The LED chip market balance is hanging on a string, according to LEDinside Senior Analyst Figo Wang. In this article Wang outlines San’an Opto’s LED chip production expansion strategies.

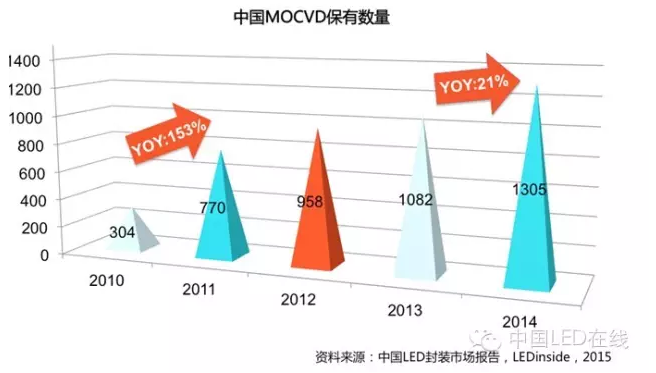

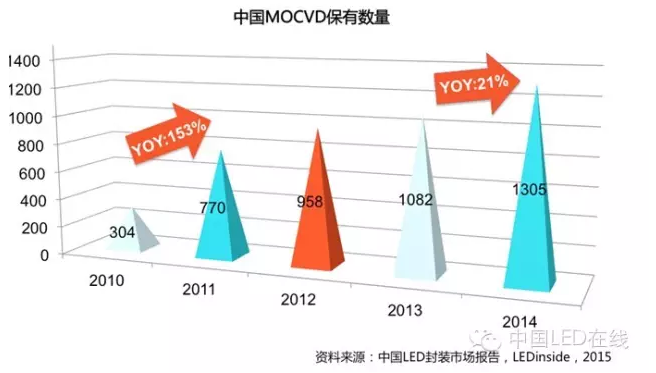

Compared to the wailing cries of despair in the LED package industry from over competition, rivalry between LED chip manufacturers has been far more reserved. The main reason being LED chip production capacity expansion over the last two years has greatly limited room for further price cuts. In 2014, 223 new MOCVDs (calculations are based on multi-chamber MOCVDs with 2-inch 54 pcs LED production capacity) were installed in China. Despite the apparently high figure the increase is only 21% YoY. Taking into consideration the withdrawal of older MOCVD models, the production capacity increase is actually fairly limited, and the current market size can sufficiently digest the expanded production capacity. Most of the newly added production capacity have been concentrated among competitive large LED chip manufacturers, which has prevented the market from being impacted by large volume of low-priced LED chips.

|

|

China's MOCVD volume. (Source: LEDinside) |

China’s MOCVD production capacity expansions have significantly slowed in 2015 compared to the industry’s frenetic height of expansions from 2010 to 2011. In 2010, MOCVD production expansions was growing at a rate of 153% YoY. Yet, market demand growth has failed to match soaring production capacity expansions, leading to oversupply of LED chips in 2012 leading to the eventual LED price crash.

|

|

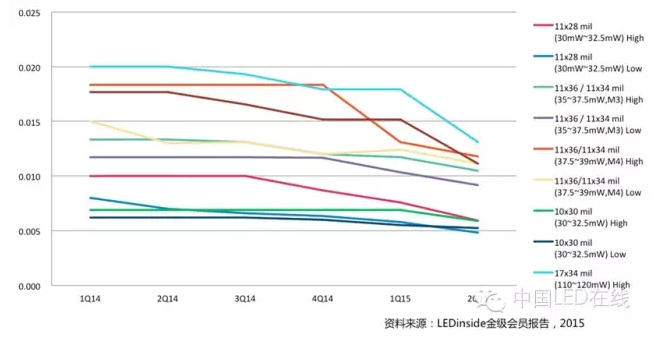

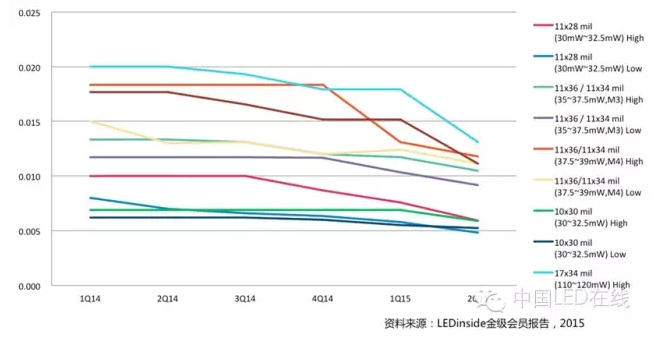

(Source: LEDinside) |

Systematic LED chip price declines occurred only once in 4Q14, and although high end product prices have declined somewhat in 2Q15, low priced products have developed a certain degree of resistance to further price declines. Overall, market price distributions have gradually converged, and there are temporarily no risks of further price crashes in the LED chip industry.

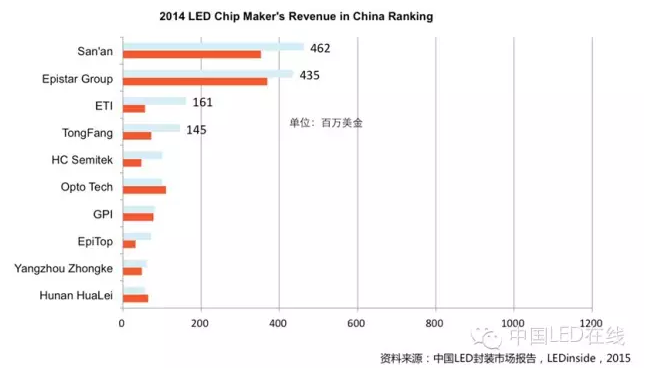

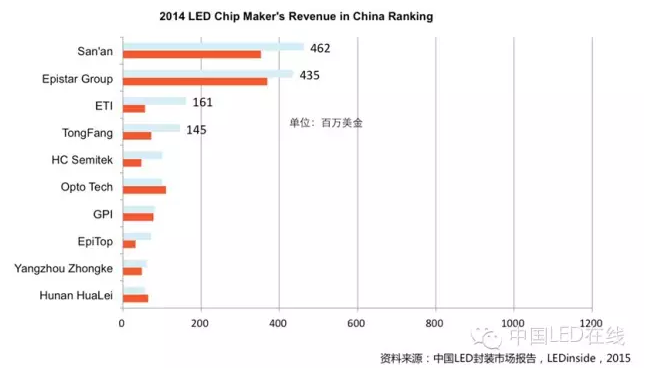

The biggest change in the local LED chip market in 2014 has been the rise of Chinese LED chip manufacturers global market share, having taken four rankings out of the top five list. Epistar is the only foreign LED company out of the top five LED chip makers in China. The company’s major competitor San’an Opto’s LED chip revenue in the country overtook the Taiwanese LED manufacturer for the first time.

|

|

(Source:LEDinside) |

However, Chinese LED chip makers’ global market share remains small, due to their later entry in the international LED market, and lack of patents. In the global market, San’an Opto’s substantial revenue has made the company the only Chinese company to squeeze into the global top five LED chip manufacturer rankings. The major challenge in the future for Chinese LED manufacturers will be gaining entry into international LED package manufacturers supply chain, and acquiring a leading position in the international LED market.

Yet, there is a sword of Damocles hovering above the LED chip industry—the still under construction—San’an Opto’s second phase LED production capacity expansion project. The current fragile balance in the LED chip market would be completely disintegrated once San’an Opto’s 200 new MOCVDs production capacity is unleashed on the market.

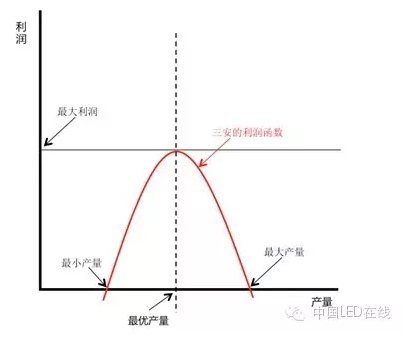

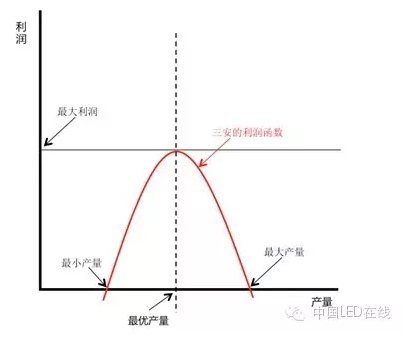

Hypothetically, if San’an Opto is a rationally managed listed company with an aim of maximizing profits, the resulting equation would be:

R=Q*P-Qc-F

Furthermore, taking into consideration San’an Opto has the largest market share in China, and its LED chip production volume is sufficient enough to impact market prices, a negative correlation can be established between San’an Opto’s production volume and market prices. The second formula as following:

P=-aQ

By inserting the second formula into the first, the relationship between profit and production volume can be summed up with equation three:

R=-aQ²-Qc-F

To find profit R’s maximum value linear programming is applied to the above equation, and due to its negative coefficent the resulting curve is inverted. The maximum profit point will be found on an area where production capacity is lower than maximum production capacity.

|

|

The point where San'an Opto can acquire greatest profits will fall somewhere in between its minimum and maximum production capacity. (LEDinside) |

A reasonable speculation is that the added production capacity will be released carefully and gradually onto the market so to prevent directly impacting market prices. The aim of the company will be raising profits so it can sufficiently cover the new fixed assets depreciation costs.

Nevertheless, all these analyses are based on the assumption that San’an Opto’s is trying to maximize profits. If San’an Opto’s intent is to acquire larger market share or solidify its leadership position in the oligarch LED chip market, it would probably initiate price wars to strengthen its market position and to clear the field. In this scenario, it will be questionable as to whether the LED chip industry can maintain the delicate market balance. Especially, under current market developments where HC Semitek is being restructured and with ETI scaling up production capacity. Moreover, it is evident that Lattice Power and Go Scale Capital’s calculated integration of Lumileds resources is intended to acquire market share in the Chinese LED market. Emergence of new powerful players could shatter the LED chip market equilibrium that the two party oligarch formed by San’an Opto and Epistar have been striving to preserve. It is hard to predict whether a bitter battle between chip manufacturers will be ensued as a result.

In addition, San’an Opto’s production capacity expansions has three major implications.

The company’s production expansion could be a deterrent to prevent other competitors from expanding production capacity, hence alleviating the intensity of market competition. In the last few years, San’an Opto has been continually boosting production capacity, which make many competitors feel rather insecure. The impact has been Chinese, Korean and Taiwanese LED chip competitors have been more meticulous in their production expansion plans. As a result industry’s production expansion growth rates has eased this year, and LED chip manufacturers have been able to breathe a sigh of relief.

From another perspective this could be a strategy to prevent new players from entering the LED chip market. Taiwanese electronic manufacturer TSMC set the precedent of employing this type of strategy in the wafer and computer chip industry. At the time TSMC expanded production capacity to create an oversupply situation on the market, and was able to block and discourage new competitors from entering the market because of the lowered projected profits. In the last few years, LEDinside has observed many new comers still willing to enter the LED chip industry. Many have done so through acquisition or integrating resources.

San’an Opto’s production capacity expansions also reflect the company’s operations to counter the business cycle. LED chip industry’s downstream market demands are rather unstable, hence cyclicity has been rather strong in the industry. These cyclic changes have impacted the industry’s profitability and estimated earnings, and lowered asset values under these business models. When there are supply shortages in the market it greatly restricts company’s profitability, but when there is oversupply situations companies have to bear the higher risks of idle equipment and employees. By building a production capacity reserve, and increasing production capacity in accordance to the market cycle, it could effectively regulate impact from the volatile market during each cycle, and improve the company and the industry’s profitability.

(Author: Figo Wang, Senior Analyst, LEDinside Chinahttp:// Translator: Judy Lin, Chief Editor, LEDinside)