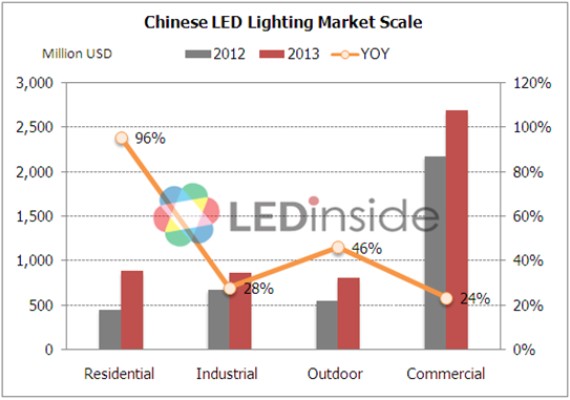

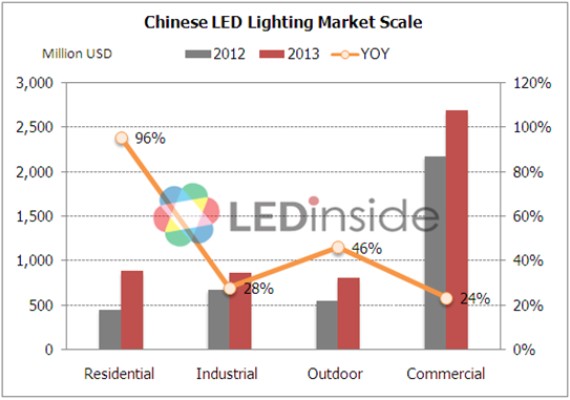

According to the latest "China LED Lighting Market Report (2013 Version)” from LEDinside, Green Energy Division of Global market research firm TrendForce, China LED lighting market will reach 32.4 billion RMB in 2013, and the annual growth rate is up to 36%. Residential lighting market is the major growth momentum with a growth of 96% in 2013, it becomes the second largest general lighting applications market only second to commercial lighting. Traditional lighting manufacturers like NVC, Opple, PAK and Foshan Lighting have expand to LED lighting, while LED package plants such as Everlight, Edison, MLS and Changfang Lighting have taken full use of LED manufacturing advantages to seize Chinese lighting market.

Source: LEDinside, 2013

LEDinside stated that benefiting from the intensive investment in lighting channel of various manufacturers, the quick falling in the sales price of LED lighting products and the improvement of average consumer's acceptance. In 2013, Chinese lighting market has achieved growths in commercial, residential, industrial and outdoor lighting fields of 24%、96%、28% and 46% respectively, and formally entered the general public channel era, the competition for LED lighting market between traditional lighting manufacturers and LED lighting manufacturers has intensified, LEDinside said that whether the LED lighting manufacturers can dominate the market in the future or not depends on their channels establishment capability.

In view of the revenues of Chinese lighting manufacturers in 2012, NVC, Opple, PAK, Foshan Lighting and other traditional manufacturers have began introducing LED lighting products, but the LED lighting penetration rate still takes up low proportion of their overall revenues, in order to avoid direct impact on traditional businesses, the introduction of LED lighting product line and distribution establishment are relatively conservative.

However, MLS Lighting, Changfang Lighting and other LED lighting manufacturers entered the lighting market channel with the image of “LED price killer" through taking full use of the cost advantage of LED package devices, which not only have price advantage comparing with the traditional brand's LED products, in order to reduce the inventory risk for distributors, it also issued attractive distribution establishment policies, such as offering the falling price strategies within three months. Chinese lighting channels controlled by the four major brands has been gradually loosened, and many distributors switched to emerging LED lighting brands under the stimulation of the tremendous business opportunities of LED lighting.

Taiwan-based manufacturers like Everlight, Edison and Unity Opto have actively conducted LED lighting market development, Everlight formally establishes distribution system in China in 2013 and conducts the channel estiablishment through the distributors, while Edison cooperates with traditional lighting manufacturers to grab Chinese LED lighting market. Unity Opto and Honyar jointly introduced Honya-Unity Opto lighting products.

LEDinside stated that how to quickly sell out products to gain the market share has become a top priority for manufacturers. In the early stage, LED lighting manufacturers mainly focused on engineering project and export-oriented sales channels, while the revenue models like distributors, agents, exclusive stores and other channel modes have not really formed. According to statistics, the revenue achieved by Chinese LED lighting manufacturers through adopting channel modes in 2012 accounted for less than 30%.With the increasing popularity of LED lighting products, manufacturers no longer depend on the sales channels like engineering projects and exports, in the future, LED lighting will be the same as the traditional lighting, the manufacturer who has superior sales channels will dominate the market.

Chinese Lighting Market Report -2013 Version

Chapter 1 Chinese Lighting Market Development Forecast

-

Introduction

-

Section 1 Chinese Lighting Market Value Forecast

-

Section 2 Chinese Lighting Export Analysis

-

Section 3 Chinese Lighting Market Demand Forecast

-

Section 4 Major Chinese Luminaire Manufacturers

Highlight: Revenue Scale, Capital, Product Segment, Market Segment, Company Profile, Business Status, Revenue And Profit, Product Mix, Yankon Lighting, Foshan Lighting, Changfang Lighting, Kingsun Lighting, Cnlight, Nationstar, Honglitronic, And Feilo Acoustics

Chapter 2 Chinese LED Lighting Industry Policy Support And Regional Development

-

Introduction

-

Section 1 Major Chinese Government Polices To Support the LED Lighting Industry

-

Section 2 LED Promotion and Implementation Plans in Various Areas

Chapter 3 Analysis of Lighting Market Segments and Channels

-

Introduction

-

Section 1 Chinese LED Sales Channel Pricing Strategy Analysis

Highlight:

1. LED Lighting Channel Ratio And Trend Forecast

Internet Channel Supply Chain Survey- Channel Introduction, Launched Product Specifications, Retail Price And Analysis

JD.com

Taobao.com

China.alibaba.com (1688.com)

2. Store Channel Survey

Survey On Product Prices And Specifications In Retail Stores

3. Distribution Channel Survey

2012 LED Luminaire Manufacturer Development In Distribution Channel

Dealer/Direct Sales Store -NVC

Analysis and Conclusions:

-

Section 2 Commercial Lighting- Retail, Hotels, Office Lighting and Entertainment Lighting

-

Section 3 Residential Lighting

-

Section 4 Industrial Lighting

-

Section 5 Outdoor Lighting

Highlight:

LED Product List And Market Field

Environment And Request

Channel Analysis

Chinese LED Market Segment Analysis

Major Manufacturer Overview

Chapter 4 Chinese LED Lighting Supply Chain Overview

-

Introduction

-

Section 1 ODM / OEM Supply Chain International Lumainire Manufacturers

Highlight: Philips、Osram、GE、Toshiba、Sharp、NEC

-

Section 2 Basic Requirements For Entering the ODM / OEM Supply Chain

-

Section 3 Case Analysis and Discussion on ODM / OEM Projects And Conclusions

Chapter 5 Major Energy Management Business Models For LED Energy Saving Project

-

Section 1 Energy Management Contract (EMC) Model

-

Section 2 Build and Transfer (BT) Model

-

Section 3 EMBT Model

Chapter 6 Analyzing Characteristics And Cost of LED Lighting Products

-

Introduction

-

Section 1 Analyzing The Features Of LED Lighting Products

-

Section 2 Analyzing The Key Materials Of LED Lighting Products

-

Section 3 LED Lighting Products BOM Cost Analysis

Highlight: 40W Equiv. LED Lamp, T8 Light Tube, 100W LED Street Lamp, 12W PAR30, And 5W MR16

-

Section 4 LED Energy Saving- Case Analysis

Chapter 7 Lamp Accessories and Major Manufacturers Overview

-

Section 1 LED Driver IC Development Situation and Major Manufacturers

-

Section 2 LED Power Supply Development Situation and Major Manufacturers

-

Section 3 LED Lighting Thermal Module Development Situation and Major Manufacturers

Chapter 8 Investment Suggestions and Trend Analysis

-

Introduction

-

Section 1 Suggested Investment Strategy

-

Section 2 Trend Analysis

Published Date: June 30, 2013

Language: English

Format: Electronic File (PDF)

Page: 229

If you would like to know more details, please contact :

|

Taipei:

|

|

|

|

Joanne Wu

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |

|