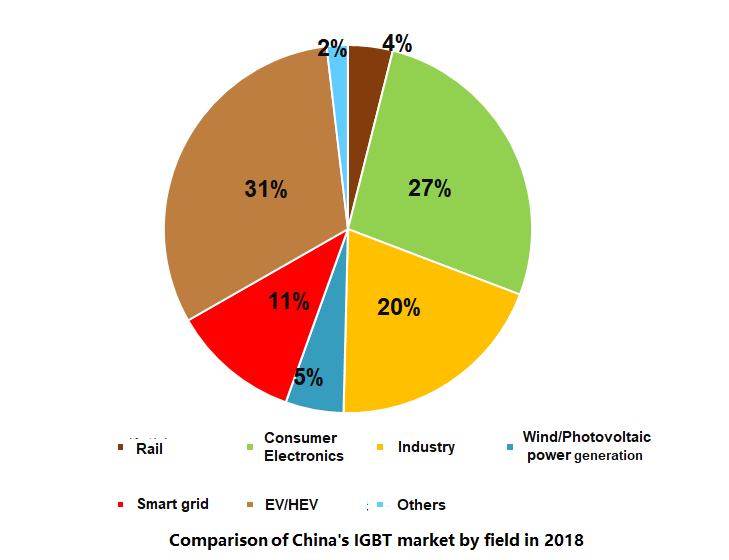

(Market Scale Comparison of Various Application Fields of China IGBT in 2018)

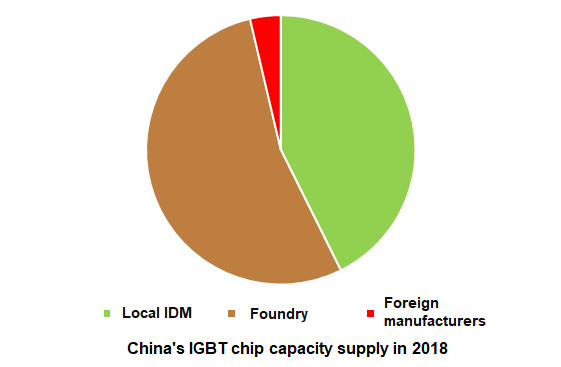

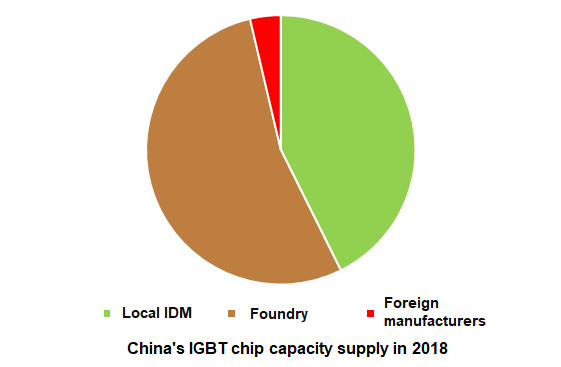

China Capacity is Mainly Supplied by Foundries

The increase in capacity of epi wafer Foundries is mainly due to the releasing capacity of new 8 inch factories and the product structure change of existing manufacturers. As Trendforce’s latest data shows, currently eight 8 inch factories are under construction in China and general capacity released will exceed 300,000 pieces after reaching targeted output. Thanks to the advantages in process technology and production capacity, Foundry will continuously be the major supplier of domestic IGBT wafer manufacturing capacity. In addition, Foundry has large room for growth in this field with considerable economic benefit.

As to foreign IDMs, they focus on the business of module packaging at present. Only several international manufacturers such as Texas Instruments, AOSL and ROHM deploy wafer manufacturing. Foreign IDM capacity increase is mainly from that of existing companies and the releasing capacity of those under construction. Later, it is also likely to see investment in making wafer production lines, but the capacity increase will be smaller than that of domestic enterprises.

(Capacity Supply Comparison of China IGBT in 2018)

SiC Devices Starts to Largely Replace IGBT

EV power system is expected to lead in SiC power device in three years, which will further expand application fields with mass production. So far, manufacturers like BYD and Tesla have applied SiC power devices in their EV charging devices. As the price of SiC power device keeps declining, it will replace silicon based IGBT to some extent.

However, the development of SiC power device is not supposed to be treated over optimistically. After all, SiC technology is not yet completely matured; instead, silicon technology has been fairly matured and it is also likely to make innovation. Thereby, it is estimated that silicon base IGBT will still dominate power device market before the year 2025.

Author: Trendforce Royce

Trendforce 2019 China IGBT Industry Development and Market Report

Release Date: 1 January 2019

Language: Chinese/English

Pages: 149

1.IGBT Introduction and Development History

1-1 IGBT Definition

1-2 IGBT Industry and Technical Development History

1-3 IGBT Product Category

1-4 Introduction on IGBT Industry Development Pattern and Industrial Chain

IGBT Product Development History

IGBT Product Category - By Package Mode

IGBT Product Category - By Wafer Structure

IGBT Product Category - By Gate Structure

IGBT Design Flow

IGBT Manufacturing and Packaging Flow

IGBT Module Packaging Production Process

Equipment and Materials Involved in IGBT Module Manufacturing

2.Global IGBT Industry Development Situation Analysis

2-1 Global IGBT Industry Scale Analysis

2-2 IGBT Development Situation of Major Countries

2-3 Development Situation of Major Foreign Enterprises

Global Power Device Industry Scale Analysis

Global IGBT Industry Sales Scale Analysis

Global IGBT Industry Scale Analysis - In Regions

Global IGBT Industry Scale Analysis - In Application Fields

Global IGBT Industry and Summary of Major Companies

Main Global IGBT Manufacturers’ Market Share Analysis

Main Company Product Distribution of Global IGBT Industry

The U.S. IGBT Industry Development Situation Analysis

Japan IGBT Industry Development Situation Analysis

Germany IGBT Industry Development Situation Analysis

Major Foreign IGBT Enterprise Analysis (Infineon)

Major Foreign IGBT Enterprise Analysis (Renesas)

Major Foreign IGBT Enterprise Analysis (Mitsubishi)

Major Foreign IGBT Enterprise Analysis (Fuji Electric)

Major Foreign IGBT Enterprise Analysis (ON Semiconductor)

3.China IGBT Industry Development Status Analysis

3-1 China IGBT Industry Scale Analysis

3-2 China IGBT Industry Development Pattern Introduction

3-3 China IGBT Upstream, Medium-stream and Downstream Industrial Chains

China IGBT Industry Scale Analysis

China IGBT Local Capacity Supply Analysis

China IGBT Industry Development Pattern

China IGBT Industry Map

China IGBT Industrial Chain Upstream and Downstream Enterprises

Major China IGBT Design Companies Comparison

Major Domestic IGBT Module/Manufacturing/IDM Company Development Situation

4.Main China IGBT Industry Manufacturers’ Development Situation Analysis (Development History, Main Products, Revenue Performance, Suppliers and Customers, Development Strategy, etc)

比亞迪 BYD

中車時代 CRRC

華微電子 HWD

揚杰科技 YANGJIE TECHNOLOGY

嘉興斯達 STARPOWER

中科君芯 CAS-IGBT

寧波達新 DAXIN

江蘇宏微 MACMIC

中芯國際 SMIC

華虹宏力 H-Grace

5.China IGBT Application Market Analysis

5-1 China IGBT Application Market Scale Analysis

5-2 China IGBT Application Market Types Analysis

5-3 Business Opportunity Analysis of Major Future Application - HEV/EV

IGBT Application Field Introduction

IGBT Application Field 1: HEV/EV

IGBT Application Field 2: Smart Grid

IGBT Application Field 3: Rail Transportation

IGBT Application Field 4: Consumer Electronics

China IGBT Application Market Scale

China IGBT Application Market Scale - By Application Fields

Main Business Opportunity Analysis: HEV/EV Industry Overview

China HEV/EV Industry Cluster Distribution

China HEV/EV Market Scale

HEV/EV Charging Pile Introduction

HEV/EV Charging Pile Production Scale

China HEV/EV Enterprises Competition Pattern

HEV/EV Charging Pile Industry Competition Pattern

HEV/EV IGBT Market Scale

China HEV/EV Market Fluctuation Risk

Main Difficulties for IGBT Enterprises on Entering HEV/EV Market

6.Policies Related to China IGBT Industry and Local Development Situation Analysis

6-1 Relevant Industrial and Supporting Policies

6-2 Nationwide IGBT Development Situation Analysis

Statistic Table of Relevant Policies Referring to Domestic Governments at All Levels

Nationwide IGBT Industry Development Situation (Key Enterprises and Industry Overview Included)

Shenzhen, Xi’an, Shanghai, Jiangsu, Zhejiang, Fujian, Chongqing

Comparison on Nationwide IGBT Industry Development Situation

7.China IGBT Industry Development Trend and Challenge

7-1 Industry and Market Scale Forecast

7-2 Major Trend and Business Opportunity

7-3 Challenges

7-4 China IGBT Industry Business Opportunity and Entry Strategy Analysis

2018-2025 IGBT Market Scale Change of Each Application Field

2018-2025 China IGBT Wafer Manufacturing Capacity Supply Structure

IGBT Wafer Technology Development Trend

IGBT Wafer and Packaging Technology Development Trend

IGBT Module Packaging Technology Development Trend

Material Technology Development Trend

Comparison on Key Parameters of Silicon and the Third Generation Semiconductor

SiC Device Price Trend

Prospect Analysis of Replacing Silicon-Based Device by SiC Device

Challenges Facing China IGBT Industry (Weak Base, Shortage of Talent, Insufficient Supporting Industries and Long Investment Cycle)

Entry Strategy Analysis (Capital Barrier, Technical Barrier, Brand and Market Barrier and Profitability)

Market Space Analysis of China IGBT Market Segments