LEDinside (a research division of TrendForce) indicated in their “Chinese lighting market report-2013” that the rise of the domestic LED market has brought great business opportunities. After the European debt crisis, the export-oriented Chinese LED lighting industry shifted their business to emerging markets. Exports to Russia, for example, has already accounted for 2.8% of China’s total exports. The Chinese domestic LED lighting market has also become the major focus of manufacturers. Government bidding project support is a significant influencing factor; because the Chinese LED lighting market is deeply affected by the policy, an in-depth understanding of China’s policy for LED lighting would help understand the mechanism of the Chinese market.

The Chinese LED lighting industry is highly dependent on exports. Europe and the US are ideal markets for LED lighting market development due to customers’ less price sensitivity and strong interest in energy saving and environmental awareness. Therefore, in the initial stages of China’s LED lighting business, the Chinese LED industry relied heavily on exports to Europe and the US and was deeply involved in the global industrial chain. According to LEDinside’s Chinese LED lighting market report, data from Chinese customs showed that in 2012, China’s LED lighting fixture exports amounted to approximately 5.8 billion USD. Japan, Western Europe, and the US were the major LED lighting export markets, in which the US market, accounting for approximately 24% of China’s total exports, was the largest export market. The major export markets are becoming more concentrated each year; in 2012, the top 8 export markets (including 4 European countries) accounted for 62.7% of China’s total exports. In 2012, Russia became one of China’s top ten export markets by achieving a profit of 160 million USD (a 49% increase compared with that of 2011).

Due to the European debt crisis, LED lighting demands in European markets (and even in the US market) have decreased. Several LED lighting manufacturers that overly relied on foreign trade were struck by the sudden decline in orders. Export-oriented LED companies in Shenzhen, Ningbo, and Dongguan, for example, suffered an unprecedented downturn; several small and medium-sized companies were even forced to lay off employees and reduce production in order to avoid business bankrupt.

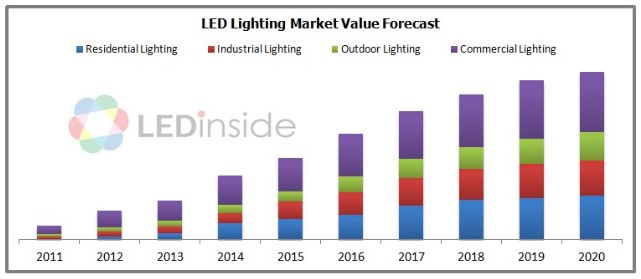

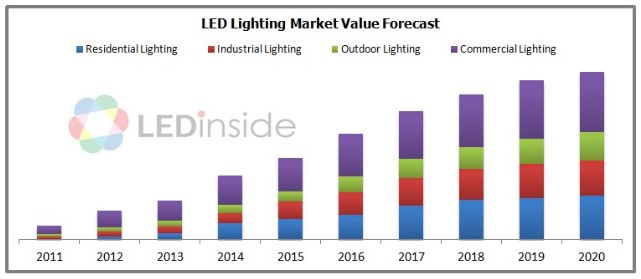

On the other hand, China’s huge domestic market also became a solution to the sharp decline in LED export orders. According to China’s lighting market scale data, residential lighting products were most widely adopted in China (approximately 4.2 billion products), making the residential lighting market the largest potential LED lighting replacement market. However, due to the high price, the LED lighting penetration rate was low and the expansion of the residential LED lighting market was hindered. As for the commercial and public lighting market, demands for HID lamps and fluorescent lamps with high luminous flux are significant; the total lighting demand in these markets was only slightly less than that of the residential market. Commercial lighting products have a shorter replacement cycle, and buyers in this market can accept a higher price, thus the LED lighting penetration rate in the commercial lighting market could be rapidly enhanced.

Unlike mature markets such as Europe, the US, and Japan, the Chinese LED lighting market may easily be affected by the policy. Therefore, an in-depth understanding of China’s policy for LED lighting would help understand the mechanism of the Chinese market, and by observing government bidding projects and market trends, the policies as well as China’s resource allocation would become clear. CEIEC was commissioned (by Ministry of Finance, National Development And Reform Commission, and The Ministry of Science And Technology) to hold the second public subsidy bidding project “2012 SSL Product Fiscal Subsidy Promotion Program” in Beijing on August 13, 2012. This project was the most formal public bidding regarding the LED lighting industry that was held by the government. The Chinese government tends to promote domestic LED lighting by subsidizing indoor and outdoor lighting products. In addition, local governments have also announced policies based on “The 12th Five-Year Plan” to encourage investment and development in the LED industry. Such promotion may deeply enhance LED lighting popularization in the Chinese lighting market.

Source : LEDinside

Chinese Lighting Market Report -2013 Version

Chapter 1 Chinese Lighting Market Development Forecast

-

Introduction

-

Section 1 Chinese Lighting Market Value Forecast

-

Section 2 Chinese Lighting Export Analysis

-

Section 3 Chinese Lighting Market Demand Forecast

-

Section 4 Major Chinese Luminaire Manufacturers

Highlight: Revenue Scale, Capital, Product Segment, Market Segment, Company Profile, Business Status, Revenue And Profit, Product Mix, Yankon Lighting, Foshan Lighting, Changfang Lighting, Kingsun Lighting, Cnlight, Nationstar, Honglitronic, And Feilo Acoustics

Chapter 2 Chinese LED Lighting Industry Policy Support And Regional Development

-

Introduction

-

Section 1 Major Chinese Government Polices To Support the LED Lighting Industry

-

Section 2 LED Promotion and Implementation Plans in Various Areas

Chapter 3 Analysis of Lighting Market Segments and Channels

-

Introduction

-

Section 1 Chinese LED Sales Channel Pricing Strategy Analysis

Highlight:

1. LED Lighting Channel Ratio And Trend Forecast

Internet Channel Supply Chain Survey- Channel Introduction, Launched Product Specifications, Retail Price And Analysis

JD.com

Taobao.com

China.alibaba.com (1688.com)

2. Store Channel Survey

Survey On Product Prices And Specifications In Retail Stores

3. Distribution Channel Survey

2012 LED Luminaire Manufacturer Development In Distribution Channel

Dealer/Direct Sales Store -NVC

Analysis and Conclusions:

-

Section 2 Commercial Lighting- Retail, Hotels, Office Lighting and Entertainment Lighting

-

Section 3 Residential Lighting

-

Section 4 Industrial Lighting

-

Section 5 Outdoor Lighting

Highlight:

LED Product List And Market Field

Environment And Request

Channel Analysis

Chinese LED Market Segment Analysis

Major Manufacturer Overview

Chapter 4 Chinese LED Lighting Supply Chain Overview

-

Introduction

-

Section 1 ODM / OEM Supply Chain International Lumainire Manufacturers

Highlight: Philips、Osram、GE、Toshiba、Sharp、NEC

-

Section 2 Basic Requirements For Entering the ODM / OEM Supply Chain

-

Section 3 Case Analysis and Discussion on ODM / OEM Projects And Conclusions

Chapter 5 Major Energy Management Business Models For LED Energy Saving Project

-

Section 1 Energy Management Contract (EMC) Model

-

Section 2 Build and Transfer (BT) Model

-

Section 3 EMBT Model

Chapter 6 Analyzing Characteristics And Cost of LED Lighting Products

-

Introduction

-

Section 1 Analyzing The Features Of LED Lighting Products

-

Section 2 Analyzing The Key Materials Of LED Lighting Products

-

Section 3 LED Lighting Products BOM Cost Analysis

Highlight: 40W Equiv. LED Lamp, T8 Light Tube, 100W LED Street Lamp, 12W PAR30, And 5W MR16

-

Section 4 LED Energy Saving- Case Analysis

Chapter 7 Lamp Accessories and Major Manufacturers Overview

-

Section 1 LED Driver IC Development Situation and Major Manufacturers

-

Section 2 LED Power Supply Development Situation and Major Manufacturers

-

Section 3 LED Lighting Thermal Module Development Situation and Major Manufacturers

Chapter 8 Investment Suggestions and Trend Analysis

-

Introduction

-

Section 1 Suggested Investment Strategy

-

Section 2 Trend Analysis

Published Date: June 30, 2013

Language: English

Format: Electronic File (PDF)

Page: 229

If you would like to know more details, please contact :

|

Taipei:

|

|

|

|

Joanne Wu

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |

|

|

|