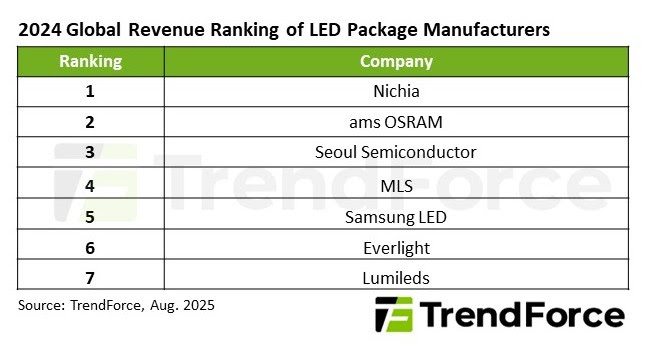

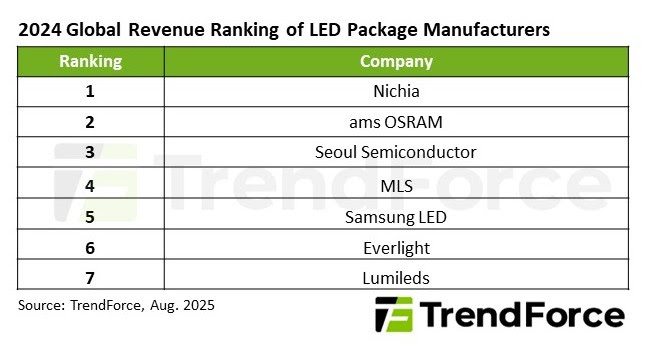

San’an Optoelectronics and Lumileds announced on August 1st that San’an, along with foreign investors, will acquire 100% of Lumileds Holding B. for US$239 million in cash. TrendForce’s LED industry demand and supply database notes that Lumileds ranks among the world’s top seven LED packaging companies. The acquisition will help San’an leverage Lumileds’ two-decade legacy in the global market.

While the deal is still subject to shareholder approval and regulatory reviews in various jurisdictions, completion under the current terms would see San’an indirectly own 74.5% of Lumileds by 1Q26, with the company to be fully consolidated into San’an’s financial statements.

TrendForce notes that Lumileds holds significant strategic importance in the optoelectronics industry and generates approximately $600 million in revenue in 2024. The company specializes in automotive lighting (headlights and taillights), smartphone flash LEDs, and premium/niche lighting applications, with manufacturing and business operations across Europe, China, Malaysia, and Singapore.

Lumileds ranks third globally in automotive lighting LED revenue, behind only ams OSRAM and Nichia. In smartphone flash LEDs, it is part of Apple’s supply chain, ranking just below Nichia. For premium and niche lighting, it is seventh globally, widely trusted by lighting brands in Europe and North America.

TrendForce reports that the uncertain macroeconomic outlook driven by retaliatory tariffs is intensifying price competition across the LED sector. End clients are likely to expect cost synergies following San’an’s integration of Lumileds’ operations. This may escalate price competition in key segments, including automotive lighting, smartphone flash LEDs, and high-end niche lighting.

In the long term, the market will be watching to see whether San’an can successfully integrate operations and technologies, and maintain Lumileds’ customer relationships while leading its teams in Europe, China, Malaysia, and Singapore toward sustainable development.

TrendForce 2025 Global Automotive LED Market- Lighting and Display Product Trend

Release Date:

1. PDF (196 Pages)- 30 June 2025

2. EXCEL- 30 June 2025 and 31 December 2025

Languages: Traditional Chinese / English

TrendForce 2025 Global LED Lighting Market Trend- Database and Player Strategies

1. Database and Player Strategies

Release Date: 15 February 2025 / 15 August 2025

Format: PDF and Excel

Language: Traditional Chinese / English

2. LED Lighting Market Dynamics Monthly Report

Release Date: 20th of Every Month

Format: PDF

Language: Traditional Chinese / English

Gold+ Member Report

Gold+ Member Report

(Global LED Industry Database vs. LED Player Movement Quarterly Update)

|

Content

|

Publication

|

|

and Supply Database

|

PDF / Excel

|

2025-2029 Demand Market Forecast

|

|

Supply Market Analysis:

|

|

2. WW New / Accumulated GaN LED and AS/P LED MOCVD Chamber Installations

|

|

4. GaN LED and AS/P LED Wafer Market Demand and Supply Analysis

|

|

and Capacity

|

PDF / Excel

|

Top 10 LED Chip Manufacturers by Revenue and Wafer Capacity

|

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis

|

|

LED Industry Price Survey

|

Excel

|

LED Industry Quarterly Update

|

PDF

|

EU / U.S- Lumileds, ams OSRAM, Cree LED

|

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys

|

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride

|

|

Micro/Mini LED

CES 2025 / Touch Taiwan 2025

|

Aperiodically

|

|

If you would like to know more details , please contact:

|