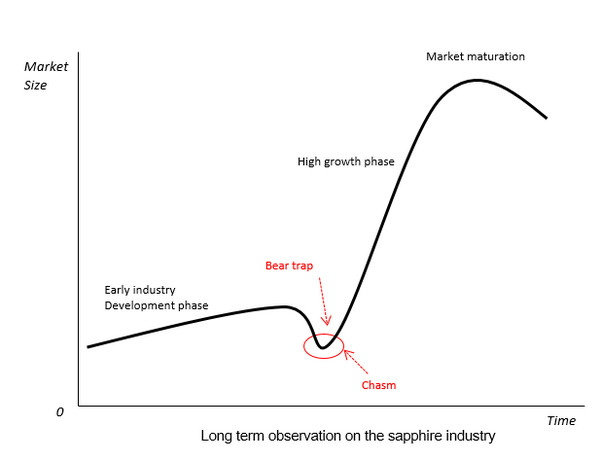

After Apple abandoned using sapphire protective glass covers in the iPhone 6 last year, sapphire substrates have been viewed as the equivalent to market speculation in the investment market. Following GT Advanced Technology’s (GTAT) bankruptcy filing in early October 2014, the idea of applying sapphire material in consumer electronics has become ridiculed on the mainstream market.

Yet, a completely different conclusion can be drawn by taking into consideration the industry’s current development phase, challenges, and future developments. LEDinside has been following sapphire supply chain developments for a very long period. In a report released in early 2014, LEDinside warned clients that there were no signs that the new iPhone 6 would be employing sapphire glass. Sure enough the iPhone 6 came without protective sapphire glass. GTAT also was unable to meet sapphire supply deadlines according to the deal, and declared bankruptcy in early October 2014.

Apple’s iPhone 6 decision to forgo sapphire substrates created market panic and overreactions in the market. LEDinside observed slight rebounds in the sapphire industry since incident, the industry has arrived to a turning point from a long term perspective. GTAT’s failure does not represent the demise of the sapphire industry, in contrast it will allow the industry and investors to be able to steer clearly towards the right direction.

Traditional sapphire market supply and demand models

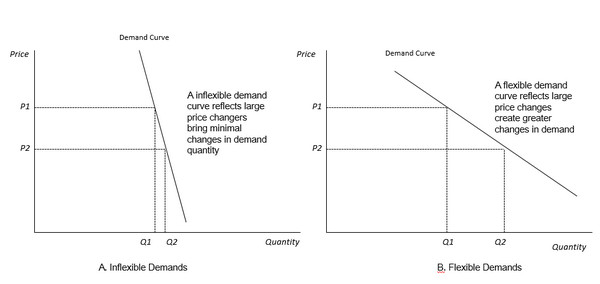

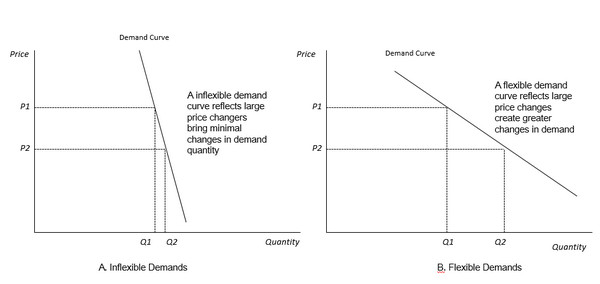

By removing impact from the consumer electronic industry, LEDinside observations of the traditional sapphire market supply and demand structure will give a better picture of the recent industry developments. Previously, with the exception of sapphire substrates, the sapphire industry was a major window film market supplier. The window film market is a highly customized industry with inflexible retail prices. On the other hand, the LED epiwafer market makes up more than 70% of sapphire substrate demands, and performance is highly correlated to LED industry’s market developments. This is also a fairly inflexible market.

In other words, LED manufacturers can absorb costs even when there are upticks in substrate prices when there are high LED epiwafer market demands. But when there is a downturn in LED epiwafer market demands, it can be difficult to stimulate growth demands, even when sapphire substrate prices are halved. LED epiwafer manufacturers might take the opportunity to stock up their inventory with low-priced sapphire during this period, but it is insufficient in stimulating market demands. Therefore, the sapphire market demands is fairly rigid.

|

|

|

(Source: LEDinside)

|

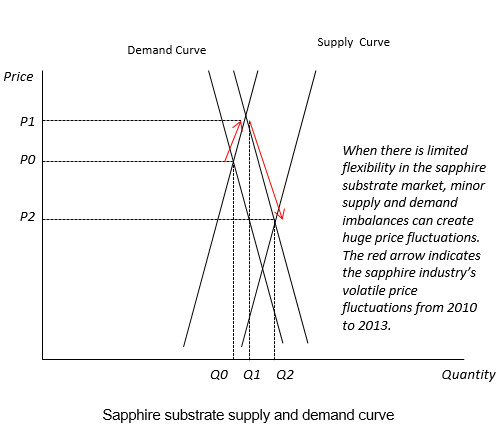

From a supply perspective, LED substrates mainly use Kyropoulos (KY) sapphire crystal growth methods. However, KY sapphire crystal growth methods have very limited supply flexibility.

One of the main reason is supply demands, which includes procurement, installation and testing. Finally, it takes a relatively long period before yield rates can climb up, making it very difficult to quickly meet market demands. Additionally, the learning curve for crystal growth method is declining at a fairly slow rate compared to other industries, hence experienced engineers are crucial. The KY crystal growth method is a highly professional technology that requires human resource investments, and swings in supply and demands which have added uncertainties in the long Return of Investments (ROI) period. Manufacturers involved in the sapphire growth industry are usually reluctant to train engineers, as they take into consideration the lengthy ROI period and employee turnover risks. Skilled engineers in sapphire crystal growth are hard to come by. When market demands soar, employers will not always be able to find a suitable replacement, even when lucrative salaries and packages are offered. Moreover, it is impossible to meet manufacturing demands by hiring an average technician. These two factors alone have greatly limited the flexibility of KY sapphire substrates.

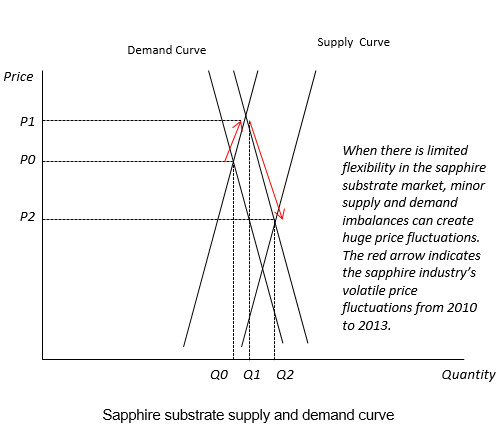

What does small supply and demand flexibility mean? This can be illustrated by sapphire substrate’s volatile retail prices in late years. When Chinese LED epiwafer manufacturers scaled up production capacity in 2010, the sapphire substrate market underwent exponential growth. Shortages in sapphire material, caused two-inch sapphire substrate prices to soar soared to US $30. High prices further stimulated large sapphire substrate production expansions. When the production capacity were released in 2012, prices plunged to US $5 below manufacturing costs.

|

When there is limited flexibility in the sapphire substrate market, minor supply and demand imbalances can create huge price fluctuations. The red arrow indicates the sapphire industry’s volatile price fluctuations from 2010 to 2013. (Source: LEDinside)

|

Taking into consideration consumer electronics sapphire supply and demand model

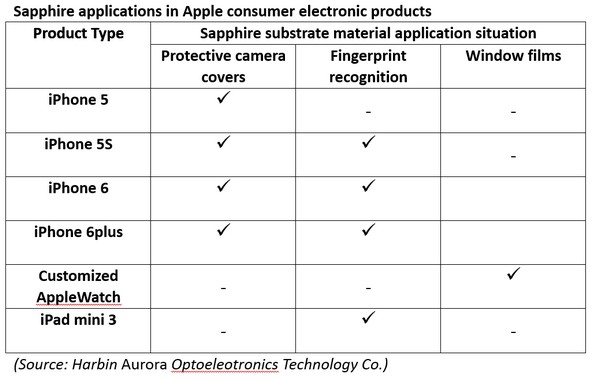

In the consumer electronics sector, Apple was the pioneer in introducing sapphire material into Apple’s iPhone 5 camera lens, and iPhone 5S home buttons. The usage of sapphire cover glass in the upcoming iWatch and smartphones will also change sapphire substrate industry’s supply and demand structure.

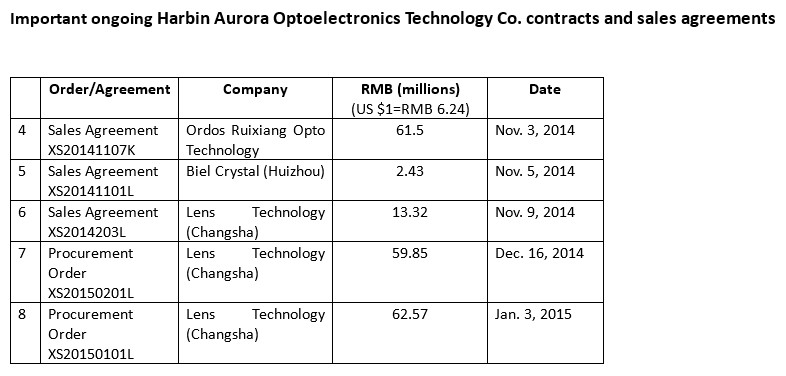

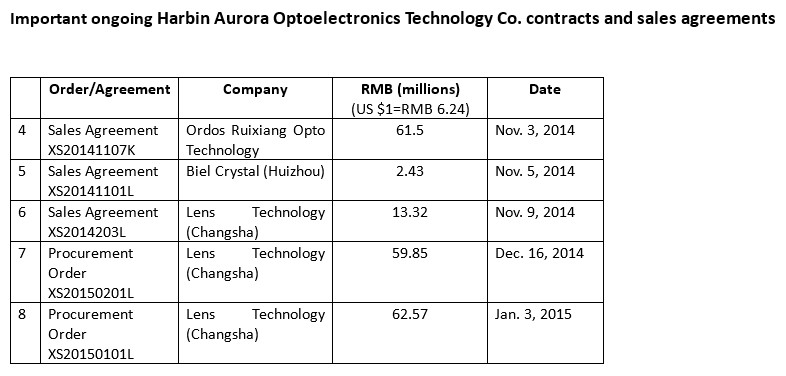

Estimations of Apple iWatch demands are based on current sapphire supply situations. For instance Harbin Aurora Optoelectronics Technology (Aurora) claims has received in total 30 million PCS 2-inch sapphire ingot supply orders for the device from Apple in 2015. It is estimated the company’s sapphire ingot revenue will grow 100%, 33% and 19% respectively from 2016 to 2018, while gradually stabilizing in 2019. Aurora’s 30 million sapphire ingot order is equivalent to a third of global sapphire substrate consumption in 2014, and industry experts estimate iWatch sapphire consumption is expected to surpass LED substrates by 2017 latest.

|

|

(Source: Aurora) |

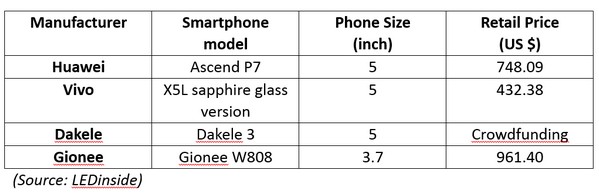

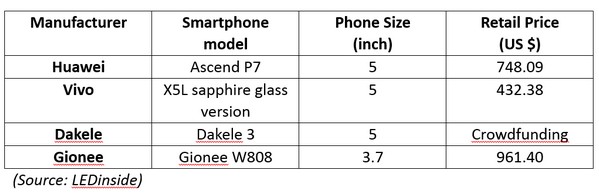

Based on LEDinside observations, Chinese smartphone manufacturers Huawei, VIVO and Dakele have followed Apple’s adoption of sapphire substrates in smartphones. These manufacturers have implemented more flexible strategies. Due to limited sapphire cover glass production capacity, most manufacturers are only employing sapphire glass screens in high end smartphones. Breakthroughs in future production capacity is required for sapphire smartphones to eventually become a standard phone spec. Some smartphone manufacturers are still planning to release sapphire smartphones in high-end phones. Even if iPhone sapphire usage is taken out of the equation, the smartphone market’s annual sapphire glass growth rates is projected to reach 50 million.

Delving into Apple’s supply chain, LEDinside has found the company is still striving to bring sapphire glass covers to newer iPhone models.

Chinese smartphone manufacturers that have adopted sapphire glass

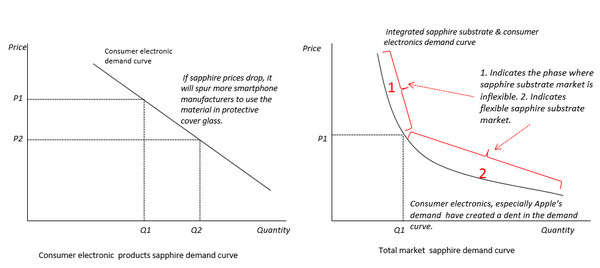

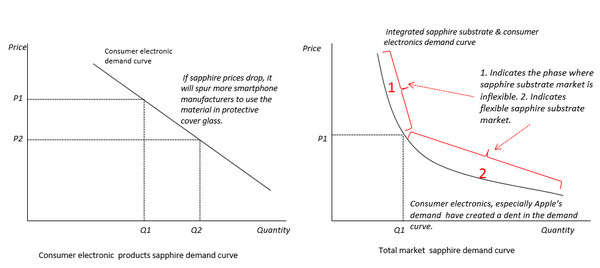

Sapphire substrates demand flexibility can be significantly improved by entering the consumer electronic supply chain. Consumer electronic devices that incorporate sapphire glass become luxury products to a certain degree, which greatly raises retail pricing flexibility. Different consumer groups will also be inclined to pay different prices for these products, if sapphire smartphones are too expensive than it will only be affordable to a few people. If prices are slashed, though, it will stimulate larger market demands. The previously straight demand curve will become a titling curve. By adding sapphire substrate market’s rigid demands into the graph, the sapphire market demand will become a dented curve.

|

|

(Source: LEDinside) |

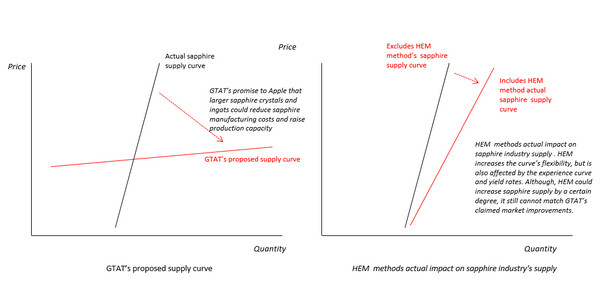

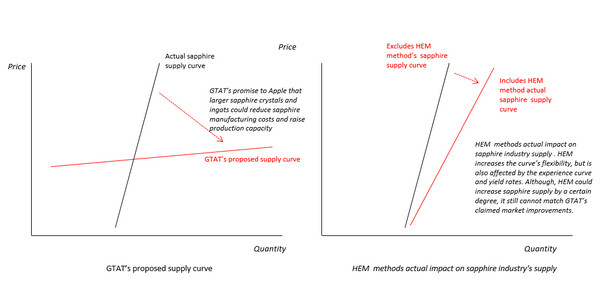

Due to the wider scope of consumer electronics, Heat Exchanger Method (HEM) crystal growth methods, which are unsuitable for LED substrate manufacturing, can finally be considered by suppliers. One method for optimizing HEM crystal growth is completely automating the entire production process. One person can keep an eye on several machines, thus lifting potential restrictions caused by manpower shortages. GTAT has been a major sapphire crystal growth equipment supplier, and has standardized production methods that have greatly shortened the period for engineers to become familiar with equipment operations, hence expanding the supply and demand curve’s flexibility.

However, experts have different opinions when it comes to determining the exact increase in supply flexibility. The supply and demand curve is nearly horizontal in GTAT’s projection to Apple. In other words, as long as Apple can afford it, GTAT can supply the requested volume. Hence, the world’s wildest business decision was made in front of a globally stunned audience, and the public was again left stupefied when the deal failed flat.

GTAT had rashly invested in 500 HEM crystal growth furnaces, even though it was inexperienced in crystal growth. Without experienced engineers and technicians the company ventured straight into 200 kilogram (kg) grade sapphire production. This is a very risky move. It took several years before China’s early pioneer in HEM crystal growth method, Haotian Optoelectronics to move from 80 kg grade sapphire production to eventually 110 kg. It took a couple of years for the company to slowly progress from 80 kg, 90 kg, 100 kg, and finally 110 kg. Even though the HEM crystal growth furnaces use simplified menus for production, there is still a lot of know how involved in the crystal growth process, such as overcoming discolored sapphires that can become pink or purple tinted. When it comes to boosting supply flexibility, the HEM sapphire growth methods can create a slant in the supply and demand curve, but not a flat horizontal line. This is probably the hardest lesson GTAT learnt from its unsuccessful deal with Apple.

|

|

(Source: LEDinside) |

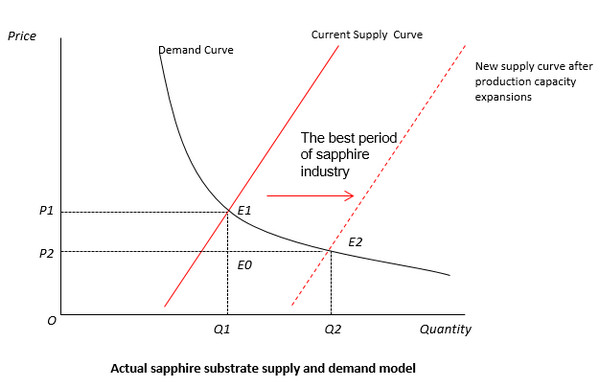

Actual sapphire substrate supply and demand model

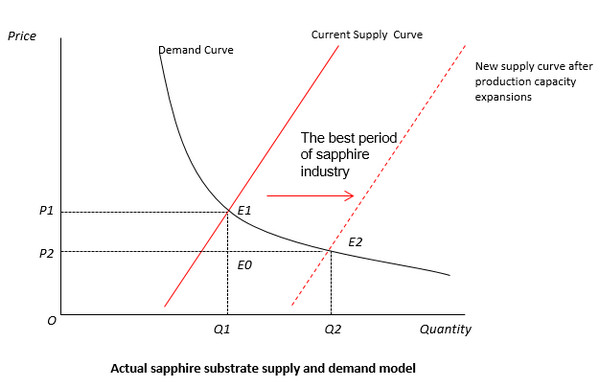

From the above logical reasoning, estimations of the general sapphire industry supply and demand can be reached. In the below graph, a new market equilibrium can be observed when HEM crystal growth methods are introduced to meet consumer electronic market demands.

|

The current market demand equilibrium is mainly supported by sapphire substrate demands. Addition of the consumer electronic demands will result in the new equilibrium point at E1. However, expanding sapphire production capacity will meet expanding consumer electronic market demands, which will generate the new equilibrium point that can be found at E2. The overall market size will also transform from P1E1Q1O to P2E2Q2O, as the market rapidly expands. Substrate clients need to take into consideration consumer electronic clients different retail prices. If an effective retail pricing strategy is implemented, such as pricing discrimination strategy, than the actual market size will be equivalent to E1E2E0 deducted from P1E1E2Q2O. To conclude, the long tail effect from the consumer electronic market will spur sapphire substrate industry market demands into a period of high profits and high volume manufacturing.

(Author: Figo Wang, Senior Analyst, LEDinside China, Translator: Judy Lin, Chief Editor, LEDinside)

(Editor's Note: The graphs have been updated on Feb. 10, 2015)

CN

TW

EN

CN

TW

EN