In general, Thai LED manufacturers at EcoLightTech Asia 2014, tend to import LED components from China before assembling and rebranding them as LED luminaires, which was consistent to earlier findings by LEDinside’s research team. The trade show ran from Nov. 12-14 in Bangkok, Thailand. Some ambitious players in the local Thai LED market are aiming to scale down reliance on imported components by establishing their own component production line.

Of the 33 manufacturers interviewed at the trade show, only 13 were revealed about product specs. Some large Thai LED manufacturers including Lekise, Lampton and Acrolux even declined to be interviewed, possibly indicating the intense market competitions. Of the 13 manufacturers, five reported using LED chips from Nichia or Cree, followed by two using Philips Lumileds. The remaining manufacturers reported using LED chips supplied by Epistar, San’an Opto, Honglitronic, and Chimei Lighting.

|

|

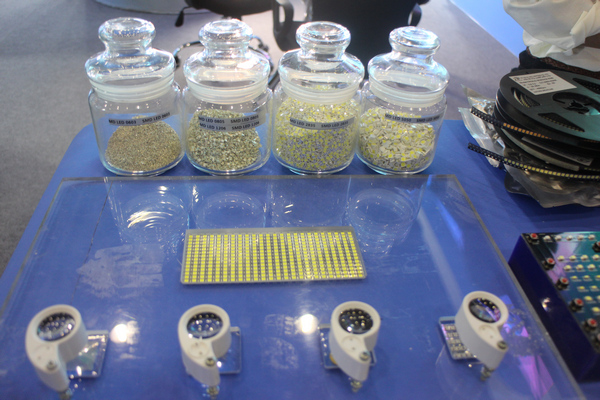

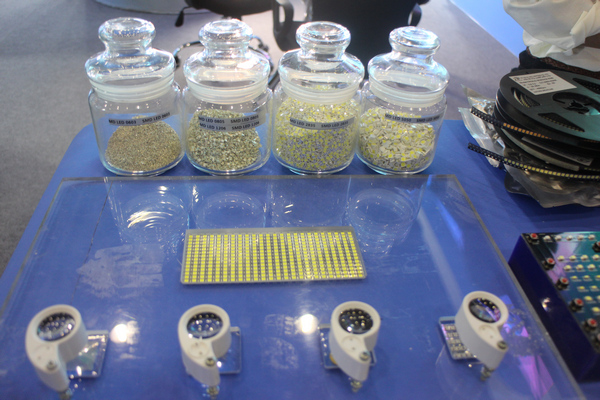

TP Halo is vying LED package market in Thailand, and was the only manufacturer displaying die-bonding and wire-bonding machines at EcoLightTech Asia 2014, which took place in mid November in Bangkok, Thailand. (LEDinside) |

Thai manufacturers entering LED package market

The reliance on imported LED components has hurt some Thai LED manufacturers’ revenue. Having been in the Thai LED market for five years, TP Halo LED Lighting Director Howard Huang observed LED products manufactured by the some 400 LED manufacturers in Thailand have dropped last year, and projected further future declines. Huang attributed the sliding production volume to Thai LED products lower cost/performance (C/P), caused by dependence on imported LED components.

To keep a competitive edge in the Thai LED market, Huang’s company has formed a partnership with Taiwanese LED maker Grand Halo to redirect its focus to manufacturing LED package products. “The company previously sold imported Chinese LED products, and was mostly a LED trader”, said the company Director Howard Huang. “We have decided to transform our business model to become a LED manufacturer in 2014.”

In the first stage of its transition, the manufacturer is focusing on production of 2835 LEDs that will be supplied to local Thai LED luminaire manufacturers, said Huang. Another company source noted most in-house made LED packages are for the company’s LED tube product consumption. TP Halo’s LED chip suppliers include San’an Opto, Chimei Lighting, and ETI, while LED glue used is mainly from Shinetsu. The company uses gold wire bonding for most of its LED package products.

|

|

TP Halo LED packages from left to right 0603, 0805,1206, 2835 and 5050. (LEDinside) |

LED chip specs displayed at the booth also included 5050, 1206, 0805 and 0603 LEDs, which will be released on the market next year. The new LED package factory is to be constructed in Samut Prakan Province in Thailand, which is very near Bangkok, said members from the company’s R&D team.

|

|

TP Halo's R&D staff demonstrate the company's LED package products. (LEDinside) |

One of Thailand’s leading LED manufacturers Lighting and Equipment (L&E) also has plans of kicking off LED package R&D. The LED manufacturer, which comes from a fluorescent tube light manufacturing background, plans to kick off PCB and SMD LED packaging in the near future, said Pongskorn Ouvuthipong, LED Product Director, L&E. Ouvuthipoing refused to further comment on the company’s LED package progress.

|

|

Pongskorn Ouvuthipong, LED Product Director, L&E reveals the company's R&D intends to focus on LED package. (LEDinside) |

Ambitious manufacturers look into upstream LED chip production

Discontent with using foreign LED chips, Thai LED manufacturer Hatari has started testing in-house LED chip and wafer production. Hatari has been working with German LED manufacturer to develop its own LED chips and wafers, said the company Vice President Dennis Stech. The manufacturer declined to offer further details of the chips scheduled launch, saying they want to make sure LED chip quality is ready before release. The traditional fan manufacturer entered the LED business after acquiring renowned local LED manufacturer BlinQ, explained Stech.

|

|

Hatari Vice President Dennis Stech (center) posing with two show girls. The ambitious Thai LED company aims to in-house develop LED chip and wafers.(LEDinside) |

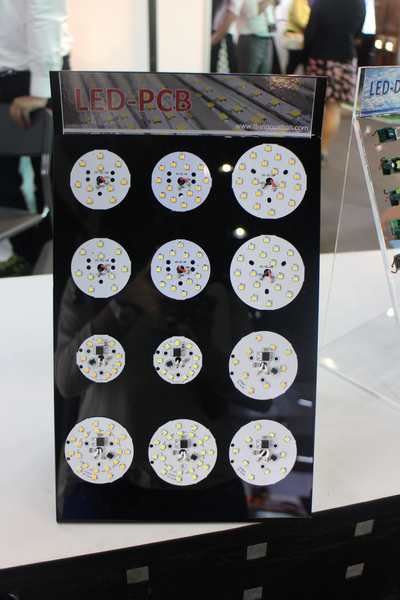

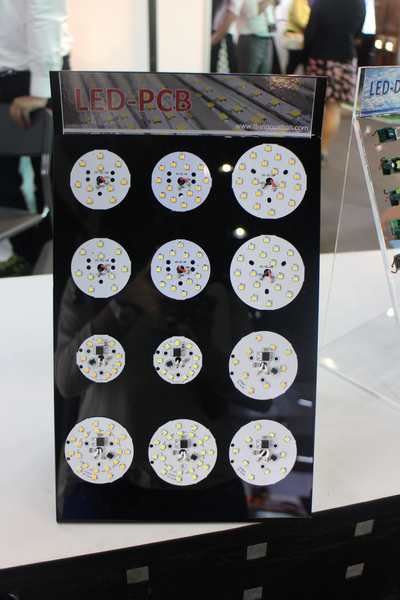

Another company that showed interest in developing LED chips was T&T Innovation, the manufacturer was the only company showcasing LED drivers and COB products at the trade show. Having been in the Thai LED market for two years, the company is a LED-PCB and LED driver supplier, and mainly selling products to Thai and Laos LED manufacturers. About 40% of the company’s products are being exported to Laos, said Suriya Chaisiri, Project Engineer, T&T Innovation.

|

|

T&T Innovation was the only company displaying assembled LED-PCB at EcoLightTech Asia 2014. (LEDinside) |

“The company assembles LED chips imported from Cree, Samsung, and Everlight into the finished product”, explained Chaisiri, Project Engineer, T&T Innovation, who is also the main product designer. Other chip components the company uses include from Honglitronics. But the company aims to progress to the next stage of manufacturing their own LED chips. To get to that stage, the company has sent engineers to Taiwanese LED manufacturers to learn the packaging process.

|

|

Nex Innotec LED luminaires on display. (LEDinside) |

Nex Innotec (Nex) has adopted a similar strategy by regularly sending a delegation of engineers to be trained in Taiwan for 11 months, said Sompong Aksorn, Account Executive, IT Products division, of the company. The company is in the process of setting up a manufacturing base in Thailand. Some of the company’s LED product components are imported or supplied from Taiwan. Originally, a bathroom manufacturer in Thailand, Nex has only entered the LED manufacturing business in the last four years, said the company’s Service Engineer Manager Vincent Ng. The company’s Taiwan office outsources LED manufacturing to its Chinese factory, where most of the LED products are assembled and packaged.

|

|

Nex Innotec has a branch in Taiwan, and is training most of its engineers at the Taiwan office. (LEDinside) |

To conclude, some of the top Thai LED manufacturers are striving to enter the mid-stream or upper stream of the LED supply chain to stay competitive. To achieve their goal, most are working along with Taiwanese LED manufacturers to acquire the technology know-how. For Thailand manufacturers to stay relevant in the highly competitive LED market, reducing reliance on imported LED components is a strategy some vendors are implementing to differentiate their products from competitors, while bringing down production costs.

(Author: Judy Lin, Chief Editor, LEDinside)